To whoever reads this HELLO!

I’ll cut straight to the point.

I have dedicated my Life to mastering/understanding FX trading and BabyPips has been God-sent I’ve learned so much!

I’m stuck though now, could you help.

Scenario

Trading pair: EUR/USD

exchange rate: 1.5000

Margin Required:%2

Lot size: Mini lot (10 000)

If I buy this pair I am buying 10 000 units of EUR and selling 15 000 USD units of currency

Then the notional value for USD is equal to $15 000, Notional value for EUR is 10 000 units

Sow Required Margin is: $300 (account denominated in Dollars)

but (the question)

If I sell the same pair

1.I am buying 10 000 USD units then I am selling how much EUR?

is it 5 000 EUR units?

2.Do I deduce the Required margin from this 5 000 EUR if I’m right ?

3.Simplified version

What I’m asking is. Will the required margin of a trading pair be the same whether I’m going long or short?

if not. How do I go about calculating the difference? (emphasis on selling in the scenario provided)

Thank you in advance.

It depends on your broker. Check the contract specifications which should state the “margin hedge” requirements".

Some brokers like IC Markets require nothing when you hedge, so if you open 1 lot long requiring $300 margin, when you open a 0.5 short, the total margin on the table will only be $150. If you have 1 lot long & 1 lot short, you require zero margin!

Other brokers may require 50% so you would find the total margin on the table to be $450.

I suggest you get a demo account going and play with various scenarios in order to understand how it works.

I should point out that many inexperienced traders have blown accounts because they do not understand the impact of the zero margin hedge. Firstly, even though hedged, your equity is a function of number of lots x spread. If the spread widens, your equity will go down even when fully hedged. The next problem is traders end up with massive amount of hedged lots which require zero margin. Lets say the total exposure is 100 lots long and 101 lots short, the actual margin will be $300 despite the massive true exposure. They go to bed believing they are safe because they are fully hedged and their margin % is up at 3000%(remember only $300). Rollover happens and the spread widens to 50 pips x 201 lots>>>>>BOOM account gone and the tears are rolling at FPA.

1 Like

Kenny Hello and thank you for the reply.

Before I go any further Ill admit I’m one of these traders you speak of. I started live trading after I figured I know enough, which obviously wasn’t, hence I decided to relearn with a fine-tooth comb.

This is why even though I understand the zest of your answer I still have a couple of questions to clear the fog.

1.Margin Hedging . Meaning I take a short position in an asset I already have a long position on .OR vice versa.

if that’s the case

That is something I still can’t wrap my head around as this tactic still seems counterintuitive. At the end of the day, I won’t make any gains ! right?

but that is not the original question. I Asked that just for clarity.

2.What if I’m taking a short position in the same example but not hedging …just going short?

The reason I’m asking this I’m figuring out ways to beef up my risk management. (Know how much Margin will be required before I even take the trade)

Knowing very well that as well as Leverage, Margin, Broker, exchange rate and whole other factors including the currency pair in question also stipulate what the final required margin may be at any moment.

To put it another way, I understand the broker will set the Margin requirement for each currency pair.

I know that The required margin will change as the exchange rate changes in value.

I know I will use the exchange rate .multiply it with the lot size to get the Notional Value which I will get the desired percentage from the value to get the Required margin.

My question is will I use the same exchange rate value or what if I’m going short instead, just going short?

and if not what and how?

Forgive me if I may be making a mess . It’s just that I have no intention of losing money foolishly in this market if I can help it!

and by the way, Love the example you made . I learned something big from it.

Hi Bhozo,

To answer your questions.

-

You are right that it doesn’t make sense to go long and short at the same time but there are people that believe in it. Hedge grid trading is a popular although misguided trading system. I used to do it until I saw the light…

-

The margin for long or short is the same. Possibly the broker might use the ask or bid price depending on long or short but it makes literally no difference. Also if your account currency is the same as the margin currency eg my account is in euros so when I trade EURUSD, the margin is fixed and won’t change with the exchange rate.

First I’d like to point out Its Bhoza not “Bhozo” haha, hoping that was unintentional.

Then to get in the business at hand.

1.I’m glad you saw the light! and thank you for mentioning this . It helps in remaining firm in the light.

2.Your answer both helped and caused confusion.

I understand If you say the Required margin is the same irrespective whether I’m buying or selling . That would make sense.

What confuses me though is when you say “if your account currency is the same as the margin currency eg my account is in euros so when I trade EURUSD, the margin is fixed and won’t change with the exchange rate”.

a)Does that mean the margin is fixed irrespective even if you Sell the pair?

Your answer implies that it does I’m just asking to make sure …

b)If that’s the case could you explain by breaking it down why is that so?

Again my goal is comprehension not just knowing the end result.

Hi Bhoza,

Yup, sorry an honest mistake.

I’m not sure if you coming at this from a stock market perspective where shorting is a vastly different operation from going long? Nevertheless, there is absolutely no difference in margin requirement for going short vs going long.

The initial margin does vary with the exchange rate(so small that I haven’t really noticed it before) but it is the same for long and short. It does not change after you enter the trade.

Bear in mind that going long or short is exactly the same thing. 2 sides of the same coin if you will. In the trade you are always buying one currency and selling another. If you sell EURUSD, you are selling EUR but at the same time you are buying USD. Conversely if you buy EURUSD, you may be buying EUR but you are selling USD to do it.

To clarify about account currency it simply means if you buy or sell when your account currency is EUR and you trade EURxxx, then exchange rate does not feature in the calculation and is, therefore, always the same.

Kenny its all good.

I’ll admit I started in the Penny storks market but never even made a single trade though the are still a lot of conceptions I am having paradigm shifts on due to realizing, unlearning, then learning.

Which is why I am so thorough in all my question I want to be sure that whatever I’m consuming is legitimately correct as much as possible.

Then Yes I agree the changes are very small. Though small is relative to one’s account size in my opinion.

According to the school, it does actually with every single pip move the is a change differing in magnitude due to your position size but that is all I can reference. I have no idea if this factor changes due to factors like brokers etc.

all I have at the moment is theory and all my previous trades are redundant as I never really understood what margin really is.

2 sides of the same coin, buying and selling always simultaneously happening I am aware.

Last but not least your explanation about the stagnant margin due to account currency matching the base currency is compelling but rather vague.

Though since that is all I have at the moment I’ll take it with a bit of salt while I do more research.

(I hope you take that as just what it is an honest answer from someone who appreciates your input).

If I find anything else which might drive the conversation in one direction Ill let you know, and please do also if you stumble onto something.

Then I don’t know if you would like me to show you a page in the school that shows and explains how and why the Required margin changes with each Pip move.

Hi Bhoza,

Nah, it’s ok thanks. I do understand why the margin changes. It’s simply because you need a percentage of the margin currency on the table(margin currency is the first currency in a pair). If your account currency does not match the margin currency, the margin has to be converted and that is where the change comes in.

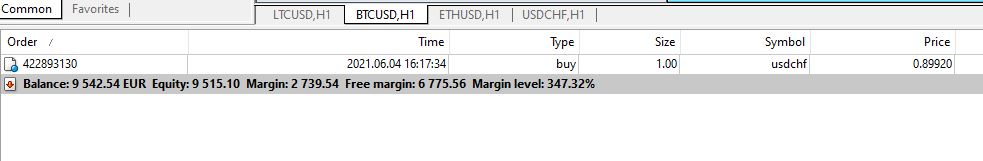

In the case of margin currency matching, here are a couple of picture I took from a demo account.

The first a 1 lot EURUSD - note the margin as 3333.33 the second is for 1 lot EURJPY and you will see the margin required is exactly the same at 3333.33

This is because the margin required is 1/30th of the contract size for 1 lot ie 100 000 euro divided by 30 = 3333.33 euro - there is no other currency conversions involved unlike USDCHF for example where I would require 1/30th of $100 000 ie $3333.33. That needs to be converted to USD at the EURUSD rate which fluctuates. See the screenshot below. Margin is 2739 which is $3333.33 divided by the EURUSD rate of 1.2169

1 Like

Kenny Hello!

Yes, Yes …Yesss. Not only were you right! but I Finally Get it now!

I see the LIGHT haha.

Side note I know I can be a bit hard-headed and opinionated, but I am truly grateful you took your time to explain this simple matter (simple now thanks to you) until it sank in while fully comprehending your explanation.

If ever I have another matter that I need deciphering I am definitely massaging you. I hope that’s ok with you.

Have a good weekend man.