WTI June contracts fell as low as $6.50 a barrel before it bounced back to $15. However, it’s hard to see how the WTI can hold up against the immense pressure caused by the lack of storage.

Even the global benchmark for crude oil—Brent Crude Oil (BZ)—tanked. The turmoil in global oil markets dragged Brent futures under $16 a barrel, leaving the front month trading at its weakest since 1999!

Luckily, the Brent futures contract is cash settled, not physically. So in theory, Brent should not see negative prices. But now we are seeing similar concerns about floating storage (oil tankers) starting to fill up as oil demand has fallen off a cliff. Globally, there are about 160 million barrels of oil already sitting in oil tankers, awaiting higher prices.

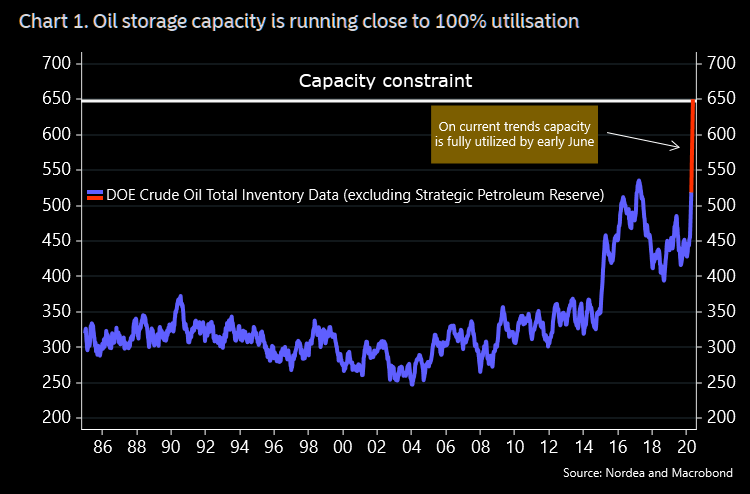

So if global storage is running out—and that is what the Brent trade is starting to suggest—then there will be no bid and prices could hit zero. An indicator of trouble in Brent, which is ultimately a seaborne crude, will come from shipping freight rates. If these costs go up and begin to soar, it probably indicates floating storage is filling up globally.

What was sad to see was the retail investors getting burned by this. However, they have only themselves to blame—the harsh reality in the oil market is that, thanks to the so-called coronacrisis, there are 30 million too many barrels of oil out there every day as demand dries up. The Saudi-Russia deal brokered by President Trump will only remove about 10 million barrels a day of production.

Over the last few weeks, retail traders have been pouring unusually large amounts of money into the popular oil exchange-traded funds (ETFs), such as the United States Oil Fund (USO) , with $4 billion in assets.

These ETFs reflect the price of oil largely via futures ownership at the front of the curve and a steady roll into the second month (and by now partly also the third as risk mitigation) as expiry approaches.

As the funds diligently executed their normal functions, they set themselves and investors up for disaster when it became clear last week that they owned a quarter (or at the end even more) of the outstanding May contracts that no one wanted to buy! Not only that, but the United States Oil Fund also owns about a quarter of the June contracts, too.

The United States Oil Fund is ditching its June holdings as it tries to shore up its balance sheet, and this will have an impact on the front month trading. Its actions will also be sharpening the super contango . It becomes a vicious circle as long as no one wants to take delivery . For those not familiar with the term, contango is a situation where the futures price of a commodity is higher than the spot price.

USO had been 100% collateralized, with nearly $5 billion in cash and ultra-safe investments backing its futures positions, according to its website. But May delivery US oil futures fell more than 300% on Monday. “The concept of ‘fully collateralized’ just went out the window,” Carl Gilmore, president of Integritas Financial Consulting (a derivatives markets consultancy), told the Financial Times .