- Tokyo underlying inflation surprised to the upside in October

- The BOJ will deliver its October monetary policy decision On Oct. 31, including a potential tweak to its YCC program

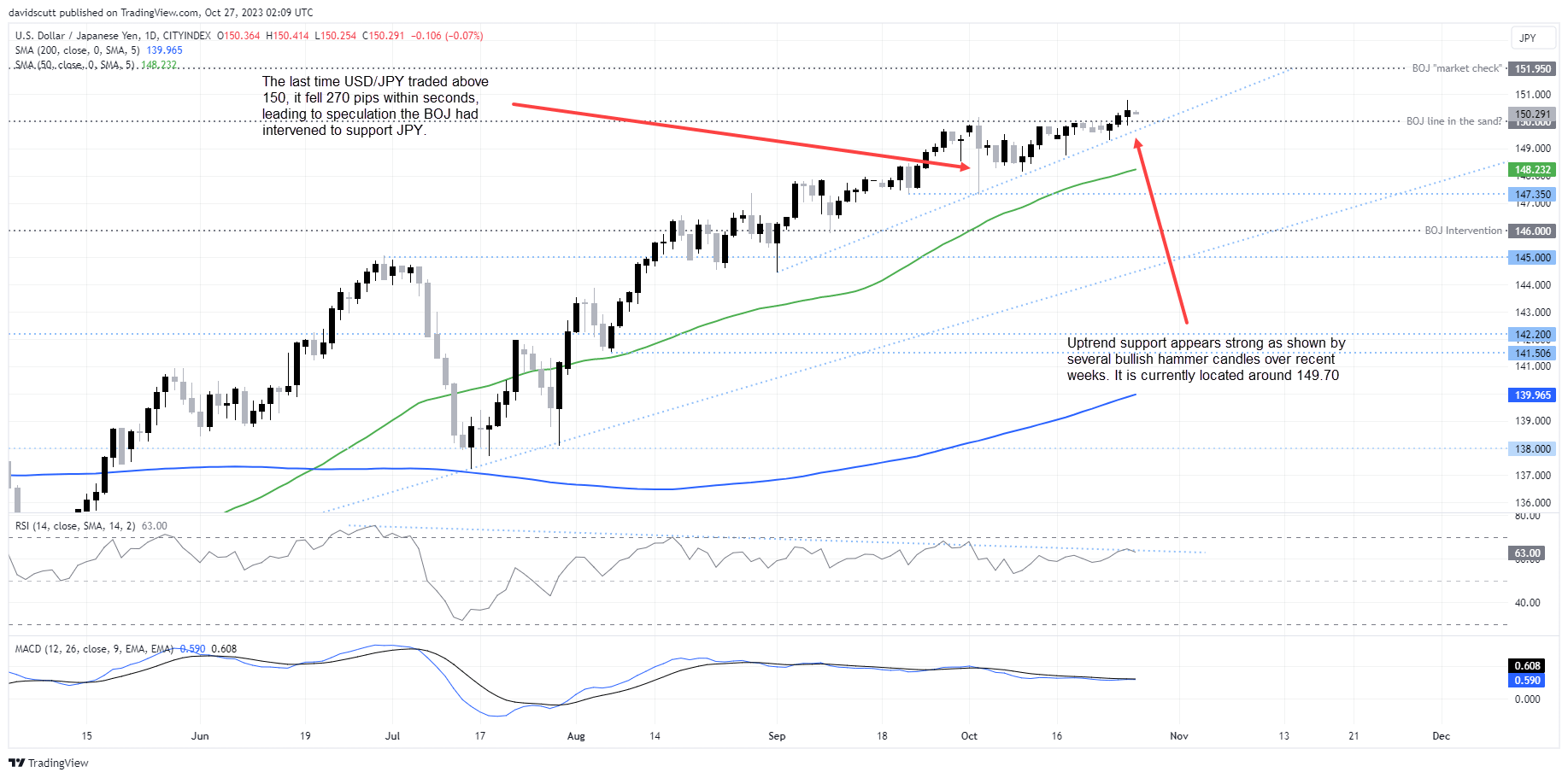

- USD/JPY trades above 150 despite intervention threat

Underlying inflation in Tokyo came in well above expectations for October, pointing to a possible upside surprise in the national reading when released in three weeks’ time. With speculation continuing to swirl about a tweak to the Bank of Japan’s (BOJ) yield curve control program when policymakers meet next week, it may see Japanese yield differentials with other monetary jurisdictions narrow, helping to boost the Japanese yen and potentially reduce the risk of BOJ intervening on behalf of the government to put downward pressure on USD/JPY.

Tokyo inflation heats up

According to data released by the government, consumer price inflation (CPI) ex fresh food rose 2.7% in Tokyo in the year to October, accelerating from the 2.5% pace reported in September. Markets were primed for the annual rate to remain unchanged from a month earlier. Ex fresh food and energy prices, the so-called core-core reading which best aligns with underlying inflation readings in other advanced economies, remained stubbornly above the BOJ’s 2% target, holding steady at 3.8% growth from 12 months’ earlier.

While the Tokyo CPI data does not necessarily match trends seen nationally, it still provides a useful lead indicator as to what markets should except. It also comes at a useful time for BOJ policymakers who will hand down their next monetary policy decision on October 31.

BOJ, YCC and the potential USD/JPY impact

Ahead of the BOJ meeting, several articles have been written naming BOJ officials and unnamed sources floating the idea that policymakers may tweak their yield curve control (YCC) program, potentially reacting to the rise in government bond yields globally over the course of this year.

The BOJ’s current policy is to pin 10-year Japanese Government Bond (JGBs) at 0% while tolerating movements of up to 100 basis points either side of the target. Recent speculation seems centered on the idea the -1% to +1% range may be widened further or potentially abandoned entirely.

While not out of the realms of possibility, it would be risky for the BOJ to normalise policy settings further before being confident the inflationary pulse going through the Japanese economy will flow through to wage pressures longer-term. But what such a move could do is see Japan’s yield differential to the rest of the world narrow, a scenario that would likely see the JPY strengthen against other FX pairs such as the USD.

Right now, government policymakers are anxious about the rise of USD/JPY as yield differentials between Japan and United States balloon, delivering warnings about excessive FX volatility and movements being driven by forces other than fundamentals, at least in their eyes. Only this morning, with USD/JPY sitting above 150, Japan’s Finance Minister Suzuki has been on the wires repeating the same language heard umpteen times in recent months.

By the BOJ tweaking YCC, it may alleviate that issue for the government.

USD/JPY finding buying on dips below 150

Looking at the USD/JPY chart, it’s obvious USD/JPY remains in a strong uptrend with corrective episodes only leading to fresh highs soon after. The most recent decline came earlier this month when the pair last ventured above 150, resulting in a dramatic 270 pip plunge within the space of seconds. The event has been annotated on the chart.

The interesting thing on this occasion is that despite USD/JPY having ventured above the figure, and with numerous warnings from the government about unwanted FX volatility, there’s no evidence that bulls are eager to book profits despite the apparent risks. Maybe it’s because the move is orderly, but it may also signal that something may be cooking at the BOJ meeting next week. Near-term, the release of the Federal Reserve’s preferred core PCE inflation measure for October will likely influence the USD/JPY when released later Friday.

Support is located on dips below 150 and ahead of strong uptrend support currently located around 149.70. Looking above, USD/JPY topped out at 150.77 on Thursday, making that the first logical upside target. Beyond that, the multi-decade peak of 151.95 hit last year is the next major target to watch.

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.