Hey guys,

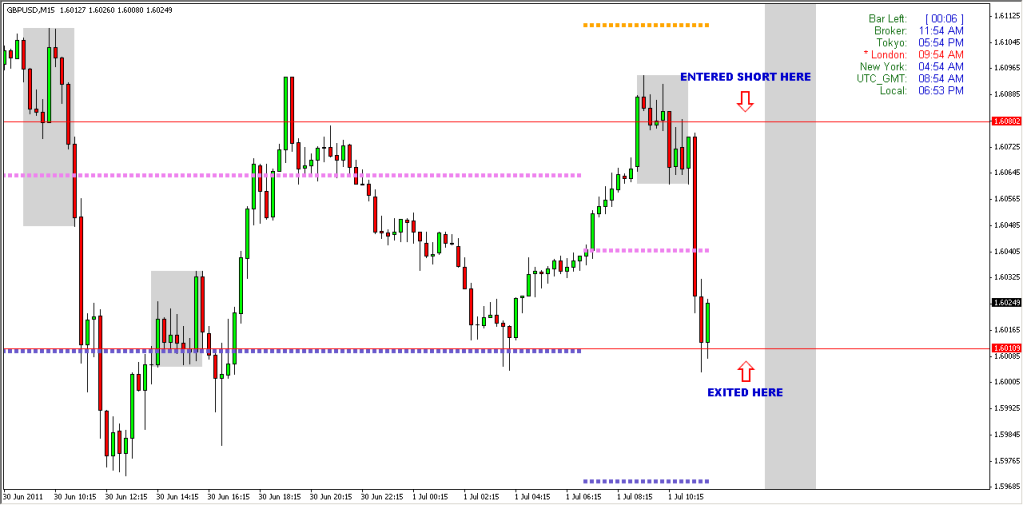

Took a long position at NYO on the GBP today, counter to the LO move. Shifted stop to +5 pips after the initial move up and was consequently stopped out on the retrace before it then headed higher.

imageshack.us/photo/my-images/14/gbpusd020711.jpg/

Reasons for long were higher trending prices on the daily (even though market flow is still down) - could easily be a retrace of the latest swing to then drop further down, and similarly 4 hr. There was also a long OTE on the 4hr/1hr. Zooming in revealed a nice OTE at NYO on the 15min/5min. Also in buy zone and support at the 1.6000 level, which happened to coincide with MS1.

2 winners and 1 loser, trading NYO this week. Winners were marginal due to moving stop just into profit and getting hit on the retrace similar to this one. First losing week for me in a little while (-20 pips). Really trying to find form and consistency, but I’ll be the first to admit that I overtraded this week and took one less than optimal entry. I paid for it accordingly. I really need to work on trade selection and management.

It’s amusing to me that at the core of becoming a successful trader is the ability to find an edge and then simply exploit that edge over and over again. It sounds so straightforward, but really it’s anything but. To anyone who isn’t seeing consistent success, I put this out there for you to ponder: clearly with the methods that ICT is teaching we have an edge, a number of them in fact, I don’t think anyone can or would dispute that. Everyone who has been following this thread for some time is posting winners (and sure, the occasional loser too), so we’re seeing the tools work time and time again, right? Why aren’t we all on our way to building a fortune? Maybe you’d argue that you haven’t seen enough of the setups yet or you still question your analysis – you just need more chart time - and that would be reasonable. For me though, and I’m assuming many others, I feel that it has little to do with the analysis and much more to do with the psychology. Now that seems fair, but the problem for me is that we continually make it about the analysis when we ask questions like “why did that trade go against me - all of the tools lined up?”, and then we proceed to analyse what happened and tailor our rules accordingly. We might even start thinking about that other thread we were reading where they’re talking about using candlestick patterns to confirm a continuation or breakout at the level we’re watching, entering when price actually turns in our direction. If we only tried that in combination with our other tools we could minimise risk further, couldn’t we? As we start to do all of this we morph our edge into something that it doesn’t need to be. The answer to the question posed above is that the market can go in either direction at any time. We have an edge and that’s all we need. From there it’s about trade selection, trade management and money management.

Now I’m not saying that trade analysis is unnecessary, anything but. In fact I believe it’s critical to long-term development, but I also believe that we place a lot of emphasis on this when most of our problems stem from trade selection, management while in a trade and general money/risk management. This weekend I’ll be working on these areas primarily. Coming into next week, I’ll be looking for a single trade to make my 50 pips at 1% risk in either NYO/LC. I’ll have clearly defined trade management rules and will only take the absolute cream of the crop.

Sorry for the long post, I’m no trading guru so take all of this with a grain of salt. Just some thoughts that will hopefully prompt discussion and/or reflection in others. I’m interested to know what everyone else will be working on over the weekend and what, if anything, you’ll be doing differently moving into next week.

EUR/CHF reached a level of resistance right before LC KillZone and retraced 25% of it’s ADR. Moved right into OTE when LC KillZone starts, I think it’s 1500 GMT. I took off 50% at 25 pips profit and closed the remaining portion at 1800 GMT - 23 Fib!

EUR/CHF reached a level of resistance right before LC KillZone and retraced 25% of it’s ADR. Moved right into OTE when LC KillZone starts, I think it’s 1500 GMT. I took off 50% at 25 pips profit and closed the remaining portion at 1800 GMT - 23 Fib!

Entry got missed by 2.5 pips and 15 minutes. This is pretty much the same setup like a LC as I mentioned in the last post, expect that it occured in NYO. Maybe this is something we could look at NYO. I don’t know

Entry got missed by 2.5 pips and 15 minutes. This is pretty much the same setup like a LC as I mentioned in the last post, expect that it occured in NYO. Maybe this is something we could look at NYO. I don’t know  Another reason to take this setup would have been the SMT divergence I mentioned in my last post. The weaker pair GU trying to catch up to EU again. I’d like to see more comments about these thoughts, don’t know if I’m right with this!

Another reason to take this setup would have been the SMT divergence I mentioned in my last post. The weaker pair GU trying to catch up to EU again. I’d like to see more comments about these thoughts, don’t know if I’m right with this!

but loaded it up the third time because I draw wrong hehe, I guess you can see it on you charts

but loaded it up the third time because I draw wrong hehe, I guess you can see it on you charts