Saying hello for the first time in this thread, though I’ve been lurking for quite some time.

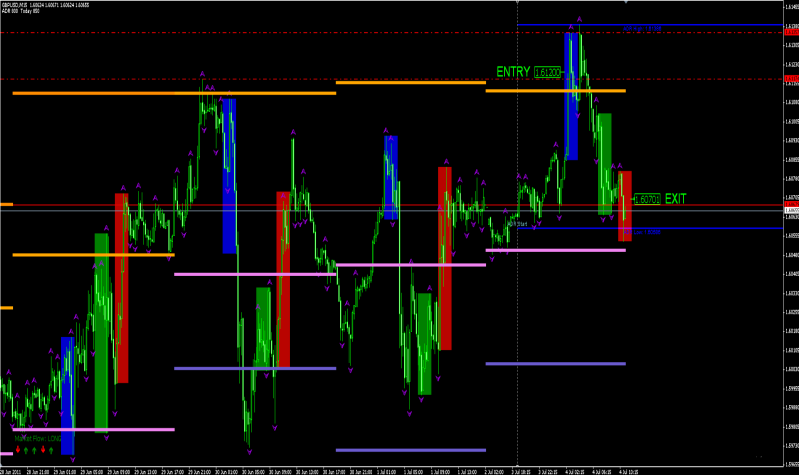

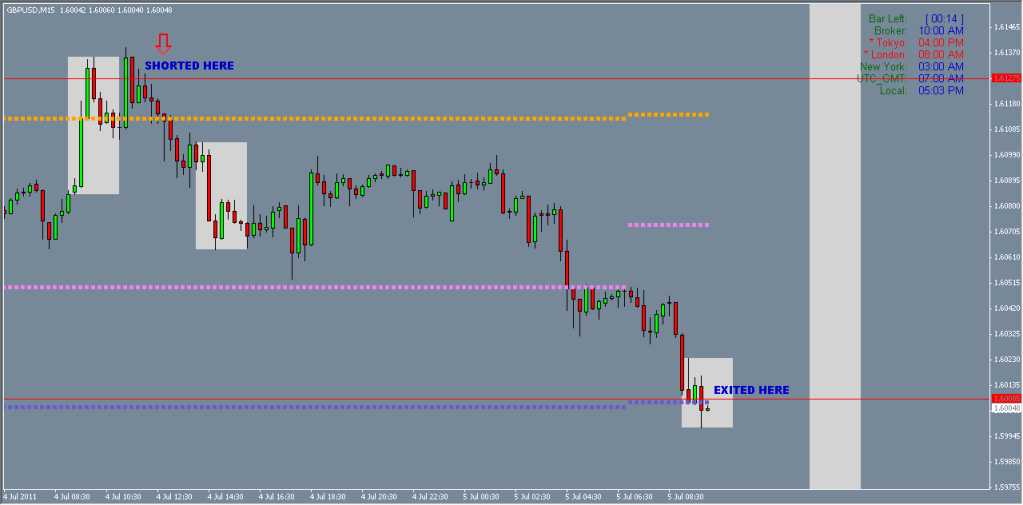

I’m not yet qualified (to my own mind) to know the accuracy of this trading schema but I’ve given it a very brief shot finally, and within the first week or so I’m up 3.6% on demo trading, mostly shorting cable from what turned out to be daily highs. It could be sheer luck still, of course, but time will prove that out.

“Big Picture” data is being drawn from a few places; I can’t seem to post links yet but needless to say for those that have been following innercircletrader I’ve been watching COT, dollar index and Treasury 2, 5 and 10 closely for clues to the overall market.

Mistakes so far have included:

a) Not letting the trade ‘run’ when winning, been cutting it off sharply at a 50 pip TP against a 25 SL

b) Not setting the SL quite far enough above one of the highs

Advantages I have:

a) Incredible discipline; I’m not one to mess up money management basics. Ever.

b) Ability to read forum posts unemotionally, no personality issues with anyone

c) Strong math background

d) I can be taught.

Disadvantages:

a) I’m new(ish), been following here and there for about 1.5 years but quiet until now

b) Large holes in my knowledge about all this; "I don’t know what I don’t know"

c) Time limited; I have multiple small businesses and they can take priority at times.

d) Technical/scientific background. Not financial at all.

e) Tendency to overtrade; trying to shake that off.

Regardless, 3.6% a week… if only 1/3 of that can be maintained, that’s still an incredible victory. A week is statistically too short to be relevant of course, but let’s say it was more encouraging than a poke in the eye with a sharp stick.

In any case… I have a big question mark in my mind about many things, that perhaps someone here might be able to fill in a bit…

-

Supposedly the bulk of the market has to do with bank trading; big US, Euro and other banks. Question, how many big banks are there that make up 80% of this trading, is there a top twenty, or two hundred, or two thousand of them?

-

Of this bank trading, what are the primary motivators, and is one motive outweighing most of the rest? I’m guessing it makes sense to hold various currencies in order to maintain one’s overall value position, i.e. hedging, is a main reason… perhaps another reason is simply pure arbitrage and cashing in on market information they have, perhaps yet another is “X customers simply need Y of currency Z today.” In other words, are banks aggressively looking to control the markets, or are they on the back foot themselves, just trying to hang on? Are there perhaps a few monstrously huge banks that traditionally operate in opposition to others, or is it total anarchy, or… ?

-

I’m guessing that each bank has a number of employees whose job it is to come in and start placing currency orders, or tell computers to do it, as per 2) above. Has anyone ever known such a person, and in general, what sort of scenario is it for them? A casual environment of people sitting at terminals that come in at eight, chat casually and then take a relaxed lunch? Or a heated, competitive environment run by a seasoned financial wizard, with apprentices on the front lines as banks ‘compete’ perhaps? Maybe it’s utterly different, almost scientific in nature where data mining types refine strategies to feed to a computer, and it’s all very ‘human hands off’ except for guiding strategies? Or are all banks totally different?

Simply looking for a basic understanding of the business. Does anyone here have a sense of these things, or is it just a sort of black box to everyone?

The reason I ask in this thread, is that the core principles here seem to be more ‘top down analysis’ than technical; with a strong emphasis on really knowing what’s going on.

Apologies for the tl;dr first post, I thought it would be more effective summarised this way. Eager to hear any insights that anyone might have.