In answer to your questions, Clint…

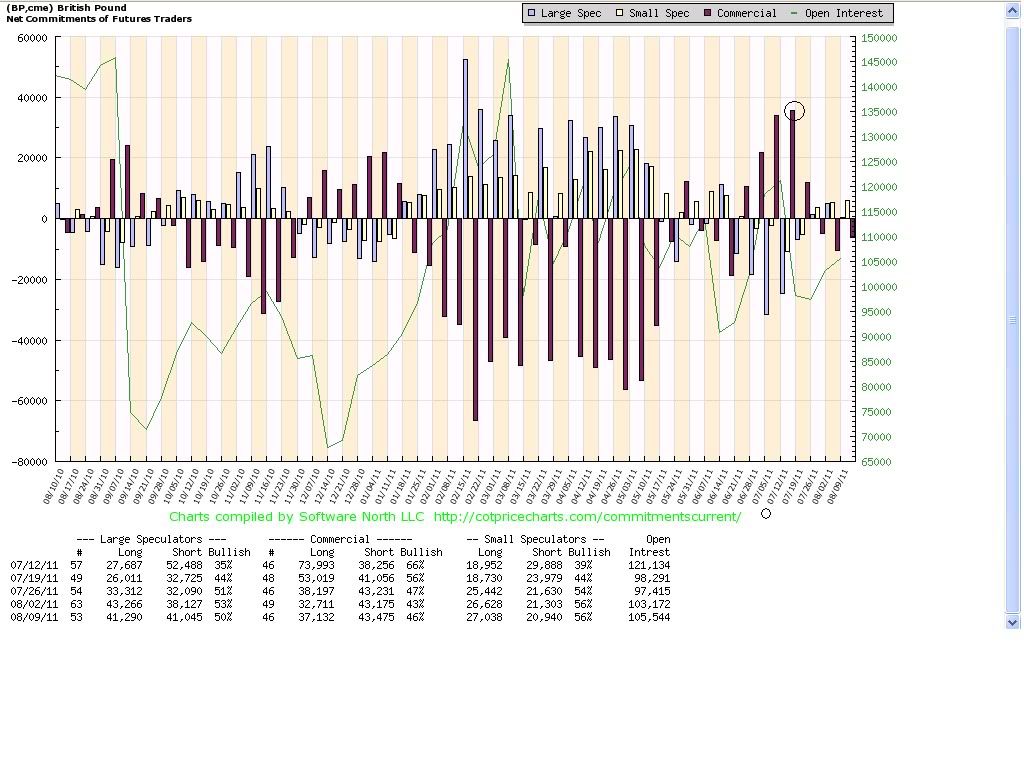

[B]Since the graph of open interest for the commercials is essentially the [I]mirror-image[/I] of the graph of open interest for the large specs, what difference does it make which one is watched? Are you saying that commercial open interest [I]anticipates[/I] market turns, and large spec open interest [I]reacts[/I] to market turns?[/B]

The markets were set up by the Commercials in order to facilitate business. The Non-commercials are exactly what their other name suggests, speculators. It would make sense that we are more concerned with the ones that actually created the markets, although I accept that they are a mirror image, and there may not be a difference in which one you watch (I say ‘may’, because I am just following Williams, and what Williams does seems to work for me - I don’t have the time to find out what ‘also’ works!)

In answer to your second question, yes, Commercials ‘anticipate’ and Non-commercials ‘react’.

[B]Also, COT data for currencies is [I]futures data[/I], not spot forex data, is it not?[/B]

I believe COT data released on a Friday is the sum of all Futures contracts that are currently active.

[B]Finally, you described who the large specs are, as well as how they track the market — basically as trend-followers. But, who are the commercials? And how can they survive, doing what they seem to be doing — which is, persistently [I]shorting a rising market[/I], and persistently [I]buying a falling market?[/I] [/B]

You should try and pin Michael down on this one, but I believe the Commercials are all entities that are hedging their risk. This may be the banks, or it may be large multi-national companies such as Boeing and Airbus who sell a lot of their products outside of the geographical location where they are based. These people know how the economy is fairing before the funds do, and they want to offset their currency exposure by taking the opposite side of the trade. When you say ‘shorting a rising market’, and ‘buying a falling market’, it implies that they are ‘reacting’ to what another entity is doing, which would make them the ‘dumb money’. My take on it is that even though they seem to be doing the exact opposite of what price is doing, they are the ones that know first what price will do! Does that make any sense?

Regards

Ali