all priceless, cant wait Let’s rumble’ ;)

haha, well done, was watching this trade myself,but EU was going higher hence got mindblocked

Hi guys,

Just wondering what people make of tonight’s trading.

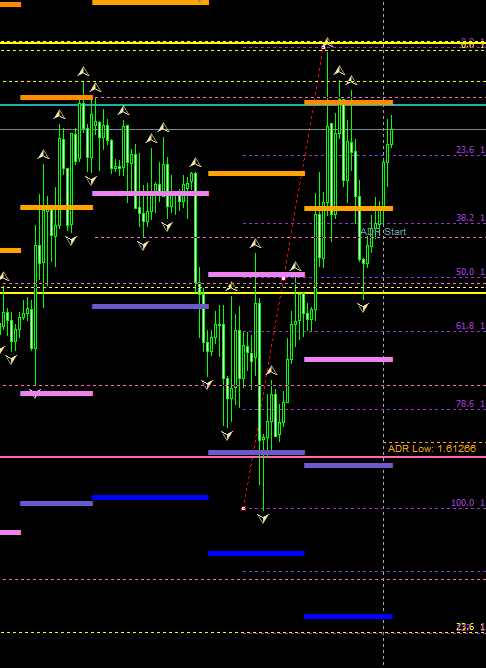

Around the London open, I spotted an OTE short around R1. This trade only moved 17 pips in favour before reversing. Do others share my view that this was a good setup, which just didn’t happen to pan out particularly well today?

Later, around the NY open, we see another OTE short, this time around R2. This one played out rather better, moving around 40 pips lower.

Finally, around 3PM GMT, we get another short entry above the 79% retracement, around R2. With hindsight, this is obviously the best entry of the day, as it moves lower roughly 75 pips, with minimal pausing on the way.

I have noted the areas of interested with yellow scratches on my attached chart.

Some questions for those that feel like responding:

-

In the first trade, I would not have adjusted stops, or taken any profit yet. Would others feel the same way? This one is just one of the inevitable losses?

-

Admittedly, I was not paying much attention to market flow on 1H, 4H, 1D, etc. If you were, what did you see? Would you have taken all three trades, 1 or 2, or none at all?

-

If you entered on the 2nd setup, would you have stayed in through the retracement prior to the 3rd setup? Or would you have adjusted stops by then, which would have been triggered?

I’d love to know what others think about tonight’s trading!

Is your ADR set to start at midnight EST with the default 5 day range??? My ADR High was at 1.6291 today:confused:

I think ICT said to use default settings for now so mine has been default since I’ve been using it, seems to match price very closely too

I took 3 trades today off the NY session GU. The first long was taken after the spike up that pierced ADR (was asleep so missed that). Price pulled back to the 72% area after spiking up to retest the monthly high, at this point was a previous day low and R1. Took trade long from right below yesterday’s R1 up to R2 for 30 pips. Today’s R2 is a confluence of s/r (R2 + prevoius day high + Daily ATR + 4hr s/r + previous week high). So TP was taken knowing it probably wasn’t going higher and trade was in direction of trend.

I waited and watched PA touch previous week high and stop hard. Entered short under R2 back to R1 and netted 28.5 pips. This trade was based on the total resistance sitting up top. I exited the trade and tried to go north again b/c this swing pulled back 72% of the last move up. That failed and I exited by hand with 10 pips.

I completely missed the other opportunity to go short. Price went back up to retest the high which was also a 78% pullback of the daily high/low. That move went all the way back down to yesterday’s pivot + a previous daily low and previous monthly low.

Hi Guys,

Sharing another trade I took last Feb 23. What I like about this trade is that it’s the first one that I simply set before going to sleep and just left it to work itself out.

Market flow was up and was looking for a chance to go long. Saw an optimal entry at the 1.6180 figure which was a strong reaction level. This is also an institutional figure and was in line with the previous day’s pivot as well as the current day’s MR1.

My take profit was set at 1.6230. Reason I chose this level is that it was also another institutional figure which also is a strong reaction level. It was also in line with the previous day’s R1 and the current day’s MR2. So I was expecting that price may start consolidating again once it hits this level.

I woke up this morning and checked the market and my levels were right on the money. Price bounced right off the 1.6180 level and then just hit the 1.6230 when I got online. This trade proved to me that there really is no need to keep watching the markets. As long as you’re confident in your analysis, you can just let the market do what it does and make a profit without the stress of watching every tick.

I think 4Hr flow had broken up by this stage. What confluences did you have? Any Fib levels?

Wanted to share this setup too.

Around 2pm EST Gu retraced from the move up. This was a good confluence if you were around. The yellow line is weekly/monthly s/r point and industry level of 1.6180. Here we had a 50% fib pullback; sitting there was previous day pivot, a previous day low (pink line) weekly previous low (yellow doted). The trade would have been with the trend towards the Monthly high retest.

I really don’t know what is happening, but I seem to have all the same settings on the ICT_ADR, but a different value! I have uploaded a host of other ATR/ADR apps and one has ATR high at 1.6249, and support at 1.6166 and 1.6142 (yes two support levels…don’t ask me what that is all about!) I wonder if you could confirm that that is approximately what you were looking at?

Regards

EDIT: Default settings??? Does that mean you are not adjusting time to midnight start?

Press “Reset” and those are the settings I’m using, high 1.63226, low is 1.61519

Price opened above the privot today and is already at R2 :o

This may be considered cheating on the homework, but this is my new way of getting the ‘set-up times’ and session times in my crosshairs. If anyone is interested in these two indicators I am using, then speak out and I will post their links and input details. These are the least obtrusive indicators I have tested so far, and these particular colors are the best to work with.

The dotted line boxes indicate the three main sessions: Tokyo, London, and N.Y.

The blue and red fill indicates the ‘Hunting Ground Set-Up Times’. When I saved the screenshot, it cut off the 30% of screen I leave to the right of the last candle (just as ICT taught) and so you can’t see the full effect of it, but I have two bars of color which tell me the best time for London open set-ups, and London close set-ups. These are the only times I am interested in at the moment, which is convenient as the Indy only lets you set up two periods of time! I guess if you want to add the NY open then you can just use the drawing tool as per ICT suggests.

crosshairsindy.gif picture by Alishijo - Photobucket

(left click to maximise and center)

Anyway, sorry if you don’t approve, ICT, but this is definitely a leading indicator, and not a lagging one

N.B Black space on the chart indicates chill-out time

Thanks again hellogoodbye. As expected you are not changing the ICT_ADR with consideration to your broker software. If I leave it on default (and my broker is +1GMT) and you also leave it on default (and your broker is -5GMT), then of course we get different levels.

ICT, I presume you are using different accounts for actual trading and PTC videos, which likely have different broker time settings. Are you setting ADR to midnight EST?

Regards

My default settings of my broker are GMT, if you are using MT4 it sound like you are using Alpari because they are GMT+1 while I’m using IBFX which is basic GMT times despite being located in the U.S.

If you are using Alpari try GMT-1? (I think) and that should help, if you’re not using Alpari then I’m not sure what the problem is. Just wait for ICT to post the correct settings based on whatever TF and use that.

Hey Babypipsters… I just uploaded the new video… please give Youtube about 20 minutes to finish the final touches on the quality [HD]… as always… pause the playback as soon as it begins and wait 90 seconds then continue the playback… you will enjoy High Definition audio and video without any pausing.

GLGT

great new video, the time and price thing your explaining is another amazing golden rule to trade by that i never knew until a few videos ago ! very cool stuff!!

Great video! I especially liked the ‘cycle of a loser’ part at the end…LOL! Been there, done that. Never again!

Thank-you.

Morning gang, just trying to share my first screenshot of this mornings (8.50GMT) long cable trade.

Price 1.6162, buy zone,4hr and daily MF are rising and just a little late for OTE. S/L is 1.6090, 25 pips and below this weeks low and I’ll take some profit (hubris anyone:o) at the, no just below 1.6200.

<a href=“ThursdaySS.png Photo by Deckard33 | Photobucket” target="_blank"><img src=“http://i1086.photobucket.com/albums/j459/Deckard33/ThursdaySS.png” border=“0” alt=“Photobucket”></a>

Thanks Rokas I’ll try now. I’ve lost my nerve and exited at 1.62 as it’s a strong level and I’m not sure. Still 37 pips to the good:D

http://i1086.photobucket.com/albums/j459/Deckard33/thursdaymorningexit.png

Woohoo thanks again.