MEGAUPLOAD - The leading online storage and file delivery service

Would you be able to give a little more information on this, I’m not getting this? Sounds simple enough but for some reason it’s just going over my head?

Now I’m confused …

Hit all the first time, but now I was also unaware.

same here…, bit confused what ICT means?.. :33:

I think he is trying to get at the judas swing not only extending across timeframes but also killzones.

He treats 5-7 GMT as the time to watch for a Judas after azn session. Well 10-13 would be after london open looking at new york and it can present a judas there.

Just what I am gathering, and I think this also extends past that to LC

Michael, do you mean that the high/low of the day is made during London in the time-frame 5:00-7:00 GMT (and thus this is where the Judas swing takes place), and so the same applies for NY (the high/low of NY takes place in the time-frame between 10:00-13:00 GMT, or the so called NY Judas swing)? Maybe you could explain by a short video? (but only after permision of your loved one ;))

If I do so …

I marked a vertical line at 10am GMT and 13H GMT.

And I can see a lot of OTE forming within this 3 hour.

Am I seeing right? :51:

Wait for the video.

If we combine this with the power of three, for the most part of the time I also see the judas swing

5:00 GMT is NY midnight, start of the new day for michael. Now use 10:00 GMT as start of the new day in the examples.

7:00 GMT is the start of the London Open killzone. Now use 13:00 GMT as start of the London Open killzone in the examples.

This is how i would “translate” the task.

I have really been learning a lot from your videos and postings. Guessed two out of three right just from focusing on likely perspective of the banks (taking out stops & creating reversals). It would have been more obvious if I would look at the oversold condition shown at the bottom of the first chart as well price action.

-Thanks for sharing

Could someone help a little. So many videos, timeframes, my head is spinning a little bit. On Wed night there was a great three hour session that was recorded, where Michael finished up with making 20 pips every day tied to the Judas swing. However, we had another great session Thursday night (is there any other kind) where Michael went over the SMT divergence of AUD and Kiwi, then went into Fiber and Cable. I don’t see this video posted anywhere. Was this recorded, or does someone have this. Apologies, I just want to try to get caught up with the class.

See why I take it slow?

Re-posting this, since I see you’re hangin’ around Michael

your thoughts would be much appreciated

and yes I feel like there is an abundance of material. My personal strategy is to attack the markets with everything I know, every week. The holes get filled in as experience mounts…

I got you covered and Matty tonight. You get the intended (minus the cool personal touches of course) power of three, short term trading modules. Tomorrow night i hope I can have the Explosive Profits and Equity module up. Wee shall see.

Some of you, I’m sure are buzzing with excitement as you jumped lightyears in one or two steps this week. The patience pays off this week. :57:

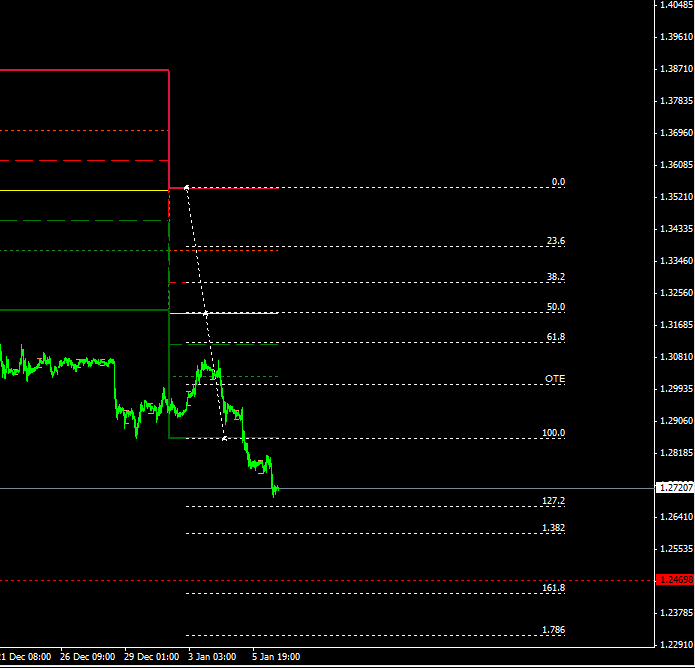

So I’m going to try to post a weekly analysis every Saturday this year to get my bias for the upcoming week of trading. Here’s my thoughts on this next week…

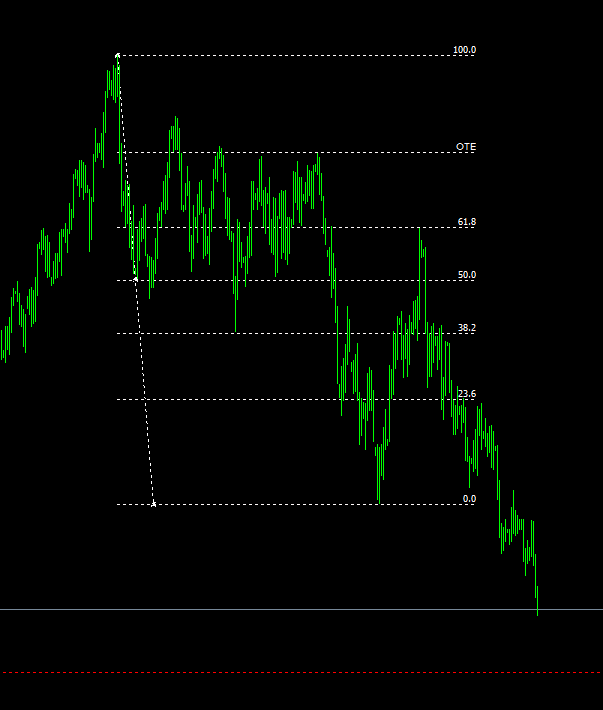

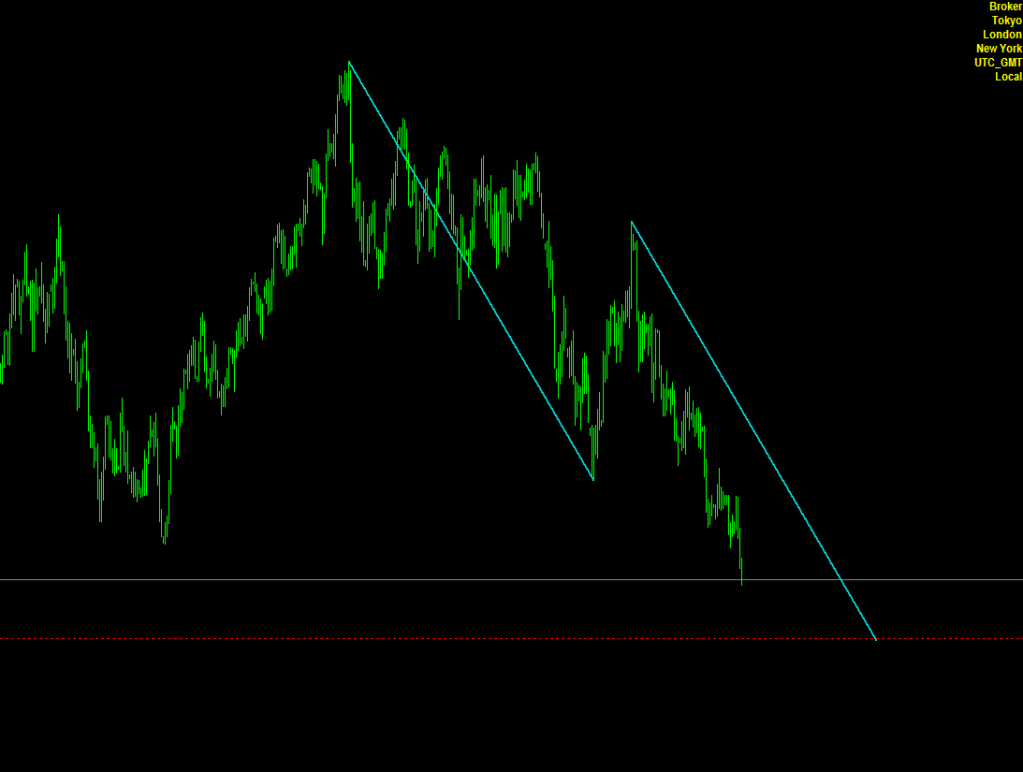

Market structure and market flow are bearish currently, and there are a lot of things that are pointing towards lower prices in my opinion…

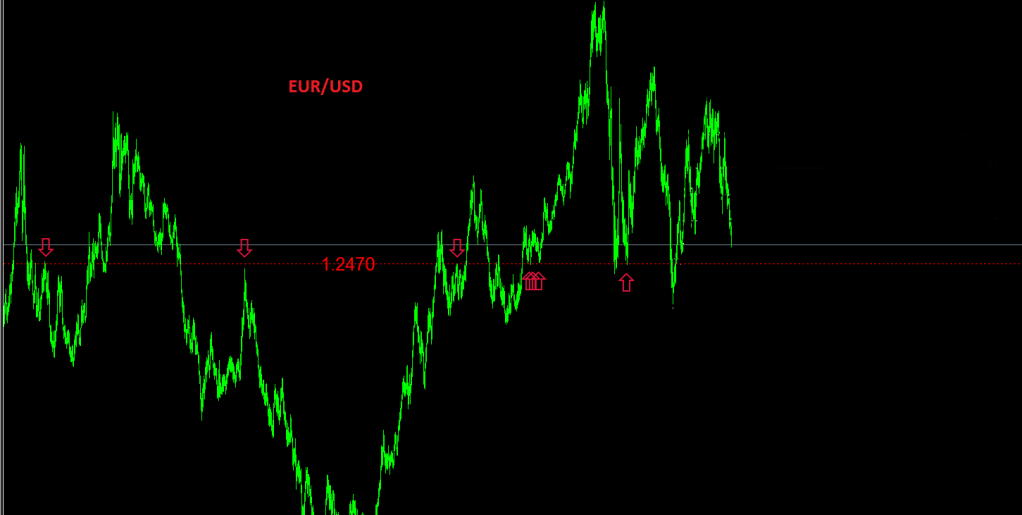

Price is moving down to a long term S/R level around 1.2470

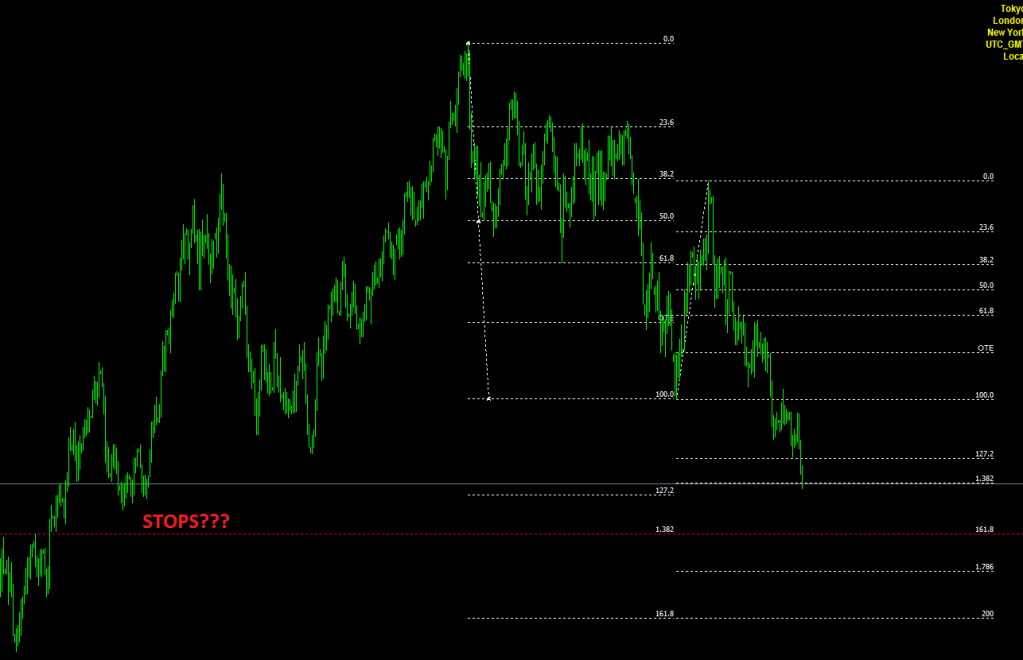

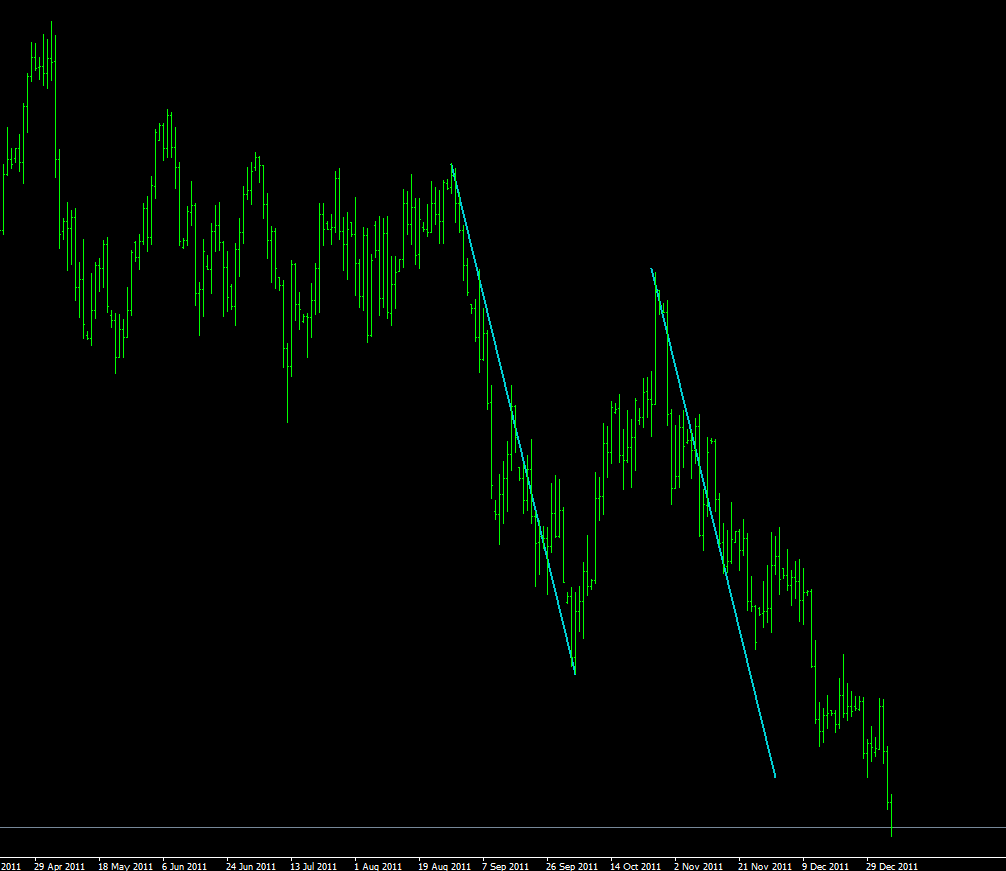

The 138% extension of the swing from May 4 - OCT 4 and the 161.8% extension of the swing from Oct 4 - Oct 27 line up perfectly with this S/R level

40/18 period MA is bearish with nice separation

More below…

Monthly TT has been broken to the low side and the 161% extension is just below previous mentioned S/R

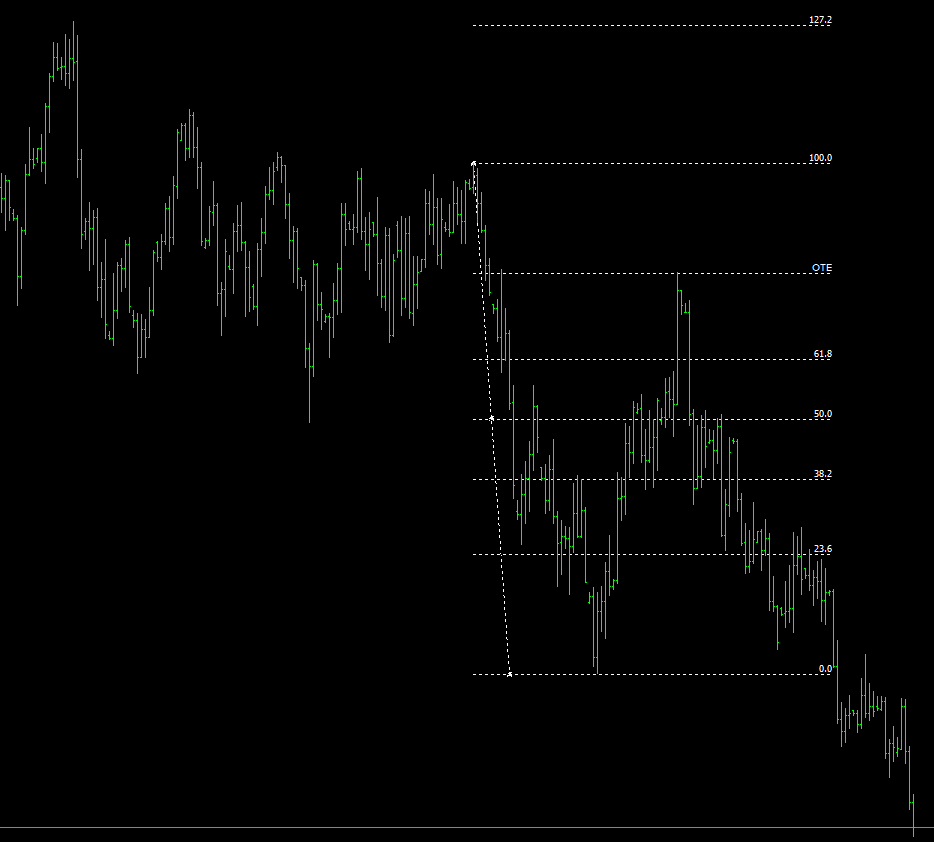

Using the May 4 – Oct 4 swing, there was an OTE at the 61.8% level…

…that can be reasonably expected to move down a similar distance, which just so happens to be, you guessed it, at the same 1.2470 S/R level

More below…

HOWEVER…

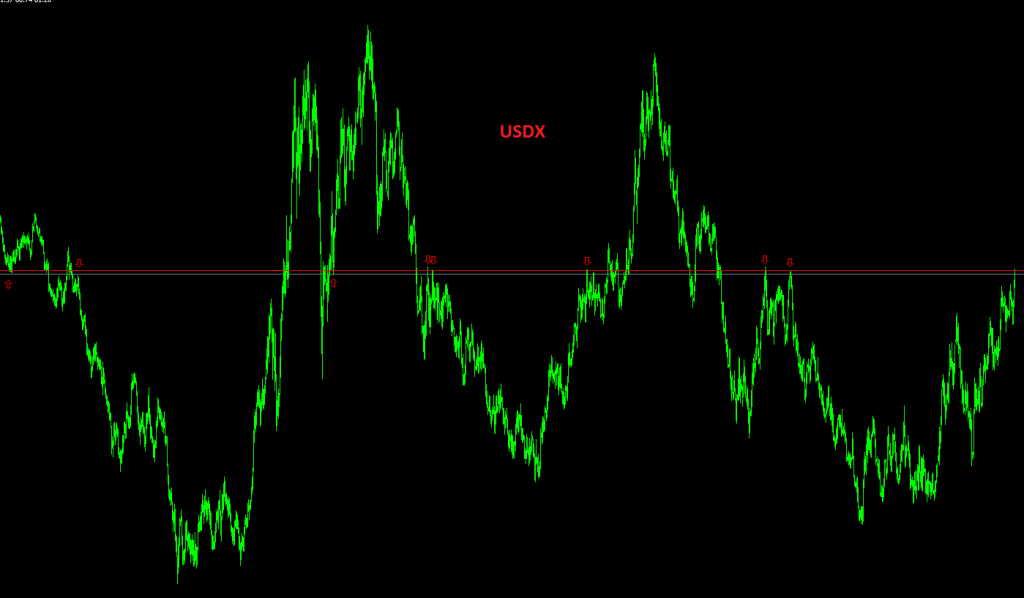

The things that lead me to believe that we may be at a reversal point in the market are the COT data that shows commercials have been extreme net long for a while, and the fact that the USDX has moved up to a long term S/R

And if we use the swing from Aug 29 through Oct 4 to form the OTE at the 79% retracement…

…the 127% extension has already been fulfilled as well as the equidistant move in price downward

So with all that in mind, I think I’m looking at a sell program for the week and will anticipate price making a weekly high near LO Tuesday and will be looking for sells mainly this week.

Anyone have any thoughts on this?..MICHAEL? Love to hear your thoughts if you have time before the wife makes you leave the computer

Matty