And that’s half the battle!!

Yeah…we’ll have to see how the rest of the (using GMT time) evening goes and Asian Range, but potentially setting up for a judas swing up to 1.2700 or 1.2710 (Week open price and Sunday AR high respectively).

On Cable…it’s a little far away at this point, but 1.5375 is last weeks low that could be a swing point.

I am very pleased today… Feels good.

My lil’ bazooka weilding Great White riding Raptors you.  lol

lol

been stalking for a couple weeks, learning. i guess the typical process for a newb. it didnt take long to realize the value of this thread and ict’s masterful instruction. like no other.

cant believe there is someone out there willing to share this much for nothing in return. money wise that is.

ITC, funny enough, it was your md. accent that sparked the initial interest to stick around and absorb. grew up probably very close to you! i think. now i know i can stop searching for a “system”, and concentrate on mastering this concept. i have found a home now. thanks again micheal

WELCOME! You’ve found the right place to be

thank you matty44

That’s the best thing I’ve heard in a while. You just made my day. Congrats man!!! :35:

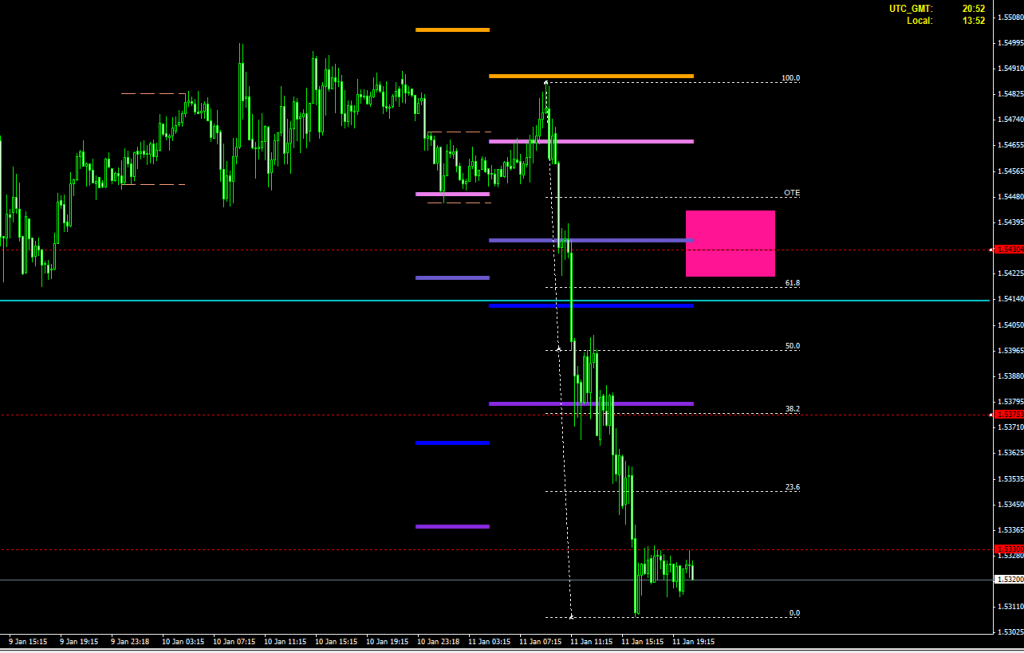

today was my first entry with a full 2% risk at LO. The few times I have traded LO, I usually enter between 1/2- 1%. I initially entered with 1 1/2% on the cable and felt very comfortable with the trade. Shortly after, a trade entry opened on the fiber in an OTE, so I entered another 1/2%. I fell asleep last night before I could could take of a portion at 30 pips, and move my stop to BE. When I woke up this morning, I quickly closed 30% of my trade and moved my stops. As the trade got more profitable, I closed more of my open positions. Finally, when I was down to my last 2 lots, I asked my wife if she thought I should hold them or close them. She said I should hold them, so of course I closed them. Well, as the LC came closer, I realized she was correct (imagine that) and I ended up with a little more than half the move of the Cable.

I am quite happy with today’s trading, but the thing that keeps biting me in the rear is PATIENCE, not using the tools to plan my exits effectively, and PATIENCE

Nice job lazy : ) !

LMAO The stuff that comes up on this thread will never be forgotten

I must say – ICT – you are shaving years off my learning curve in Forex… YEARS.

ICT tweeted a webinar by two individuals I will not disclose here for fear of search engines and BP’s backhand. Contact me privately if you would like to set up some acquisition method.

They mentioned they are recording as well so I am unsure if you will get this as a cut down advertisement or an intro, overall it might be a good look

Totally agree. I have no idea where I’d be if I didn’t find this thread. I’m still new to forex (less than 1 yr) and I get upset when I don’t make more than 5% per week. That’s a testament to ICT, not myself at all. What Michael has taught us is so powerful that even for a newbie who should just be happy to have not blown an account yet, I expect to be profitable. And I know that I WILL be profitable as long as I’m a good boy and just do what I’ve been told. ; ) Thanks again Michael. You’re probably tired of hearing this, but you’re a freaking saint for sharing your time and effort and knowledge with us all with out asking anything in return.

Matty

or if you find ict on twitter you might find out

I just wanted to say thank you to ICT and everyone who has made this such a great thread. I dabbled in forex a few years ago and went live way before I knew what I was doing. Sound familiar? Luckily I only lost a little money before closing the account and taking a hiatus.

I started a demo account again and recently found this thread. What a gem. For the first time ever I actually feel like I know what I am looking at. I am going to open a small (very small) micro account just so I can get my feet wet with what I have learned. Once again, thank you to everyone.

Hmm not sure if there’s anything particularly useful in this webinar it seems more like a shameless self promo than anything,

I got to review the first 10 mins since I was away while recording a bit of it I’ll get back here if I find anything that may be particularly useful

Update__

Never mind its more of a promo than more of an informative webinar its just how they trade or what they will teach you so not much that ICT probably wouldn’t teach you for free. I guess what’d you pay for is someone to hold your hand a bit more

Sniper Kashix reporting in:

OBJECTIVE Complete

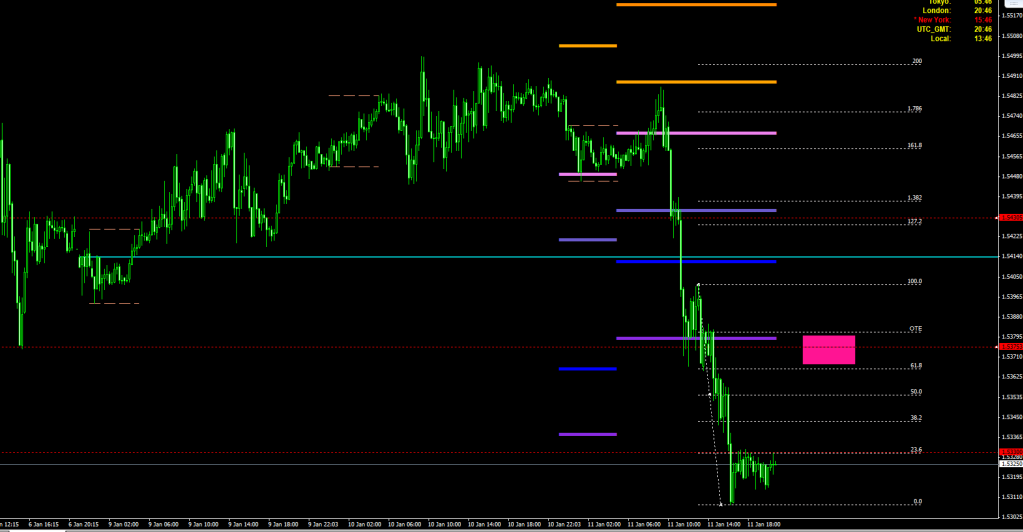

Took my first forex trade on live account today. Shorted fiber at 1.2782 at around 9:30 GMT. I saw the the cable tank lower than the fiber basically creating a SMT divergence and anticipated that the fiber would do the same shortly after and it did (among a confluence of OTE, MR1, 80 level, previous consolidation). Took initial profits at 30 pips (70% of position) and moved stops to breakeven for the remaining 30%. TP was 1.2720 which was ~100 level of the fib, TP should have been at 162 or 200 level which ICT stressed. The 200 level ended up getting hit when I woke up this morning. All in all good first trade, made 4%.

The part I’m not sure about was my entry. It worked out but when the cable goes lower and the fiber fails to go as low it shouldn’t be a reason to short it on its own.

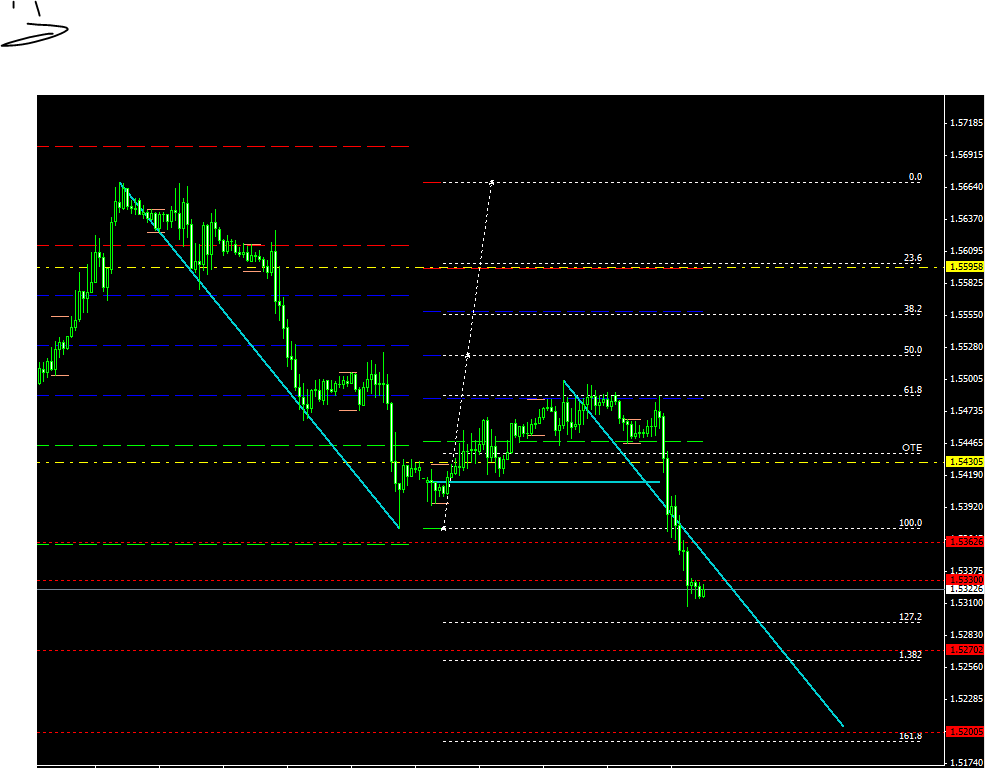

So here’s where I’m anticipating price to eventually move to on the Cable…

Looking at the 1.5200 level because of TT fib extension, swing projection, and we still haven’t taken out low from October ~1.5270.

I’m looking for price to trade up to one of these levels by LO tomorrow to take a short

First possible entry is an OTE from NY session high to dailiy low, today’s S3 (we’ll see what pivots are tomorrow), previous S/R at 1.5375, and institutional 1.5380

I would prefer to see price move up to this level which is an OTE from today’s high to low, above this weeks opening price, great S/R at 1.5430 long term which also runs through a handful of asian session highs and lows, today’s S1 (we’ll see what pivots are tomorrow), today’s asian low.

So those are the two areas I’m eyeing for the LO. Anyone else seeing things similarly?

Matty

This also a bullish divergence, cable made a lower low while fiber wasn’t able too. I thought about gettin long because I thought weeks opening could be a good support and there were also some lows which could be wiped out if it swapped below weeks opening in the untested asian range there. S2 would have been my entry but I decided to skip it as it didn’t occur in a Killzone and the high of the day made with the fake break of asia was 70 pips away of S2, too much of the battery would have been used to turn it into a profitable bull day.

Eventually it did stop at weeks opening and I had itchy fingers, but I was able to skip it  There wasn’t a strong bullish reaction at this level too.

There wasn’t a strong bullish reaction at this level too.

greetings