no problem Alishijo.

Scroll up to the top of the page and you see the ‘School’ tab, under that it says ‘chat room’…click on that and enter the LC room by entering the password.

Haha, yes overlaying them on your charts would definately be very confusing. Hence, like ICT, I have one screen for GMT settings, and another for NY settings. =) (That much closer to my 8 screen setup =P)

That really makes things better.

Regards,

Clark

I remember seeing a dog once that had a whole litter of puppies, but one of them was a stillborn. The dog continued to care for the puppy just like it was any of its other healthy new born puppies. That’s how I felt with my trade tonight! Limit order was set on USDCAD at the R2 in the OTE zone, and it came down to within a whisker, but didn’t get triggered. I was monitoring the USD index in another window, and there was good support at that level. The sad thing is I continued to care for it just like it was active, and kept checking back in the orders window to make sure it wasn’t:46:

april6th-1.gif picture by Alishijo - Photobucket

P.S. Still can’t get the damn chart up even though I followed all your rules Shauun.

P.P.S. Did I miss my Fiber chance…lets see. (EDIT: It missed me, I didn’t miss it!)

april6thfiber-1.gif picture by Alishijo - Photobucket

Ah Ali you’re all heart. I had one of these stillborn trades today on Cable, NY open, ++OTE on daily and 30m and 5m at about 1.6336 with R1 as the swing high, +10pips for my S/L, 1hr, 4hr MF down. Had it all written up for my weekly best trade but it never got passed the 62% so it’s the best that never was.

I quite like the London close trade on fiber with R2 (NY Pivots) as the entry. 10pip S/L and 20 pip scalp, but it’s not quite good enough with all MF on the rise and my high standard of entry requiremnts for the week… I mean from now on.

Just noticed this…we must be telepathic! Don’t think we need to Skype or chat:)

The hardest thing for me about ICT’s methods is getting up so early in the A.M. Other than that, it’s getting real easy to earn consistent profit. Nice London short today and with one trade this week I’ve achieved my goal. I think ICT called it “Riding the lightning” or something similar, 62 pip move south in 15mins today.

Hey dude, to get your pictures up, all you need to do is paste the IMG code instead of the link. Like this, IMGhttp://i1128.photobucket.com/albums/m492/Alishijo/april6th-1.gif*/IMG*. Replace the * with [ ].

and she’s there!

Tell us more about the trade hellogoodbye. I’ll be able to trade these one day, so I want to hear all about it. D1H4H1 market flow? Pivot level? OTE? Bang on entry or pipped over?

If you documented it before, and I missed it, just guide me to the relevant page that the post is on.

Thanks

Northerntouch101 you are a star! That has been frustrating me for a while. I have now edited my post on page 122 to prove that I can do it:), and so that people can make easy visual reference to what I am saying.

just a standard trade really. Price moved way up the day before and opened well above both GMT and EST central pivot in the new day. I think market flow was up but being that price was already so high from the previous day and Asian session I was prepared for a short. OTE was taken at the 61.8%, during London session, and went a couple pips over. Profit taken at +30, 127%, and 168%. Don’t have my charts right now or I would post a picture.

Hi all.

How everyone view on fiber today huh??

Will it have strength to push up further after pushing thru the daily high of 22nd March esp since it is thursday today so likely for traders to take profits?

Looks to me that price will likely fall to 1.4250 level as there are quite a few reaction point around that level and confluent with today S1 for both london and NY pivot ( and tuesday R1. Afterwhich likely to consolidate till the major news release later in the day?

Once again just a newbie thought.

Thought y’all might get a kick out of my equity curve. Keep that risk per trade low and don’t take more than a handful of trades per week or this could happen to you!

Uploaded with ImageShack.us

edit:

actually it’s my net profit/loss rather than total equity, my error

Well that is the minimum amount of university school fees… so can say that u have graduated from forex uni now…

Or as most ppl say… dont be too concern about the past as long as u learn from your mistakes… Cos i am sure almost all traders lose money before turning to profitability, including me T_T…

Quite, that sort of figure is reasonable for any training that sets you up for a career. And if you make Forex trading work, you really won’t worry about that sort of number, one day.

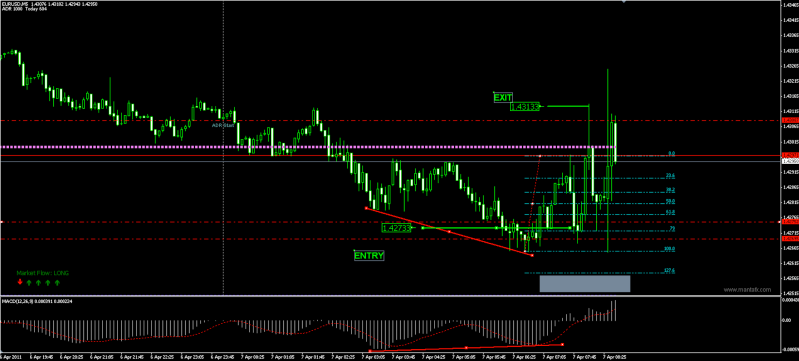

New York Open Fiber Trade.

4Hr and Daily TF Bullish

MS1 Support, (GMT Pivots)

April 3rd High,

April 6th R/L

Bullish Divergence on MACD

OTE

Entry was at 1.42733, T/P at 1.43133.

Risk was 20 pips S/L and 40 pips T/P. My weekly goal is 2R so this is my one trade for the week. I was in and out before the huge news spike (US Initial Jobless Claims). The OTE was actually hit during the EU interest rate announcement however spreads never widened because announcement was bang on expectations.

Here is my reason for choosing the Fiber. The EUR/GBP came down and hit previous support and showed what I interpreted as large accumulation into the Euro opposed to the Pound.

Edited to add that I chose to use GMT Pivots today.

Summary

Market flow- Daily, 4 hour bullish

Confluence of S/R - MS1, institutional level 1.6280, 1.6280 was support on tuesday

Optimal Trade Entry

-Going into the London open price was trading below the central pivot

-I Pulled my Fib from yesterdays low to yesterdays New York session high

-MS1 and institutional level 1.6280 fell inbetween the 62% and 79% retracement level

-Stop loss was at 1.6250 30 pips below entry,5 pips below S1

-Price fell attempting to test yesterdays lows but when London opened it pretty much rocketed up above the central pivot

-I took 20% off at +30 pips (1.6310)

-2nd TP was at 1.6330 where a further 40% came off ( I did this because i wasn’t sure price had enough momentum to push through to R1 and test yesterdays New york session high)

-3rd TP was at 1.6360 just below R1 (i got stopped out after price fell back below central pivot where i had moved my stop up to 1.6300)

Initially I thought this was a very achievable TP if price broke through the New York session high and then went on to test yesterdays highs but not today:)

-overall 50 PIP trade

Edit…Waking up this morning i see price eventually reached R1 after New York close which was my 3rd TP, but eeking out those extra 20 Pips doesn’t really seem worth it considering you would have to hold the trade for the entire day…

HOWEVER…

when i did the 50% swing projection and placed the 50% Fib level on the New york session high i had a R2 take profit in mind at 1.6416,so round that down to the 1.6400 level and it becomes a monster 120 pip trade,Price just penetrated the 1.6400 level. How would you know to hold onto this trade even after price fell from MR1 to MS1??

London Close

Password: ict

I’ve never been able to get into that chat room it gives me the error “error connecting to chat room try again in a few minutes”??

Are you at work? Or using public connection? They tend to block it…