Back tests are meaningless. I could show you a back test that turns $1,000 into 10 billion dollars in 5 years, they mean nothing.

Good points here, especially about 90%+ “shaved majority” who went through active learning about freely published basic trading strategies. Did you ever think that winners in this game are probably happy that we learn basic trading strategies (rules) as they are presented here or on any similar other site? If we behave like bees in a coordinated way through publicly well known trading strategies, they just adapt their »shaving« process to get as much as possible out of the market.

As it is pointed out in the article, most of the “trading rocket science” used today is from the past and the markets and biggest players have already adapted their strategies. They just run scenarios on as many as possible outcomes in the market future and account for all of the expected behaviours of “shaved majority”. They have to win to stay in the game, and they invest what we cannot as we don’t have the resources (nor money nor expertise).

As I heard in the video of one retired quite successful trader a few years ago, it comes to following to become a profitable pro trader: The first few years (up to five) you are an apprentice with no trading authority, you just play the “game” and compare it to the real unveiling of the market at a set future time while being supervised by experienced mentor trader and team of psychologist.

Only after you deliver more than 50% of accuracy for profit and your profits are higher than your losses, you are allowed to trade, again only through case by case authorisations. If I remember it right, he told that drop ratio of »wannabe traders« is quite high and that only a small percentage gets to the highest ranks and authority, most of them are just a supervised and directed »trader army«.

To make everything short: he put forward that only after twenty years in the profession he was allowed to execute his trades without any supervisory and he became a mentor to younger candidates, while most of the colleagues he started with, were not successful. As he pointed out, after almost four decades in the operations, he made a lot of money and through dedication and discipline became even a junior partner of a trading company (if I remember it right, it was owned by the bank).

That video was one of the best things ever happened to me and helped me not to lose too much money at the beginning (considering it at the time as the investment in my learning process). After a few years I developed a thicker skin and got to some deeper knowledge, which I would evaluate as humble apprentice approaching the final score to be allowed to trade for some profit.

My conclusion from quite some time ago is, that you have to trade outside the box and always make some profit, while you use the conditions on the market to your benefit by not following too often the established free available trading strategies.

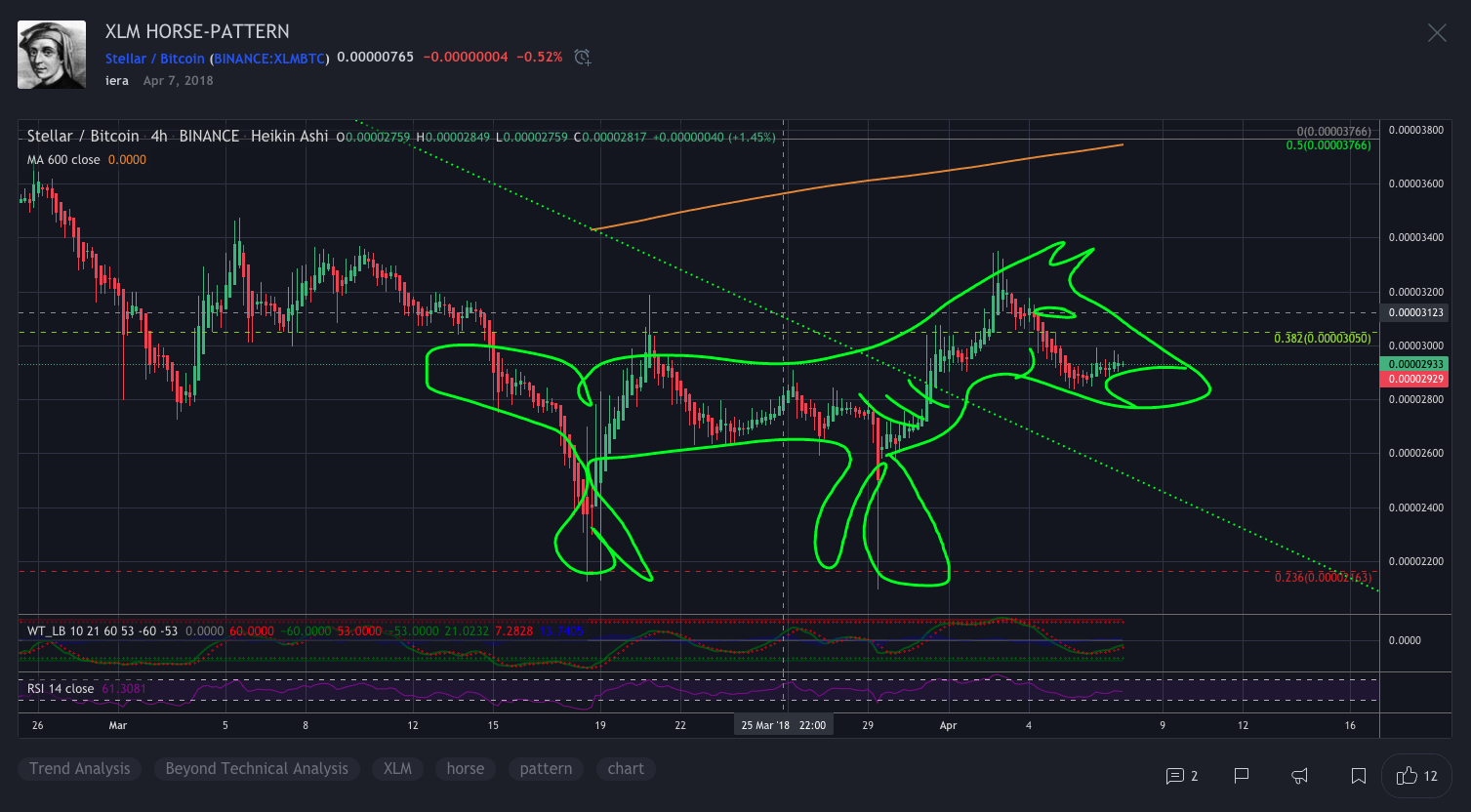

Quit horsing around, you look like an ass. It’s obvious a dog, pointer to be specific. And yes, I think it’s tired for sure.

nice post!

i also wonder why 90% of trader are wrong. i mean how is this even possible?

even when you go with market sentiment you end on the wrong side of the track mostly so i’m wondering if going intentionally against the market sentiment (since we figured out that 90% of trader are wrong anyway) could lead to better results, even one of the first lessons of babypips school suggested it.

i always try to improve and optimize things this applies to everything in my life, fitnes, work, trading and litterally anything. even if i’m still sucessful i always try to find new options to optimize. so this week i tried a new system and damn it was a bomb, i opened a few trades on monday (10 to be precise), 8/10 hit TP, 1 trade (i guess it was EUR/AUD) hit stoploss but just a few minutes later i saw how it turned in the other direction and even passed my initial TP, i should had set my SL just 5 pips furher and it would had be 9/10 winning trade. the other trade ( i gues it was CAD/JP) hit SL too. it brought me a total of 110 Euros (Demo account, 3.000 Euro).

So i just sticked to those rules/system the whole week and entered market for the next days only if price meet the prerequisites of my system (or should i say the same conditions as monday).

and guess what, what do you think happened? yeah, all trades went wrong  so now its friday and i have only one trade left, which is about to hit my stop loss. So how is this possible? there were no high impact news for the pairs i traded, every textbook would told you to do exactly what i did but it went wrong anyway, expect monday. i analyzed my winning trades and the losing trades and i just can’t find any mistakes. So i’m starting to think that trading is just a luck game or charts/price always lies to you since it represents the action/psychology of traders and remeber: 90% of traders are wrong.

so now its friday and i have only one trade left, which is about to hit my stop loss. So how is this possible? there were no high impact news for the pairs i traded, every textbook would told you to do exactly what i did but it went wrong anyway, expect monday. i analyzed my winning trades and the losing trades and i just can’t find any mistakes. So i’m starting to think that trading is just a luck game or charts/price always lies to you since it represents the action/psychology of traders and remeber: 90% of traders are wrong.

so i’m really thinking of going against market sentiment / chart. i will give it a try next week. just a lil example: when you see price in a uptrend, indicators showing you to go long (RSi above 50 etc), price above MA, price nearby support y’all would probably go long, yeah i agree i would go long too, but guess how it would end  so this time i just will go short

so this time i just will go short  i’m really excited to test this “way of trading”, a friend of mine told me she’s planing to do so and i also read a post a few days ago (here on babypips) where a trader wrote about trading without SL and so on (he called it “ugly style of trading” or something like that and is profitable…

i’m really excited to test this “way of trading”, a friend of mine told me she’s planing to do so and i also read a post a few days ago (here on babypips) where a trader wrote about trading without SL and so on (he called it “ugly style of trading” or something like that and is profitable…

it really sounds stupid and not logical at all but damn rules are there to be broken and why always go with the herd when you can go against the herd

well of course i will continue trading my system which i’m trading profitable since months, but as i wrote at the beginning of my comment, i’m always seeking for better results and chill fellas, it will be just a demo account (in first ;D)

ps sorry for my english, optimizing a language takes way longer  i’m in south germany right now and its friday 6:20 pm so have a nice weekend!

i’m in south germany right now and its friday 6:20 pm so have a nice weekend!

Guys you wont believe me,but forums helped me alot in understanding markets

I just did vice versa to what everyone was posting on forums,that was the first step I took to understand markets

Eh…i remember my first time here on babypips… Still remember my old enemy “tommor” , we could argue about everything… Competition leads to new visions,new ideas…so boring now here

Trading is not luck, it is a game of probabilities.

As far as the 90% number is concerned, forget it, its historic and not helpful. More relevant are the numbers published on websites and literature by EU and UK brokers identifying how many of their currently active clients are losing money. Typically it is 70-80%. Which obviously means that 2 or 3 people out of every 10 trading today are profitable. That already sounds better.

Of the 8 who are not profitable we can conclude from postings at babypips and elsewhere that 4 of them started trading without a proven strategy but immediately using real money in a live account. Likewise 7 of them are intra-day trading and they are entering counter-trend at or prior to what they hope are reversal points.

Its not surprising that so many people are losing money. Very few people would start a business that way. But most of the people who approach trading in a rational, methodical and business-like way are making money.

What was your “Ah-hah” moment if I may ask, what was that thing that helped you break through your threshlod of consistent success in the markets?

And what do you think the solution to this is? What is it that thing aspirant and unprofitable traders should DO/LEARN to achieve the results they desire? What is it that specific thing(s) they need to learn and where can they find it?

Can you recommend any resources that might be helpful in learning all this, books, specific courses or videos?

Does this have anything to to with fundamentals, cause I know most traders nowadays are mostly focusing on technical analysis (including myself).

yeah I read and hear it everywhere and its true what you are writing  but I will test it anyway, parallel to my usual trading activity

but I will test it anyway, parallel to my usual trading activity

You are on the right way, learning how market works,will bring you to profit,and after watching charts for 2-3 years ,you will understand everything,your experience will dictate you . You will reach a point,trust me i know what am talking,where you will just open pure charts with no lines,no indicators,nothing,just naked chart,and you will be like "oooo,its a buy because… and you will profit. And you will do it several times,and then you will laugh and cry at the same time ,and from that moment will be so nice and easy day after day

You are on the right way,but dont be lazy,and put it into work day in and day out for 2-3 years . There are no shortcuts . Now you see why no one can teach you learning,but only a little guide

The figure comes from a sole study carried out by a large Wall Street firm which had many US clients who were mostly day-trading (in the mid-90’s I believe). The study found that 90% of their clients lost 90% of their initial deposit in 90 days.

But we know nothing about who these traders were or what markets they were trading or what T&C’s, charges, commission etc. they faced or how they entered their orders or whether they were using charts or following the firm’s analysts or newspaper tips or anything relevant like that. Take it with a pinch of salt.

Statistics like these are just being used to make new traders afraid, so that they will turn to various vendors for help.

It doesnt matter how they traded,or based on what they traded,what matters is that they were easily manipulated,and lost majority of them at the end.

It was always like this. But this is easy to understand with logic,but its hard to spot it when a newbee looks on charts

I just dont understand how majority think…

They think like this: lets buy everyone,lets say 100 people 1 lot each,or 1 share for stock mkt, so 90 people buy 1 share each,and 10 people sell 1 share each,and those 90 believe that price will go up,because they are more on buy side . Lets do the math now : 90 people won,and the rest 10 must pay to those 90 ,but the thing is that those 10 can not pay to these 90 people,because they had the same amount traded,1 share each,even if price went up ,how would 10 shares of loss pay 90 shares of profit? Its just not enough money,as simple as that…

Now lets do different math : 10 manipulate with 90 and make them buy,they bought from 10 people. The question is : can 90 shares of loss pay to 10 shares of profit? The answer its obvious YES they can

What do you expect, say even if 50 per cent people, who opened an account are consistently profitable that would be even more unlikely than

90 % winners

10% losers

I don’t know why it’s surprising, even though the figures are not set in stone

We all have our ways to learn. I was introduced to forex as get rich fast kind of scam but after little research I realized that’s not it. But because of this, I tried to trade and I fell in love with trading forex. I opened an account with little to no money and almost daily, I read my account is underfunded but I always cared about my finances so I put in what I am willing to loose.

Since I started (end of 2019), I preferred to take trades in my live account over demo accounts. It does not interest me if I am not part of the deal.

This also allowed me to feel what you feel when you loose your money. Today, I am more emotionally numb towards my finances overall because it is only a tool to get what you want.

More I learn, more the market interests me so I’ll be always around to watch the charts even if I blow my account which btw did not happen yet.

Money is not the only benefit Forex has to offer.

I swear that your forex skills will adapt to use outside of it. I am way more patient with myself than I was when I first started. I improved my time management skills, mind set, purpose.

I think that there are various reasons new and aspiring traders lose money. I would say the top reasons people lose money in the market are:

-

They lack a comprehensive understanding of some of the key skills involved in successful trading such as risk management. Profitable trading comes from mastering a complex skill set. Unfortunately, not everyone is capable of such mastery. That’s just the harsh truth.

-

They have no proven edge in the market. Instead of researching and developing one, they waste their time looking for the golden strategy that will somehow miraculously make them ‘profitable’.

-

They are under-capitalised. As long as you have the right education and a proven edge, you can grow an account from any size. However, to grow a small account takes real discipline, something that most new and aspiring traders simply lack.

The way we can do better is to ensure that we really do have these things in place and that we are not fooling ourselves, falling prey to the Dunning-Kruger effect perhaps. The way to do that is through regular reflection. Go back over your trade journals, think about why you have taken some of the trades you have and, perhaps most importantly of all, check your long-term profit and loss.

You keep mentioning this guys theories, in your posts.Basically it just explaining what naivety is .

Actually it’s only the second time I have mentioned the Dunning-Kruger effect in a post and it’s a little bit more than an explanation of what naivety is. Someone can be naive without being self-delusional. What makes the Dunning-Kruger effect more pernicious than simple naivety, perhaps, is it is very difficult for people to recognise it in themselves. They think they are smarter than they actually are and there’s no reason for them to doubt it. Oftentimes, there is also no convincing them otherwise even in the context of an educational environment where they should be naturally more receptive to learning.

The reason I mentioned the Dunning-Kruger effect for a second time in the post above is because I believe it is probably one of the most common reasons for the high failure rate among traders. You only have to listen to people in this forum or on social media for five minutes to see it blatantly there at play.

No offence or disrespect intended, I find it interesting that you would generalise and distort the facts by suggesting I ‘keep mentioning this guys theories’ when I had in fact only mentioned it twice. It is a good example of how our perceptions can be distorted without even realising it perhaps, something I was trying to point out in the first post where I mentioned the Dunning-Kruger effect.

Kind of ironic, hey?

Cheers Dan thanks for the reply .

my early twenties I used to play poker for a living and I would often come across certain players who, from tening to their conversations, thought that they knew how to play really well but in reality consistently lost (victims of the Dunning-Kruger effect). They could never see themselves for what they really were: degenerate gamblers.

[/quote]

Are nt you generalising or sterotyping here