Good afternoon! My name is Koen and I have been trading off and on for about four years. I am passionate about trading and six months ago, I decided to pursue a serious career in trading the FOREX market.

I have developed a strategy that works great on a demo account, so now I will open a small 1,000 euro account to see how I am doing live. If everything goes well I will add to my account until I have enough capital to trade full-time. It will be a long journey and I vow to document everything in this thread. I will start on Monday!

Nice to have you. Will you be sharing your strategy or will we just get an update of your results? Good luck!

Good job!! By what percent did you grow your demo account?

What pairs do you trade?

Do you trade news, chart patterns? Do you use technical or fundamental analysis?

I’m curious.

I traded demo for two months and grew it by 12%, I know that is far from statistically significant but I have saved up quite some money for my future trading. So I decided to risk 1,000 euro’s and get a more raw feeling of my trading strategy instead of continuing on a demo account where I can’t work on my psychology since it is not real money.

My strategy is build on @petefader 's VSA method with some minor adjustments. If you’re interested you can look up his YouTube channel, that should give a pretty good indication on how I trade.

Thanks! I’ll be sharing my analysis as well. First I just wanted to share the results, but it might be interesting to see my reasoning, and it also helps me reflecting on my trades I suppose. So that’s a win win

I trade the major pairs, but if I see a really good setup I might deviate. I don’t really mind which pair I trade, I don’t want to lose overview by trading 20 pairs, therefore, I stick to the majors.

Congrats!! Try to stay focused!!

If I can add something. Many people find if they keep a online trade journal that it is as real as trading your own money. Mainly because other traders are watching what you do day in day out so the psychology becomes nearly the same. Nearly. So if you start updating on a daily basis then you’ll know other people will question if you deviate or dont follow rules. I would advise starting a demo of £1000 and post screenshots. We’ll keep you honest and you’ll feel the pressure lol! If you keep it up for a few weeks then you can use real money. Remember theres no rush to start, confidence and acceptance of your strategy helps much more when you’re in drawdown. Just a thought to save you money but either way it’s up to you. Best of luck! I’ll keep an eye on this journal starting Monday.

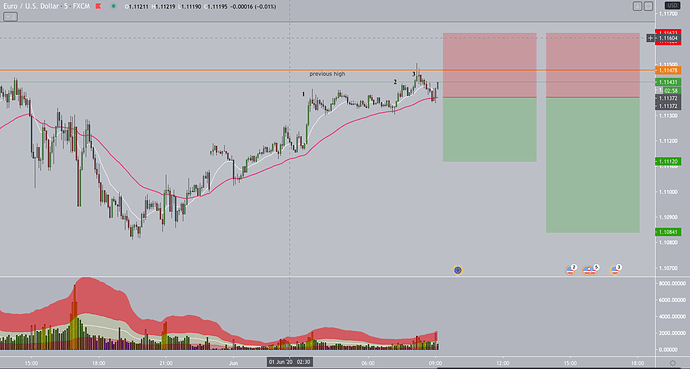

PART 1 short EU

Short EU at 1.11372

TP1 1.11120

TP2 1.10841

Although the bullish conditions, the euro shows weakness at higher prices and low volume on lower prices. Moreover, price is at a .5 .618 fib zone. Looking for a retracement to TP1 to cover the risk and move SL to BE, then continue down to the lower low.

I truly appreciate the tip, you might be right that by having a public journal you’re being accountable as well, didn’t really though about it in that way. However, I think I can learn even more by playing around with a small account I do not mind losing, this is my tuition fee. I appreciate the thought though!

Part 2 short EU

Breakeven

Trading just before high impact news is against my rules, overlooked the economic calendar. Price moved 3 pips away from my first target, however, there was some climactic buying volume on the lower prices so I moved my stops to breakeven to eliminate the risk on my trade. SL hit at break even.

Note to myself: look at the economic calendar, rookie mistake

Yeah that was unfortunate. Otherwise was moving really well to your TP. Does the same method work to get in if it sets up again or is it all or nothing?

I can retake the trade, as long if the setup is still valid. If price was for instance testing the high again on high volume, I would love to enter again. The Euro did actually fell, so that was a bummer. The volume spike on 10.10 were on al lot of pairs, idk what happend.

wise move good luck with your progress

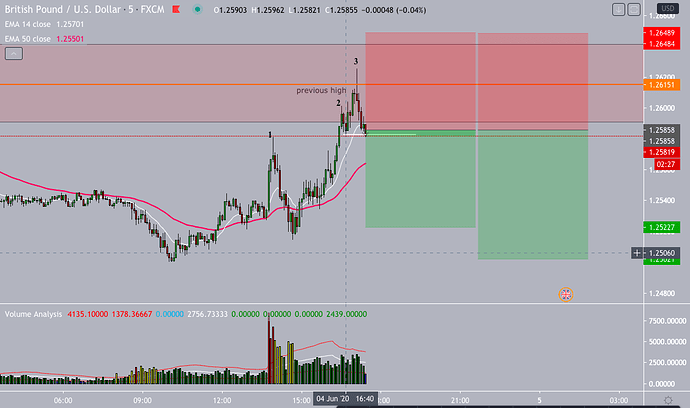

Part 1: Short GBPUSD

Took a short GU on the London open, saw a lot of high volume on the higher prices and low volume on the lower prices, which indicated that the price was going to go down. I accidentally took a 0.17 lot instead of a 0.017 lot, so I closed the trade immediately with a 2,45 loss, so I was a little bit rushed and took a 0,2 lot with a smaller stop loss, let’s see how this trade plays out. Volume leads the way!

Part 2: Short GBPUSD

0.44% win

Hit TP1 with very little drawdown. Price showed some demand of the fib zone and retraced back up to my break even stop loss. Which puts a 0.44% win in my pocket. Very unfortunate that I lost 2,44 euro’s because of my mistake in lot size.

Also…

I really feel the difference in demo and live trading, I have to trust my plan and not check the chart every 30 seconds, my heart rate increases and I get a little anxious, especially when price touched my TP1 but didn’t trigger it, for 2 times!!! It’s 5 euro’s, which is like nothing, but I really do feel the pressure. I should work on my psychology more than ever.

Any tips from experienced traders?

Part 1: long AUDUSD

1,2,3 times buying volume plus price is in the fib zone, just after the new price pushed through the automatic rally on relatively low volume. A 47 pip stop loss. TP1 47 pips to cover the risk. TP2 to previous high.

Haha. I do the same thing. I think you just have to trust your strategy.

I’m trying to figure this one out, myself.

I guess you get used to the anxiety and just not think about it so much.

Perhaps finding something else to occupy yourself with could also help.

Part 2: Long AUDUSD

0.43% Win

Nice trade! Hit TP1 with little drawdown, banked some profit and adjusted my SL to BE. Unfortunately I didn’t hit TP2 and price floated downwards and hit my stop loss.

When I entered the trade I watched a fine episode of the last dance and checked the chart from time to time, but not in an anxious way, I just let it play out.

I am happy with the results so far, hoping to hit some second targets as well in the future, because a loss of 1% is lurking and that would eat away all my profits.

Yes, yesterday I realised I just won’t change price by looking at it every 30 seconds, the market is going where it wants to go. I had to let it play out, sit back and enjoy the ride. That realisation helped me a lot on the last trade.

Part1: Short GBPUSD

The charts were a little bit messy due to news etc, I did not really wanted to trade but I saw this nice setup forming. Price is at a resistance that has been rejected multiple times. You see some nice selling volume (some buying but that’s also the news volume spike of 14.30).

I did not wait for price to actually push through the automatic rally so I was a little bit aggressive, I hope this trade won’t stab me in the back because I am on a small profit for the week. I am also going to add the one hour chart from now on, so you can see the bigger picture as well.

1 Hour chart

5 minute chart