Well let me say this. For the last 2 days I have done an extensive analysis into 8H and 3H USDJPY charts (past charts).

For the 8H charts, I have identified 11 patterns, which are all correct patterns according to TMB’s method. 6 succeeded, 5 failed.

For the 3H charts I have identified 15 such patterns, of which 8 succeeded and 7 failed.

In addition to this, I have a whiteboard in which I wrote current patterns as I saw them. This indicates a success rate not much above 50%, either.

Clearly, this is way below the touted “70% success rate” for this method.

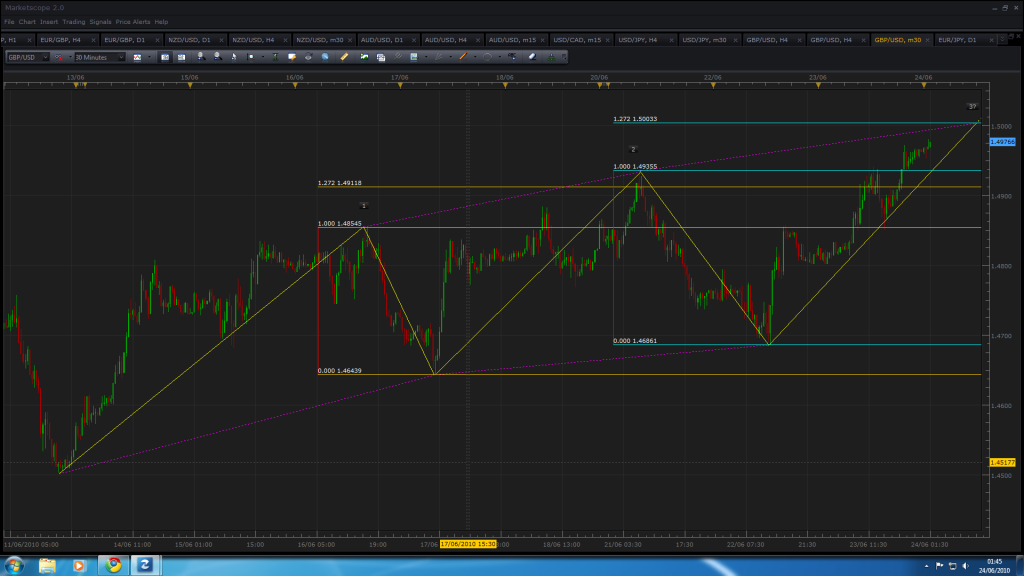

In “Trade What You See”, the AB=CD legs of the patterns are usually very symmetrical - they are both symmetrical, and are clear-cut in terms of trends. Let me try to open it up with an example.

The way we are doing it, we are choosing the B point as an “intermediate extreme”. This is correct but is not enough. There should not be a lot of swings before the B point. The line AB should not contain a lot of swing highs and lows. It should mostly be an uptrend (in case of a buying pattern). At least this is how nearly all of the examples in the book are like.

At the heart of this method lies the AB=CD pattern. And the pattern itself should be “pleasing to the eye” as Pesavento himself says. So I think we should choose AB=CD’s that don’t “stall” if you see what I mean.

Plus, and this is mostly cosmetic but, in the book each pattern leg consists of 5 to 20 bars. We are usually talking about 100 bar legs in our examples. This means that we have to go to a higher timeframe and just zoom. I absolutely know that this sounds silly, and what I talk about only means subtracting information without changing the extreme points  Just pointing out the difference between what we are doing, and what the book talks about.

Just pointing out the difference between what we are doing, and what the book talks about.

[B]The AB=CD leg is very important.[/B] From what I see, we are missing on a lot of successful trades because we are looking for the additional XA fibs confirmation. And the XA fibs are important S/R points too no doubt about that, but from what I have seen, the AB=CD fibs are more powerful.

I’m going to trade swing fibs and AB=CD patterns for a time and let you know how it goes.

but I’ll keep an eye, thanks.

but I’ll keep an eye, thanks. Just pointing out the difference between what we are doing, and what the book talks about.

Just pointing out the difference between what we are doing, and what the book talks about.