meh, this failed in a hurry.

The AB=CD doesnt match up with the X retracement, but the 1.272 does. Ill watch at the 1.00 since so many patterns have been failing to extend lately. I missed 3 good ones the other day because I was at work. And then not a single one formed yesterday. Frustrating.

Hi All,

Just a FYI - Leslie Jouflas, coauthor of “Trading what you See” is holding a webinar next week, August 4, on the Butterfly AB=CD pattern. Google…

I’m not a member, just on the mailing list, but have sat on her previous webinars re: harmonic patterns. Found it quite insightful to hear it from the horse’s mouth so to speak, and get my questions answered, clarification etc.

I believe as previously, a recording will be made available if you sign up and can’t make it.

Cheers,

inspira

PS. Still trading harmonics, just absent due to World Cup/TDF… ;p

I’d encourage you to stick at it PipBandit. You sound like you’ve found a timeframe that melds with your trading personality which is critical IMHO. Of course, on the longer timeframes we have to be patient for patterns to form and subsequently play out.

Re: rules and harmonic trading in general, I highly recommend reading Scott Carney’s fr.ee ebook the Harmonic Trader. I rate it more highly than the Pesavento/Jouflas book.

On all these patterns, my final target is generally the B point, and I will scale in and out around horizontal S/R zones with stops also based on H- S/R. My highest timeframe is the 4-hourly, which can take 1-3 days to play out depending on the size, with stops/targets generally < 100 / several 100.

I’ll see if I can’t post some 4hr charts in the next 2 weeks before my 1 week break. Seems like you’ve made up your mind though… all the best whatever your choice.

Hope this helps,

inspira

PS. AUD/NZD 4hr had a bearish butterfly, great RRR @ 2-4:1 depending on entry. I was short Fri but stop was too tight below Big Round Number 1.25, rookie mistake. It offered 30-50 pip stops, 100-130 targets, with scale outs at 1.240x and 1.235x both above BRN’s.

X = 1.2406; A= 1.2097

B = 1.2348 @ .786 of XA

C = 1.2204 @ kindof in no-mans-land between .50/.618 but at a S/R level which I’m ok with

D = 1.2502 @ ~200BC and 127.2 XA

So I’m new to forex, started in Feb. Been following this thread for a bit, thanks everyone for all the good info and imput you’ve been giving.

Now, I’m not sure if I’m right with this, and I haven’t seen anyone make mention of it, so I may just be seeing things.

I’ll be following the AUD/USD daily at the moment as it looks like a Gartley has just hit it’s “D” @ .9100

Here’s a shot of what I’m seeing as a gartley pattern. The red line is a strong trend line that hasn’t been broken yet. If all goes well it should be soon.

Welcome Belthazarr, (love the name)

Yes, well spotted! It’s pretty picture perfect that AUD gartley, nice symmetry with almost an AB=CD leg.

I’m already short from a combination of a correlated good-looking NZDUSD 30m butterfly and similar wonky AUD one. (my patterns are rarely ‘perfect’)

I’m short the AUDNZD again as well (previous post), with better RRR.

Let’s see what happens…

I have been watching that AUDUSD pattern for about two weeks, today it hit its D but absolutely ravaged through the fib levels and left me at -50 pips. However, I didn’t close the trade and eventually closed at -5 pips.

It went 30 pips through D, I really don’t think that’s too bad on a daily timeframe.

You are totally right on that. I am waiting for the cash rate news and statement. If it’s bearish, I will sell again.

I got knocked out of the AUD Daily as well, but back in now.

Still short AUDNZD. First PT hit just above Big Figure 2400s for +73, trailing stops with intended target at B, just above BF 2350s.

As Aussie rate data + statement came out kind of positive I bought some, then scalped 10 pips.

Their isn’t any daily convergence on the Daily AUS/USD, this illusion of convergence may have been caused by not using the first swing for your BC leg. B Should be 5/28/10 and C should be 6/08/10.

Hi TMB, welcome back.

My rules/interpretation are different to yours it seems… But that’s ok, this method is very robust.

The swing points you mention I treated and traded as a separate 4 hour pattern (D at 6/21/10), which played out very well. The Daily pattern totally encompasses the 4 hour just in it’s first ‘triangle’.

I’d also argue that there is convergence (not ideal but enough for me), again my interpretation. My D falls at 1.5 BC and a perfect AB=CD. That said, if it squeezes to 92 (also convergence), I’d happily short it again.

Possible 3 drives pattern here on the uj daily. Each low extends 1.272 and time symmetry not bad. Also divergence on 3/10 osciullator, and pin candle on the H1

Uploaded with ImageShack.us

and early days on this au m30, but just in case…

d is also at a pivot level

Uploaded with ImageShack.us

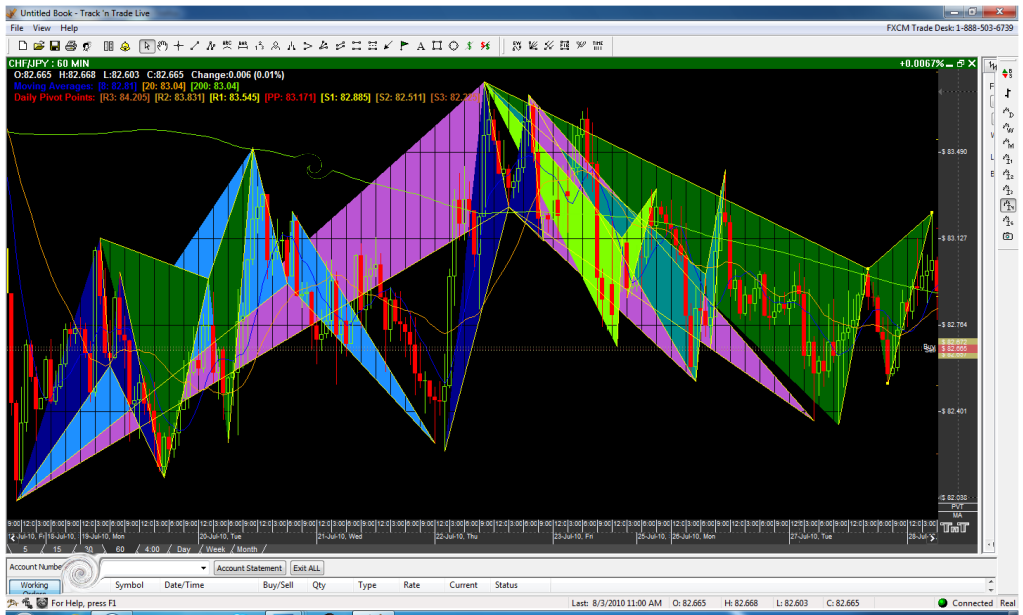

Some times when things seem out of the ordinary, such as a lack of patterns within regularly traded pairs or better said Symmetry; one must broaden them selves and analyze alternative pairs for trading. As a result, bellow you will see various patterns that have appeared and completed themselves one after another within the CHF/JPY. This is an excellent example of the type of market you would want to be trading with the method provided.

*Please note that the reason for the lack of symmetry in the lower time frames within pairs such as the GBP/USD is because they have been respecting the weekly/daily patterns which formed through out the end of may. In other words since the end of May we have had at least a 70% chance of price reaching the levels they have reached today with each respective pair. The size of these patterns as you can see now and in the past should not be taken lightly especially when fundamental news and speculation fuel such patterns.

Example:

Nice work TMoneyBags. I took 500 pips from that cable weekly and thought I was a genius at the time! Now its apparent that I left about 1000 pips on the table lol. Not onlt that but I’ve given a lot back shorting. Put it down to experience I guess. Maybe next time I’ll have the courage to hold on longer.

Example:

So we should always use the first swing as our B? I don’t remember you mentioning that before, in fact I’m pretty sure you weren’t always using the first swing as your B point.

Is this one of the modifications you newly made to the method?

In my charts the 1.00XA seems a better convergence for D. And it has indeed hit that D and retraced a bit, about 25 pips. The problem with 30min patterns is that it’s not very easy to find patterns that would certainly give 30+pips.