my notes of the entire thread…this info is priceless…read it like a book…enjoy…

setting up limit

If you want to find a limit that would work in any given time frame just about 85-90% of the time, I would set my limit at the .382 of the CD fib measurement (Conservative). Another option which works as well is the .382 of the AD leg (less Conservative). This is because of the fact that usually when a pattern such as a Gartley fails, it retraces to the .382 of AD (testing price) before it fails. Also take note that its roughly 50% of a patterns target 1 which is typically the .618 of AD. Also, a good tactic that works (if you have the discipline to follow it). Is to set your stop as a free trade once it hits the .236 of your XA. I’ve found that when 8/10 times when a pattern fails it will reach the .236 measurement of AD (wick to wick) and then fail. An even more conservative way to set a stop or limit with this method is draw your fibs from the Base price of A to the wick of D. Go back through your charts and put the theaory to the test. Its real and it works, Again I highly stress that you must be disciplined to follow methods such as this.

2am-4am EST.

6am-8am EST.

10:30am-12pm EST.

6pm-8pm EST.

FAKE OUT TIMES

9am-10am EST. is usually fake out where market makes a Lower or higher D

9pm-12pm

You left aside 12am-2am

4am-6am

8am-9am

12pm-6pm.

So what happens during this periods.

Thanks for your help!

Yes those are the ussual D points and fake out times. Now for the hours which I left off, the market for the most part prepares it self to establish a new D point during those hours. It is possible for a D to form and trade it for 30 pips during such hours; I suggest only doing this if you are comfortable taking a possible loss from a fakeout you know may occure and are experienced at pattern trading. But why take the risk FPRIVATE “TYPE=PICT;ALT=” … heh

FOUR convergences! The first one failed, though. And since the C retracement was near %100, I think this might be a Gartley pattern instead of a Butterfly, and the highest convergence point might not be the real one.

answer:

On pairs like these-gbp/jpy you should take the 786 - 2.618 convergence levels. Especially if you have good multiple convergences at different areas

There can be variations of the key fibs depending on the pair, but according to that site, the way I read it is:

B - Must be near 61.8% of XA.

C - Must be 38.2% of XA or

88.6% of AB.

D - Must be 78.6% of XA and

between 127% and 161.8% of BC.

One of the guidelines is that price must exceed the 100% line of the 2nd fib.

So what I notice most when traders post their charts with patterns that have more than one possible convergence is a problem in determining which one would be the true D. Whether this is more attributable to when it’s not being symmetrical is a good question.

Apparently the key is in the BC leg and it’s slope. The book briefly states that if the BC leg is a shallow retracement of the AB leg, under 50%, then the extension will be much longer and faster than if it retraced more than 50%

AB=CD -By measuring AB with your fibs, CD must be at least the size of AB (100% fibs).

Just keep in mind that you should close your trade if your entry candle closes negative. That is a sign of a possible fakeout.

Doing so you don’t wait for your stop loss to be hit and your losses are considerably decreased.

500, .618, .786, .886, 1.000

These are your major ratracement zones and are typically the “D” area of a gartley pattern. Please note that these fibs depend on the pair that you are trading. For example, the EURO/JPY, AUD/USD and the GBP/USD for the most part have major resistance at the .500. and typically if price does not respect this area for these pairs it will continue towards the extreme levels (1.272, 1.618, etc). The EURO/USD, USD/CHF, and the NZD/USD Typically retrace from the .618 (the .500 will normally allow price to “breathe” before reaching this fib). In addition, the EUR/GBP finds support or resistance at the .786 (you can draw your fibs from high to low swings in history and you will see that 9 out of 10 times it will bounce from this point or reach its vicinity before doing a true retracement).

- Enter after my entry candle has closed positive.

- Watching really close if price hasn’t retraced already to the 23.6% AD fib. If this is the case, probably it’s not a re-test, but a fake out, and price is going to continue in the opposite direction

tmb -I use the 30, 15, or 5 min time frame to determine the close depending on which time frame I found the pattern. If I am trading the 60-30 min I will normally wait for a 30 min close. If I am trading the 15-5 min I will wait for a 5 minute close.

Identifying a Gartley and avoiding a failed pattern:

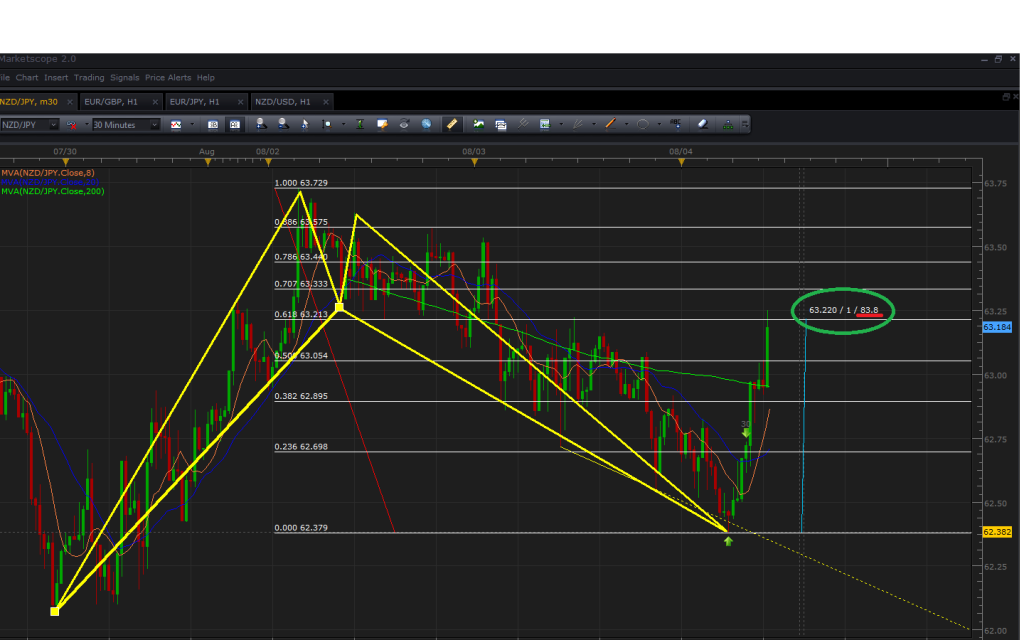

The number one rule to this is that the BC leg of the pattern must have atleast a .500 fib retracement in order for it to develop a true Gartley. This means that the BC can retrace from the .500, .618, .786, .886, 100.0 fib levels and still be considered a gartley. You will know when the true gartley is formed because of the fact that an avg of 80% of the time it will bounce (find support or resistance) when it reaches symetry with AB. As a result you will see that the 100% of CD will converge with x fib point. You see this in the last trade I made. The BC leg bounced of the .886 and its 100% completed in the proximity of the .618 of XA.

A butterfly pattern is the result of a failed Gartley. This is why a number of traders would sell a pair if it closes bellow the 100.0 fib and have an entry waiting for them at the 1.272 for a buy or vice versa. In addition, 80% of the time if BC leg reaches the .382 and retraces (without ever touching the .500), the Gartley will fail an reach the 127%. This doesn’t mean that it always has to reach the 1.272 of XA it simply states that the CD leg will retrace when cd = 127% of AD and still be considered a gartley if it hasnt passed the 1.000. Personally, these trades that do not hit the 1.272 of the XA are less symmetrical and should not be traded until you have more experience pattern trading.

Times when most D’s develop on any given pair (EST time):

6pm-8pm, 12am-3am, 5am-6am, 10am-11:30pm

Times when D’s tend to "Fake out"

9pm-11:00pm, 7am-9:30am, 2pm-4:30pm

(These times can be traded, simply note that it typically fail towards a more profound D).

This is why I normally begin to analyze the market from 2-4am and initiate my trade at 5-6am (I typically set my entry around 3am or 4am using the 30 min time frame).

-Fib levels-

The following Fib levels should be added to your Fibonacci tool:

0.000, 0.236, .382, .500, .618, .786, .886, 1.000, 1.272, 1.618, 2.000, and 2.618

.236 and .382

If you are using visual stops and wish to trade these pattern conservatively, I recommend that you draw your fib points from the Base price of your high low swing to the wick of the low or high swing and place a physical stop once price reaches the .236 fib level. Your limit should be a the .382 as price usually tends to test this zone before it continues towards the target or before it fails to become a bigger pattern.

.500, .618, .786, .886, 1.000

These are your major ratracement zones and are typically the “D” area of a gartley pattern. Please note that these fibs depend on the pair that you are trading. For example, the EURO/JPY, AUD/USD and the GBP/USD for the most part have major resistance at the .500. and typically if price does not respect this area for these pairs it will continue towards the extreme levels (1.272, 1.618, etc). The EURO/USD, USD/CHF, and the NZD/USD Typically retrace from the .618 (the .500 will normally allow price to “breathe” before reaching this fib). In addition, the EUR/GBP finds support or resistance at the .786 (you can draw your fibs from high to low swings in history and you will see that 9 out of 10 times it will bounce from this point or reach its vicinity before doing a true retracement).

1.272, 1.618, 2.000, 2.618

These are your extreme levels and where your butterfly patterns will form. The 1.272 will be your major retracement level. If price for example closes bellow the 1.272 (bullish trade) the pattern typically fails and retraces from the 1.618. If I want to be risky, I can trade price towards the next “target”. The close should always be the time frame where you found the pattern. The 2.000 and 2.618 are basically the most extreme zone and if price does not respect these it will typically continue the trend and not give you a retracement.

Please note that the 100-2.618% levels of CD should always be used to finding convergence with XA.

The longer you are in a trade the higher your risk loss %. This is because price becomes comfortable with the levels it “continues to test” and can easily switch directions…

In addition knowing that every pattern has an 80% chance of completing to the .618 in normal market conditions, greatly increases my odds as I only choose patterns which have good “convergence” and in markets that are symmetrical.

during critical news times, I make sure that we have a concrete pattern waiting for it

A CD must be at least 100% of AD and your D point seems to be only at 65% of AD. In addition, the BC leg is a .382 retracement meaning that D will most likely reach the extensions of your XA and definitely 127% of CD

When the SSD/stochastic slow/ crosses on the 5-15-30, their are at times D’s set up.

your D must be at least 100% of CD no exceptions.

always wait for the close on the time frame you found the pattern

EURO/JPY Loves .500 retracement from D point /for profit/ target point

-

Is there a difference if B is found on .382 or .500 of XA?

-

What if we’re looking for B and it rests between .382 and .500?

-

Does C always have to be between X and A in all 4 patterns?

-

Take a look at the following chart. You’ve said that if a trade close beyond the entry point for 30 min on a 30-60 min trade or 5 min for 5-15 min, you would exit. Would you have exited this trade?

answer tmb

-

I haven’t seen a difference really other then a trade that has at least a .382 B retracement from XA has more symmetry then one that does not. Also, the most important retracement involving B is that of C which is the measurement of the AB leg.

-

It is still valid

-

Yes

-

Yes and No, Yes as a daily pattern, No as a 30 min pattern. *See bellow.

First of all, what you have shown has a reason and divergence to go with it. If you where to draw your fibs from the base price of the extreme on the daily, then you would have noticed great divergence and a perfect bounce. Which is shown bellow where you can see perfect divergence with 127% of CD and the .500 of XA.

In regards to drawing your X from base to wick or wick to wick, it really depends on the market. What you want to do is test each one and see which one price respects the best. I normally do this when things aren’t making sense (no valid patterns are found, like you have). And if non work, then i switch pairs.

Also, make sure that X is always at an extreme of price and not in the middle of a leg. ?!

I only trade Gartley patterns for the EUR/GBP which touch a .786 or .886 fib convergence

Convergence between the percentage of CD (its measurement in relation to AB) and the fib point of XA must be within a 0-10 pip range based on a 30 min time frame. The higher the time frame, the higher the pip range can be. 0 = best 10 = worst

*Note: If you are looking for a bullish trade, and your convergence is bellow the XA fib level, typically price will spike bellow the fib level to touch the CD % and then close above the XA fib level. In this and in every case I always suggest that your entry or market order should be exactly on the XA fib level or a few pips above it (in order to make sure the trade goes in depending on the market). On the other hand If I did not need to be in a trade but I wouldn’t mind making an extra 30 pips for the day then in this situation, I would place my entry right on the CD % that’s bellow the fib level and If price spikes down and gets me in then I typically would end up with a perfect wick. If not then I simply did not get into the trade and that is good as well

take notice that convergence = symmetry

So with the XA leg, is it typically the more extreme highs/lows you use, the more powerful the signal?

Correct! Also, make sure that X is always at an extreme of price and not in the middle of a leg.

B can be a maximum of 100% of XA (this is rare but possible). Their is no rule for the minimum other than that it should always be in between XA. But I much rather you trade a pattern where B at least retraces off the .236 or .382 for symmetry.

This is why I said that sometimes you need to draw your XA level starting from Base (of the extreme) to wick (of A). Some times the market off set them selves by a bit. Just try and see which fibs price is currently respecting. Usually it is wick to wick but when things as you say happen, then you must do the mentioned check as well. Or possibly used a different X