grrr…lost some pips today…before go under more than half my weekly gains i will stop trading/overtrading/ …there is a whole world outside my trading room…i will go check it out:D…see ya next week

cashDemoN,

Hopefully next week will treat you right, have a good weekend and thanks for the help, this week has been crazy.

cheers dbear!

If you acknowledge the fact that just about anything can happen, how can you be wrong about the market?

By keeping this frame of mind, you ease the pressure on yourself to always be right about what the market will do next or having to take a loss. In doing so, you overcome the fear of losing money, which is inevitable to every trader

Once you are at peace with the possibility of losing money, you will be able to recognize all kinds of information that both support and argue against your market views and beliefs. So, not only will you come to a point where you trade using probabilities, and not your ego, but you’ll do a better job of seeing what’s really moving the markets.

source/babypips

and mine is 4% a day. Seriously i think people should start thinking in percentages. It does matter if the trade is 5, 10, [B]30[/B] or 100 pips if your risking 1-2% and reward is 2-4%. Keep it at 1:2 minimum.

£1000 Equity. 2% risk, Stop loss 5 pips = £4 per pip.

4% Reward. [B]10 pips = £40 [/B]

£1000 Equity. 2% risk, Stop loss 15 pips = £1.33 per pip.

4% Reward. [B]30 pips = £40 [/B]

[B]“Slow And Steady Wins The Race”[/B]

I don’t think TMB meant to take literally ‘30 pips a day’. What it means is to be conservative and not greedy because consistency is the key. For example, Trader A sets t.p. to 38.2% AD, his chances of reaching t.p are 90%.(estimate.) Trader B sets t.p. to 61.8%AD, his chances for reaching t.p. are reduced to 50%(estimate).

[I][U]Example[/U][/I]

Both traders make 10 trades. A to D = 100 pips for all trades.

Both traders have a stop loss at 15 pips, for all trades.

Trader A has 9/10 successful trades. 9x38.2 = 343.8 pips

Trader A lost 1 trade. 15x1= 15 pips

343.8 pips - 15 pips = [U]Total: 328.8 pips[/U]

Trader B has 5/10 successful trades. 5x61.8 = 309 pips

Trader B lost 5 trades. 15x5= 75 pips

309 pips - 75 pips = [U]Total: 234 pips[/U]

Trader B will think at first that he is making more pips by taking 61.8%AD. But he is not consistent. While trader A is making less pips at first but is consistent. Trader A eventually catches up, passes by, and slowly but Steadily, Wins The Race!".

I like your examples, for me and possibly others here who may not be on the same level as others, the 30 pip rule is also a comfort level situation. I know that the key to being successful is taking the emotion out of the trade, but everyone’s risk tolerance is different; I feel more comfortable going for 30 pips a day using a certain lot amount and once I get used to that level, instead of increasing the pip amount, I increase the lot amount; sometimes that 38.2% retracement looks like a pretty big hill to climb. I think that there are many paths to the top and hopefully we can all get there taking whatever route works for us

I posted the 4 HR chart last week and some went long, here is the 2 HR chart; could be we are not done with this yet?

Yes I agree dbear. Everyone chooses what’s best for them. The key thing to remember is going for more will make you less. And taking less will give you more. Weird huh?

The key thing to remember is going for more will make you less. And taking less will give you more. Weird huh?

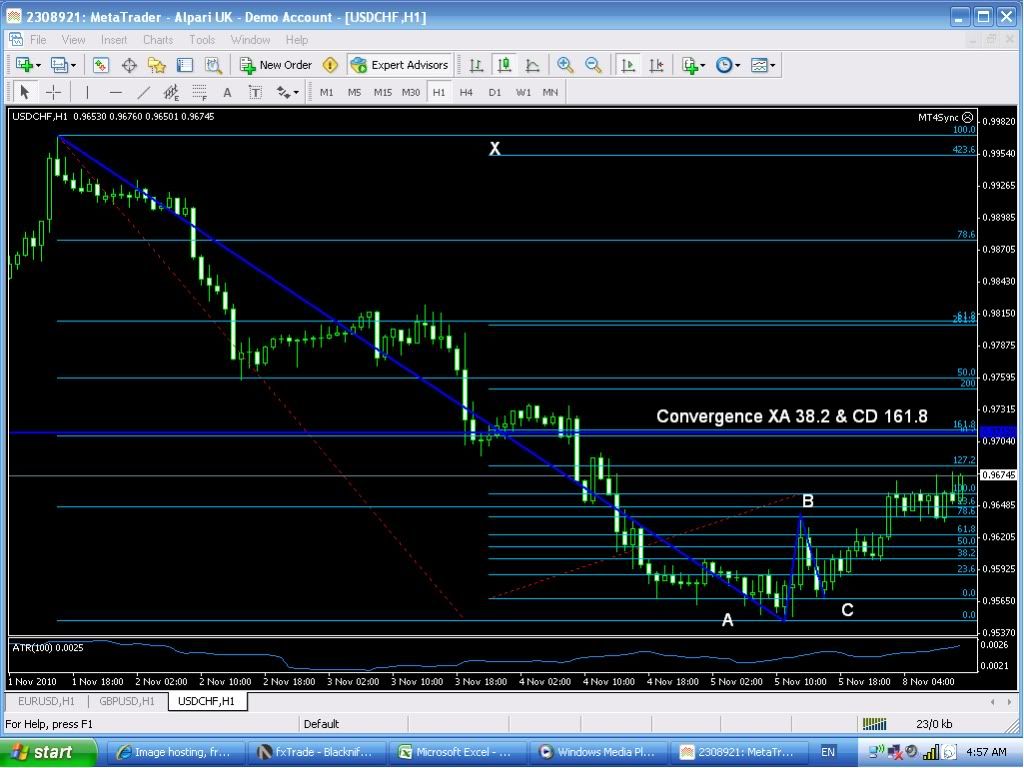

I looked at my chart and your picture and it looks like its not ready yet because it didnt reach 100% of XA.

In any system you must have a set stop. I believe TMB usually uses a visual stop and closes on a close above a convergence. (i may be wrong, if so i’m sure i’ll be corrected  ). I was curious what everyone elses typical stop was. I have been doing a good bit of stats lately and have found that typically, the maximum that price action will cross a convergence (assuming a good trade) is equal to the 100 period ATR. I have been adding 50% to 100% of this to my maximum stop loss (depeding on time period) and it has been working well at preventing a stop too close to the entry point.

). I was curious what everyone elses typical stop was. I have been doing a good bit of stats lately and have found that typically, the maximum that price action will cross a convergence (assuming a good trade) is equal to the 100 period ATR. I have been adding 50% to 100% of this to my maximum stop loss (depeding on time period) and it has been working well at preventing a stop too close to the entry point.

Does anyone else have any alternative ideas for stop placement?

You got to know when to hold em, know when to fold em, know when to walk away, know when to run. You never count your money while your sittin at the table, they’ll be time enought for countin when the dealins done

Kenny Rogers The gambler-old school advise

I should clarify, it seems that both on the 4 hr and 2 hr there are fake outs at certain fibs (I think these spikes were both news) which if one was going for only 30 pips would be successful, there is an example of this on page 3 of this thread where TMoneyBags shows a fakeout on an hourly chart but there is a trade on a smaller 15 minute chart that would have been successful “with proper risk mgmt” (EURJPY). My use of the word ‘long’ was incorrect, I meant more like 30 pips and not the 80 yard touchdown pass.

Ah, I get you now. Yea, 30 pips would be successful for the fake-outs on this time frame.

Here we go for another week. The trade I’m watching for now is a long entry on GBPUSD. I’ll trade it in the morning if it hasn’t already triggered tonight. If you are ok with using a closer X, AB is a perfect 38.2 retracement of XA and CD will complete at the 50 level of XA. Time symmetry is also very nice. Chart below. There is a weak convergence of the true XA 23.6 line with the trade, so I expect it to be a solid one. Good for at least 30 pips :D.

GL Everyone!!

Not exactly sure where to take my trade on this setup, mine appears a little different, with really good convergence, using a close X, at .786 retracement of XA. I’m gonna watch this one and see what happens, if I enter it will be @ 1.60705. If price doesnt go that far then oh well, there’s always more :p.

Also, I see that you’re using MT, you can add “%$” to the description of your fibs, that way you get the price the fib level is at as well :). Your description on your fibs would look something like “.786 %$” and that would produce “.786 1.60705”

I completely agree with you on this.

When starting off, I can make some nice profits initially, but then when I get greedy, I over trade and make huge losses.

It is bugging me to no end.

I am trying to refine my trading strategy to take my wins and stop for the day.

I am still deciding whether I should be limiting it to 30 pips a day or as many ‘GOOD’ trades as I can find but limit to 30 pips each time.

I guess at the end of the day, it is the consistency that really counts. Win consistently, then increase your lot sizes.

Thank you HG :D! I actually just found that out the other day, but I don’t do so because It gets a little crowded. I actually have more fibs on my charts than I post, so it gets really busy!

Anyway, I missed earlier posted trade (sleeping :p) but it looks like there may be another opportunity. It moved past convergence 29 pips. Those of you using limit orders will be interested to know that the total distance it moved past the convergence was equal to the 100 period ATR. As mentioned in last weekends post, my research has shown this to be the maximum move past the convergence, at least on the 1h and 15m charts. Total pips possible on this trade was 37. Congrats to anyone that did so!

Thank you again HG for alerting me to the fact I hadn’t added the .786 fib level LOL! I switched back to MT4 from MT5 yesterday evening and forgot to!

Looks like another possible entry is occurring at 1.6050. Beyond it being a psychological level, there is a very nice convergence of CD’s 161.8 and the true XA’s .382. This combined with a weak convergence of the closer XA’s .786 should make for good resistance.

USDCHF Gartley pattern, completing at convergence of XA’s 38.2 and CD’s 161.8 fib levels. Time symmetry is very poor. I’m posting regardless because it would seem logical that, because these patterns are created by trading psychololgy, and volatility decreases at close friday and during opening hours monday, that some legs may take longer to develop. It takes longer for the price to reach the important psychological levels that facilitate reversals.

Anyway, here’s the chart:

P.S. A possible abcd pattern is forming on 15 min that completes 5 pips away.

man it was so slow today…anyway… at the end i took a slow ride on this pattern and it gave almost 30 pips but the third green candle closed with 8 pips from low to high and my patience was gone…I almost shot myself after 15 min of watching the price going from 29,1 to 29,5 pips … . i have a big yellow sticky notes on my monitors saying BE PATIENT,and another one saying DONT BE GREEDY,but the first one didnt help today…man it was so slow !!!

By radofx at 2010-11-08

cashDemoN,

That is too funny, curious in looking at your chart, how did you know to take the trade at 1.618/1.272 and not the fib above where the convergence was closer?