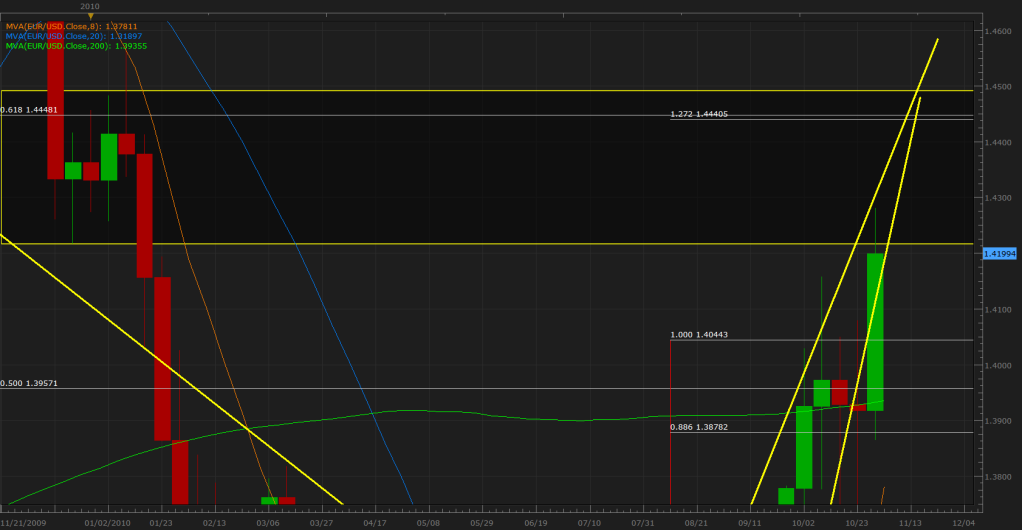

To go along with the 1 Hr chart, food for thought; sorry, fibs and lines were hastily drawn as I was heading out the door to vote

hi dbear…nice one mate…ive been waiting for this EUR/USD pattern for a long time and my sentiment on the pair went bullish toward D point since i saw it weeks ago,and every day listen to forecasts how the euro is going down and see forecasters loosing positions and wishing…/its kind of nice not being in their train/everybody has turned bearish on the pair,and i think this pattern is going to be the trigger for some reversal…

here is another possible…

By radofx at 2010-11-02

I agree I am bullish on this pair as well, also, it will be interesting to see how the technical side plays out with the elections (house projected to go back to the Republicans and the Senate to stay with the Democrats), what the Fed is going to do, what some of the other countries will do in response to that, and how the holiday season will turn out. I work for a mid size wholesale/manufacturing company that covers the western part of the US and we are not projecting things to turn around until later in 2011-credit markets are still very tight

I have encountered technical analysis concepts but not this one which resembles a butterfly or a bat. That’s really cool, especially if it greatly works. I’m newbie but love to learn this method.  I only have 5 simple methods to analyze the markets and some mentors definitely say to keep it simple but I love to learn this butterfly thing

I only have 5 simple methods to analyze the markets and some mentors definitely say to keep it simple but I love to learn this butterfly thing  cool!

cool!

Hello Tmoneybags,

I find this thread amazing, I’m newbie. Looking forward to see more and understand your trade analysis and executions… definitely I like the way you do the intraday trade, simple but profitable. Yet I’m learning to build the discipline and hopefully gonna start live soon in catching 30 to 70 pip run of the euro’s daily average range… I guess I’d visit more of this thread of yours to learn to keep it simple. I’m using MACD Divergence, Trendline breaks, Price/Bar/Candle patterns and most importantly for me, the PIVOTS. Any brief advice? Oh I also find the fibonacci retracement method helpful, is that the one your using in straight lines at the chart or is it another fib method? I would really appreciate to hear even a little from you. Thanks.

First of all, do not limit your self to one market. You must learn all the markets and you can do this by studying 3 pairs a week (ex.: EUR/JPY, EUR/USD, EUR/GBP). As for my tools… I use Fibonacci, Trend Lines, Visual Stops, MVA(s), Price History, Triangles, Head & Shoulders, Candle Stick Patterns Etc…, Discipline, Neutral Emotion to the market, Faith in my self.

Trading the real account will make you go through a series of emotions which some times becomes uncontrollable. For a few months you will be in situations where your up 40 pips and do not limit out because you see a potential of 90 or so. Unfortunately it hits a major support resistance zone which you forgot to take note of because you where thinking about what you could do with the 900 dollars you where about to snag from the market. As a result you feel helpless. This scenario plays out every day for 95% of the people in this world and it is exactly what the 30 pip a day method is supposed to prevent you from doing. Consistency, acceptance of loss, and respect of your trading rules will bring you great fortunes in this and any market. Greed and Fear is the number one cause of death in all markets and self discipline and control is the only thing that will bring you towards success. As I’ve told my students,

Your trading rules are like the rules of the road, if you run a red light you run a risk of dying, if you go above the speed limits your death % rises to that of 80%, when you obey the rules your chances of death are reduced drastically. As a result, in your trades not closing out a position after it breaks your convergence zone turns your 85% win chance to the unknown negatives growing exponentially as time passes by. Also, not limiting out at 30 in a 30/60 min chart decreases your 85-95% win chance progressively to that of 70%.

Please go through the beginning of the thread and read it as a manual. The majority of the questions you may ask have already been answered. Thank you for joining the community and in times of crisis do not give up because in the end you will come out triumphant and trade as the bankers do within the 5%.

[B][I]I suggest you view my video, they say a picture says a thousand words… so this video should give you a million :rolleyes: :[/I][/B]

Click Bellow for Tutorial.

[B][B][I][U]Tutorial I[/U][/I][/B] || [B][I][U]Tutorial II[/U][/I][/B][/B]

[B][U]::Repost:[/U][/B]:

Trading from the iphone today so no charts. The eurusd gartley completing on the 4h looks like it will come to fruition in the next few hours. My chart for it is a few pages back. Just a heads up there looks like an abcd on the 1h chart converging around the same 1.4080. Im seeing quite a bit of resistance there so i expect a good trade to come out of it. Gl all!

Not sure if anyone else has tried the 5-0 pattern much, but for this past week, I’ve been looking at the PRZ on many pairs and have noticed that there have been some nice potential 5-0 patterns creeping up.

Two completed today, one that I’m in right now is on the EUR/GBP showing up in the 1hr time frame. I don’t recall what pair the other one was on, I had to run out and can’t recall, I’ll post it when I get back home and pics too.

On a side note. I was reading through a post TMB posted to a new reader to the thread and he mentioned how the psychology of trading changes when you are using real money compared to paper money.

A suggestion I’d like to give to those who are thinking of going live, but don’t want to risk it when the psychology of everything changes, because it does change. First thing I’d do is get a micro account that can trade next to nothing, trading pennies. Oanda does well with that. (though I wouldn’t use there charts). Put in like $25 and go to town with your strategy until you can work your way through he psychology of it all. Something you can think about before you dump in a lot of cash and loose it all.

Edit

NICE - EUR/GBP did nicely on the 5-0 pattern, twice  Had jump up and took my TP and came back down, so I went in again for another 40 pips and just hit my TP again.

Had jump up and took my TP and came back down, so I went in again for another 40 pips and just hit my TP again.

Another one that looks like it’s just hit the D on a 5-0 pattern is USD/CHF, again that did a jump up, got 30 pips and seems to be on it’s way back down for another entry at 50% (not putting a lot of stock in that second move down, but have a small position set non the less).

I’m not very proud to say that I garnered 60 pips from todays trade. I didn’t expect the volatility and could have suffered a major loss. Luckily, price action moved down to my take profit before settling on a bullish move. It was a mistake to trade during a news release that was that important. I won’t do it again.

Not sure if anyone else has tried the 5-0 pattern much, but for this past week, I’ve been looking at the PRZ on many pairs and have noticed that there have been some nice potential 5-0 patterns creeping up.

Belthazarr - I have noticed the 5-0 patterns forming quite a bit but haven’t laid out some concrete rules for trading them yet. Glad to see someone else having some luck with them. I’ll be adding it to my repertoire soon. Thanks!

Here’s a few pic’s as promised of some 5-0 patterns that completed well.

this thread is so hot it made its way into the new babypips school with its own section and everything!

TMB and friends… take a bow!

Thanks! I attached the PDF that harmonictrader.com put out of the 5-0 pattern if anyone’s interested. FYI, they have a few other free pdfs of other patterns: bat, crab, etc.

The5-0Pattern.pdf (2.73 MB)

Grandmaster Pip,

Thank you for uploading the 5-0 pattern pdf, I have attached 2 patterns for USDCAD, the first on the 4 hr I did not take the first BC leg but it is still trending down towards convergence and it coincides with the daily, input from all is greatly appreciated, thanks in advance

I went long off the 4h. hasnt moved much yet, just starting to move into some profit

i sale medical x-ray machine, and i’m working a medical equipment firm,a medical x-ray machine manufacturer.recently i always come here to read something about the forex,maybe one day,i make a big money:D

Amazing how these turn out. http://forums.babypips.com/226189-post4369.html I had given up on this pattern earlier this week but it’s there. I made my demo short entry @ 1.4282 last night… high of the day @ 1.42816. lol

Bearish Butterfly on 4hr chart w/ fibs.

As I said, I expect the EUR/USD to reach 1.44 before major reaction. Most likely it will create another flag and swing around this zone until mid December - New Years.

Bellow is a Bearish EUR/USD Weekly Gartley where the .618 of XA converges with the 127% of CD.

Not only does this pattern have perfect convergence, but it also lands in the same area where Euro weakness began to be questioned last year during the same quarter (Greece). Hmm, I wonder if this might add resistance… heh of course it does, think of it as a retest of a triangle (price comes back for the retest and then plummets). As always I leave you all with a word of caution, do not fall in love with the trade. Especially one as huge as this where its close confirmation takes a week. As a result, trade it initially for 30-60 pips and keep your eye out on higher patterns or re-entries for the sell on the lower time frames (4hr-5min) and in the mean time look for buys towards that zone. Good luck and I expect us all to have some great holidays.

*Convergence is between 1.44481-1.44405

Hello TMB -

I just posted a comment on your board. I was trying to get you my analysis, but was not able to email due to my limited activity on babypips thus far. If you could get back to me, I would appreciate it. I would hate to miss out on potential opportunities.

Much appreciated,

JP

Nice one there. I took a long position when I saw your charts and agreed with your convergence levels. Worked for a +30 pip gain. That was enough for me.

My mantra is now 30 pips a day.

Anhtarus,

Glad it worked for you, it is nice to get 30 pips and be done, especially today with the US news coming out later this morning for NFP and unemployment rate