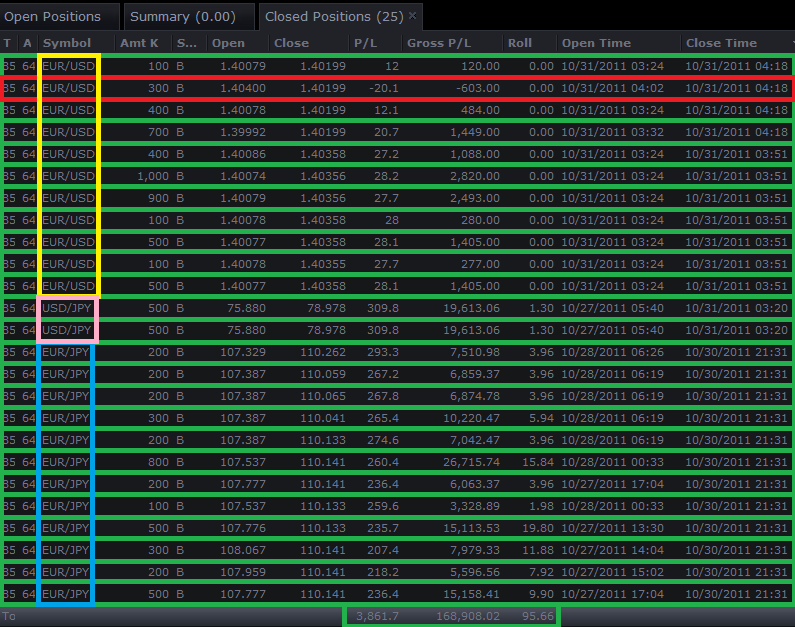

We’ve decided to close out the U/J Pair and scalped a bit of the EU… were closing for the day and waiting to see how the monthly and daily bars close today. As a result I will post my analysis for any future long/short term trades this evening; please be-careful trading today… we have closed because we see the next few hours up to the NY close as too risky to jeopardize our current profit. Again, congrats to all who payed attention to our previous analysis and rode the wave

Any books or videos coming up ?

Hi TMB, Any chance you could provide us with a chart for illustration purposes to help us understand the reason for buying this pair ?

Also, nice trades on JPY pairs

Dan

Also, there is one thing that confuses me when drawing these patterns. TMB you say to use the first swing for point B. Do you literally mean the very first swing as shown in the diagram below:

… or do you mean an obvious swing point, as in a swing that ‘stands out’

Thanks

Dan

Can anyone figure out the pattern that indicated a buy opportunity that TMB used to take long positions at the levels that he did ? I cant figure out the pattern myself .

Dan

Looking at your profits I really think that the title of this thread should be changed to 50k a day Keeps your money at bay

Just joking

TMB are you still using pattern recognition to place your entries? I mean are you still using your old Trading Plan or has it changed?

Thank you so much for sharing your journey and for giving us hope!

Well ive been looking for the patterns that would of given a buy singal on those trades he took but i cant find them. Either im missing something or TMB is using a slightly different technique/patterns

Dan

yea i did a few times, entering after the D completion, i set my RR to 1:1 (30 pips/30 pips) but i found it quite many times that price bounces at my SL :49:

that’s why i think i need a better entering strategy, some indicators? candle sticks pattern? any ideas?

yeah. i couldn’t find them as well…U/J shoots up like nobody’s business at the start of today…

BTW…really nice trade TMB!! congrats

Hey, Dan. I can attempt to answer your question. So pretty much in a perfect pattern your ideal B would be the first swing high or low that retraced the most into XA, but not greater than 1.00 as this would invalidate the pattern. I think what is important is to look at the price action of your potential B and look for price action clues like tweezer tops, hanging man, etc. that would confirm that point as your B and the beginning to the BC leg. I also think the time frame you are trading has a lot to do with how points are chosen. For the longer time frames like the hr4/d1 charts i think its much easier to pick out your points, but with the smaller m5/m15/m30 time frames it can be hard to find an exact points to the pattern. If you wanna post a chart with two different B areas I can try to explain which one is better, or maybe one of the big dogs would be able to help you out.

-Jim

How are the convergences of your CD leg & XA?? Do you think you may be forcing an area of convergence when it doesn’t exist??? You have a chart you could post?? Look at the BC leg and see what it retraces to. Smaller retracements (.382) are indicative of trending days and will sometimes blow thru retracement levels. Also, look at the CD leg while it is forming. If you are seeing long ranging bars and candlesticks with the close near the wick in the direction of your D that will sometimes mean the CD leg is heading for a retracement at the levels greater than 1.00.

- Jim

Yeah, well hopefully TMB will be able to provide us with a chart this evening when he posts up his analysis.

Dan

To me that doesnt really make sense because the D point retraces the most into XA. But you woudnt know it was a D untill you already had the correct B and C

I’ve been looking through alot of TMoneyBags charts and to me it seems there is some inconsistency when he chooses the B point. Some of his charts show the very first swing and others show the second or even third swing as his B point –if you go through his charts you will see.

If TMB could clarify exactly how to get the B point and the different factors he looks at then that would help tremendously because without getting the correct B point the rest of the pattern can become invalid.

Cheers

Dan

Hi fellow traders,

I have found a new Harmonic Indicator that detects Harmonic Patterns on any time frame and any pair. when i got this for several $$$ it was just plain indicator. I have to keep my eyes on the screen to look for new pattern. But after a while, I have made a greatly development that makes trading Harmonic Patttern easier. I incorporated this Harmonic indicator with a “Sound Alert”. With this development, I can now do my personal things without missing any new pattern on any chart on any timeframe.

Nice thing you have there  so are you planning to market it?

so are you planning to market it?

Sounds like a sales pitch

LOL… I did not even mention that Im selling it.

thanks! I dont mind marketing it…

Well if it is free…then I would gladly take one…

Does anyone know how to print an entire thread rather than going page by page and selecting view printable version and printing??? Thanks