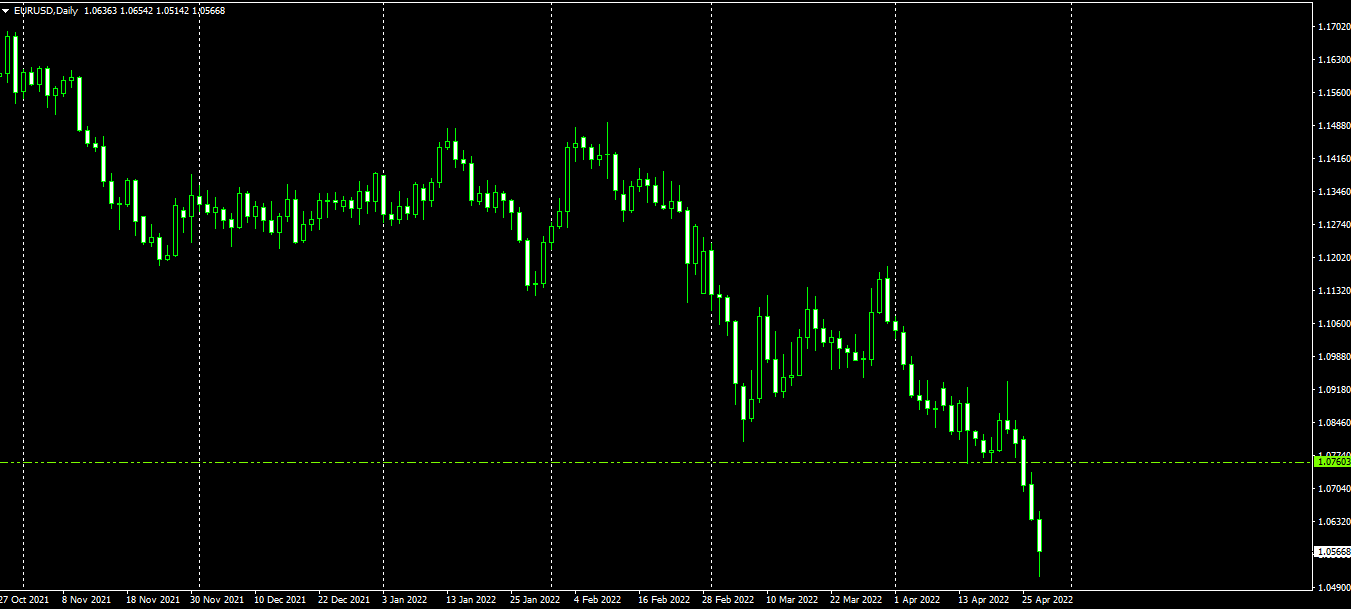

The pair is at a critical level. The level of 1.080000 has been a very significant level for the pair. The price had a strong bounce at the level last time. As of writing, the pair is trading around the line. A bullish reversal candle may push the price towards the upside. However, the sellers of course would be eagerly waiting for a bearish breakout to go short in the pair.

It’s a deciding level for sure watching closely

I agree that level have been significant in the past so ill be keeping a close eye until theres a clear indication about what it would like to do

Breaking the downside of a descending channel would show real weakness.

18/04/2022 - EURUSD weekly analysis.

Will be mostly quiet today (18th) as Easter but on Tuesday keep all eyes on USD fundamentals.

Still hanging around the strong 1.08 support mark waiting for a move.

As last week 1.08-1.075 still looks like a strong place of support on the downtrend line, probably consolidating awaiting a move.

All in all no major shock to markets post-ECB sell-off this week due to things being priced in and holidays for markets on Friday through to Monday (18th).

Dovish ECB did push markets down to 1.075 but recovered quickly ahead of the holidays.

I’ll probably be seeing if we’ll be hitting 1.07 again this week if failure to settle 1.08 which will start to show a bottom for me on the lower trend line.

My gut feeling is that longing from here might be a good choice technically with SLs set to around 1.06 as I think we’re seeing the sells overstretched and looking like a fake-out.

If tighter SL needed for longs I’d wait to see how markets settle on the 1.08 support.

Things to look out for:

- “the FOMC enters its pre-policy meeting media blackout as of Saturday, so the markets will be totally cast adrift to speculative interpretation.”

- “doves are still firmly planted as was evidence by the European Central Bank’s push back against carry over interpretation of a necessary acceleration in rate hikes from US and UK counterparts.”

Well, looks like we’re about to burst, where do you think we’re going?

The support of that down trending channel is a good area to go long. However, the pair has been bearish for quite a while in the daily chart. Thus, the buyers may have to wait for the price to produce a strong bullish reversal pattern such as a Double Bottom. I have a feeling that the pair may end up making a bearish breakout here as well.

Still bearish on this pair for the time being - order flow still printing LLs

However, let’s see what happens next week. It has currently hit one of my valid POIs - a break above 1.09343, I will look for longs.

Definitely think its still bearish could be a nice counter trend trade at your level. Ill keep an eye on it for sure this week!

Yea it won’t be a quick turn around

I can’t see this pair turning around this week.

1.06450 is where I am looking for possible reactions, cant see it reversing where it is

If it hasn’t turned by Wednesday then it likely won’t this week.

The pair has been extremely bearish in the daily chart again. It made another breakout at 1.7600. The sellers may wait for the price to consolidate and produce a bearish reversal candle to go short in the pair. The level of 1.05000 is a key level. It seems the price may breach the level and head towards 1.00000 this time.

This I call a bottom digger.

It is such a massive move down. Really hard to find a position when its melting like this

Still bearish on EURUSD personally, can’t see any sign of reversal just yet. Wouldn’t be surprised to see the 1.00 region (or lower)

I will be selling EUR/USD as soon as I can on D1. EUR/JPY seems a better EUR opportunity (but that would be long obviously which i wouldn’t really like to take). Meantime there are surely higher probability USD longs.

cpi numbers on Wednesday for the dollar will be a big factor in whether we see this continue down

The daily chart shows that the price consolidated around 1.05000 area. The level of 1.04000 worked as the level of support. It has been breached and the pair has been traded below the level. The Bear may drive the price towards the most significant level at 1.100000.

Yea looking for the bottom but it may continue on for sometime