NI 225 - foreign trade indicators impede the growth of the index

The leading Japanese stock index NI 225 continues to correct, trading near the level of 26881.0.

According to the latest report from the Japanese Ministry of Finance, Exports in September increased by 28.9% compared to the same period in 2021, amounting to 8.819 trillion yen, while Imports added 45.9%, reaching record 10.913 trillion yen. Thus, Japan’s trade deficit has already amounted to 2.094 trillion yen, which is another record both in size and in duration, as the negative trade balance has been maintained for 14 consecutive months. The data released today showed a 0.4% increase in the National Consumer Price Index in September in monthly terms and 3.0% in annual terms. The indicator has been growing for the eighth month in a row, which is beginning to cause doubts among market participants about the continuation of the “dovish” policy and the negative interest rate retention by the Bank of Japan.

On the daily chart of the asset, the price remains within the local lateral corridor, holding near the support line. Technical indicators keep a sell signal despite the local correction: the histogram of the AO oscillator remains in the sell zone, forming new ascending bars, and fast EMAs on the Alligator indicator are below the signal line.

Support levels: 26350, 25500 | Resistance levels: 27400, 28400

GBPUSD Technical Analysis

The GBPUSD pair resumes its negative trades to support the continuation of the bearish trend for the rest of the day, reminding you that our main targets begin at 1.1055 and extend to 1.0920 as next main stations, supported by the negative pressure formed by the EMA50, while the price needs to hold below 1.1290 to continue the expected decline.

The expected trading range for today is between 1.1080 support and 1.1220 resistance. The expected trend for today: Bearish.

GBPUSD - Under the pressure of the domestic political crisis in the UK

This week can be seen as the official start of a new race for prime minister after incumbent and Conservative Party chief Liz Truss announced her resignation amid widespread criticism of her proposed tax reform. Currently, only one real favorite is known – the former finance minister Rishi Sunak, supported by most current officials (178 out of 357 deputies). In turn, former Prime Minister Boris Johnson, who announced his readiness to compete for the post on Friday, has already fallen out of the race, having failed to enlist the support of at least 100 party members and gained only 59 votes. The electoral process must be completed by October 28. Today will be presented data on business activity in the manufacturing and services sectors, from which analysts expect a continued decline from 48.4 points to 48 points and from 50 points to 49.6 points, respectively.

The trading instrument moves within the long-term downward channel toward the resistance line.

Resistance levels: 1.148, 1.18 | Support levels: 1.1178, 1.0925

Euro hits three-week high ahead of major European data

Euro rose on Monday for the third straight session against dollar, hitting three-week highs on prospects Bank of Japan might intervene in the market, and ahead of major European data in October. The dollar index hit multi-week lows as US 10-year yields decline while risk appetite improves in the market.

EURUSD rose 0.3% to 0.9899, the highest since October 5, after rising 0.75% on Friday, the second profit in a row as investors buy up riskier assets.

Major Data

Investors await important European data later today, including the manufacturing and services PMIs in October for Europe. Such data will offer clues on the state of the European economy in the fourth quarter.

The Dollar

The dollar index fell 0.4% on Monday for the third session to three-week lows at 111.47 against a basket of major rivals. US 10-year treasury yields fell over 2% for the second session away from 15-year highs at 4.335%, improving risk appetite.

Such developments come on profit-taking and prospects Bank of Japan might intervene soon in the market to support yen against major rivals.

BTCUSD -Market uncertainty persists

The situation remains uncertain: on the one hand, in the long term, the position of the cryptocurrency market continues to be pressured by an increase in the interest rate in the United States, which may accelerate since inflation cannot be slowed down, and the deterioration of the global economic situation, which can reduce the activity of miners due to an increase in electricity prices. On the other hand, the potential for a serious decline in quotes seems to be limited since investors who want to abandon digital assets have already done so. A short-term positive impact on the trading instrument is the addition of support for trading cryptocurrencies in the United States by one of the largest brokers, Oanda, which has entered into a partnership with Paxos itBit, a regulated cryptocurrency platform, which should support the interest of ordinary American investors in digital assets.

The trading instrument remains within the sideways range of 19550–19000, having unsuccessfully tested its upper limit today and started to decline. If the zone of 19000–18750 is broken down, the quotes can reach 18000 (Murrey [1/8]), 17500 (Murrey [0/8]), and if they consolidate above 19550, the growth will be able to resume to 20000 (Murrey [4/8]) and 20625 (Murrey [3/8]).

Resistance levels: 19550, 20000, 20625 | Support levels: 18750, 18000, 17500

NZDUSD Takes Advantage of the American Dollar Weakness

According to the report on foreign trade, exports to New Zealand in September adjusted by 1.6B dollars to 6.0B dollars, while imports – by 1.1B dollars and amounted to 7.6B dollars. Thus, the trade deficit consolidates around 1.6B dollars, down from 2.6B dollars last month. The growth leaders in the export category were livestock products, having increased by 71.0% compared to August, and in the import category – oil and oil products, having added 111.0% over the month. New Zealand is celebrating Labor Day today, and the stock exchanges are closed, as evidenced by low trading volumes, and the dynamics can only change after the start of the American session.

The trading instrument is moving within the global downtrend, slightly moving away from the support line.

Resistance levels: 0.5810, 0.5960 | Support levels: 0.5670, 0.5535

S & P 500 - The US stock market is trying to recover

At the moment, major market participants are publishing corporate financial statements, which are not as positive as experts expected. According to the analytical agency Refinitiv, the profit of 88 companies that reported for the past quarter decreased by an average of 2.6%. The biggest loser on Friday was stocks of Snap Inc., owner of the Snapchat, which shed more than 30.0% amid historically low revenue growth of 6.0% year-on-year. The focus of increased attention of investors is also Twitter Inc., in which the administration of the President of the United States showed interest in terms of initiating possible checks. Telecom operator Verizon Inc., which reported a 24.0% drop in third-quarter net income, is also trading below the market.

The index quotes continued the local corrective trend, forming a Head and Shoulders reversal pattern. Technical indicators keep the sell signal, which has noticeably weakened recently: fast EMAs on the Alligator indicator are approaching the signal line, and the AO oscillator histogram is forming upward bars being in the sale zone.

Support levels: 3665, 3495 | Resistance levels: 3810, 3980

GBPUSD Technical Analysis

GBPUSD pair hovers around 1.1340 level since morning and keeps its stability below it until now, noticing that the price begins to provide negative trades motivated by stochastic negativity, waiting for more decline for the rest of the day as long as the mentioned level remains intact, reminding you that we are waiting to visit 1.1145 as a first target.

The expected trading range for today is between 1.1200 support and 1.1380 resistance. The expected trend for today: Bearish.

USDJPY Technical Analysis

The USDJPY pair succeeded to achieve our waited target at 151.3 and approached 152 barrier, but it declined sharply to achieve bearish correction that stopped at 145.45, to rebound bullishly and start covering the losses that it suffered in the previous sessions, at it returns to the main bullish channel to support the continuation of the overall positive scenario.

Therefore, we expect to witness positive trades in the upcoming sessions supported by the positive signal provided by stochastic now, noting that breaking 148.10 followed by 147.15 levels will stop the expected rise and press on the price to achieve additional bearish correction.

The expected trading range for today is between 148 support and 150 resistances. The expected trend for today: Bullish.

USDJPY within tight track

The USDJPY pair didn’t show any strong move since yesterday, to fluctuate within tight track, settling above the bullish channel’s support line, thus, no change to the bullish trend scenario that depends on the price stability above 148.5, waiting to get positive motive that assists to push the price to head towards our positive targets that start at 150 and extend to 152.

The expected trading range for today is between 148.2 support and 149.9 resistance. The expected trend for today: Bullish.

USDCAD Tests the Support

The USDCAD pair shows negative trades to test the key support 1.3680, as it consolidates above it until now, to keep the bullish trend scenario active for the upcoming period, waiting to head towards 1.3830 initially. Breaching 1.3740 will ease the mission of achieving the expected rise, noting that breaking 1.3680 will stop the positive scenario and put the price under additional negative pressure on the intraday basis.

The expected trading range for today is between 1.3640 support and 1.3790 resistance. The expected trend for today: Bullish.

EURUSD

The European currency shows a slight increase, consolidating near 0.9880 and updating local highs from October 6. The activity of the “bulls” remains quite low, as traders are concerned about the prospect of economic growth in Europe against the backdrop of high energy prices. The euro is also slightly supported by the comments of the representatives of the American regulator, who are increasingly speaking in favor of softening their position on further tightening of monetary policy. One way or another, the US Federal Reserve, the European Central Bank (ECB), and the Bank of England are preparing to raise interest rates in early November, and after this, time will probably be given to evaluate the measures already taken. Macroeconomic statistics released yesterday in Europe puts additional pressure on the positions of the single currency, preventing the “bulls” from realizing their accumulated potential. The S&P Global Manufacturing PMI in Germany fell from 47.8 points to 45.7 points in October, while analysts expected a decrease to 47.0 points, and the Services PMI adjusted from 45.0 points to 44.9 points, 0.2 points higher than the predicted value. In the eurozone, the Manufacturing PMI fell from 48.1 points to 47.1 points (against the forecast of 47.5 points), and the Services PMI declined from 48.8 points to 48.2 points.

GBPUSD

The British pound is trading with multidirectional dynamics, consolidating near 1.1300. The day before, the GBP/USD pair showed a moderate decline, retreating from its local highs of October 18, reacting to the strengthening of the UK stock market, which welcomed the news of the election of Rishi Sunak as Prime Minister of Great Britain. The results of the race became known ahead of schedule, as Penny Mordaunt withdrew her candidacy without securing proper support in the party. Sunak is expected to keep Jeremy Hunt as Treasury Secretary and together they may be able to submit a mid-term budget plan before the end of the month. Both officials openly criticized the unreasonable tax cuts proposed by the Liz Truss administration. Additional pressure on the position of the instrument at the beginning of the week was exerted by frankly weak macroeconomic statistics from the UK. S&P Global Manufacturing PMI fell from 48.4 points to 45.8 points in October against the projected 48.0 points; Services PMI reduced from 50.0 points to 47.5 points which was also worse than market expectations of a decline to 49.0 points, and the Composite PMI fell from 49.1 points to 47.2 points.

XAUUSD

Gold prices show flat trading dynamics, consolidating near 1650.00. Yesterday, “bearish” sentiment prevailed in the instrument, and the XAU/USD pair eventually failed to consolidate on new local highs from October 14. In turn, quotes were moderately supported by the fact of a decrease in the yield of US Treasury bonds. 10-year yields fell from 4.212% to 4.209%, reacting to the publication of disappointing macroeconomic statistics on the level of business activity in October. The S&P Global Manufacturing PMI fell from 52.0 points to 49.9 points, while analysts expected a decrease to 51.2 points, and the Services PMI fell from 49.3 points to 46.6 points, which also turned out to be worse than predicted 49.2 points. Today, the US is expected to publish August data on Housing Price Index from S&P Global, as well as the October statistics on the level of Consumer Confidence.

Trust Pilot Score 4.9

FTSE 100 - Results of the elections in the UK pushed the index up

The day before, Rishi Sunak was appointed the new Prime Minister and head of the Conservative Party with 178 of the 355 members of the Conservative faction in the House of Commons having voted for him. The official managed the British economy during the coronavirus pandemic and analysts believe that he is able to lead the country out of the current crisis. Probably, this news has already been taken into account by the market, since even the negative effect of the publication of a report on business activity, which showed a decrease from 48.4 points to 45.8 points in the Manufacturing sector and from 50 points, to 47.5 points in the Services sector could not put pressure on the dynamics of the pound.

Quotes of the index continue to try to start corrective growth. Technical indicators are holding a sell signal, which has noticeably weakened recently.

Support levels: 6920, 6710 | Resistance levels: 7090, 7270

ETHUSD - Murrey analysis

Currently, the instrument is close to 1375 (Murrey [2/8]), but further upward dynamics are restrained by the upper border of the downwards channel. If it consolidates above it, the movement can continue to 1450 (Fibonacci correction 50.0%), 1500 (Murrey [ 4/8]) and 1575 (Fibonacci retracement 38.2%). Otherwise, quotes may return to the lower border of the sideways range 1250 (Murrey [0/8]) or to 1187.5 (Murrey [–1/8]) and 1125 (Murrey [–2/8]).

Resistance levels: 1375, 1450, 1500, 1575 | Support levels: 1250, 1187.5, 1125

Gold Technical Analysis

Gold price resumes its negative trading to move away from the EMA50, reinforcing the expectations of continuing the bearish trend in the upcoming sessions, waiting for more decline to visit 1615 level that represents our next main target, reminding you that the continuation of the bearish wave depends on the price stability below 1660.

The expected trading range for today is between 1625 support and 1665 resistance, and the expected trend for today: Bearish.

USDCHF begins with bearish gap

The USDCHF pair opened today’s trading with bearish gap that puts the price under the key support 0.9990, but it begins to cover this gap and attempts to return to the bullish channel again, to keep the chances valid to continue the expected main bullish trend for the upcoming period, which targets 1.0100 followed by 1.0170 levels mainly. Breaching 1 barrier will reinforce the positive overview, while consolidating below 0.999 will put the price under new correctional bearish pressure on the intraday basis.

The expected trading range for today is between 0.9940 support and 1.008 resistance. The expected trend for today: Bullish.

AUDUSD Hits the First Target

The AUDUSD pair managed to touch our first target at 0.6270 and bounced bullishly from there, affected by stochastic positivity, waiting to resume the main bearish wave that its next main target at 0.6170. Holding below 0.6397 represents major condition to continue the expected decline, as breaching it will lead the price to achieve additional bullish correction that its next target might reach 0.6540.

The expected trading range for today is between 0.6250 support and 0.6380 resistance. The expected trend for today: Bearish.

EURUSD - Strong Statistics from Germany supported Euro quotes

The German index of business expectations in October amounted to 75.6 points, which is higher than 75.3 points in September and better than the forecast of 75.0 points. The assessment of the current situation in the region consolidated at 94.1 points, significantly exceeding the pessimistic forecasts of analysts, which suggested a decrease in the indicator to 92.4 points, and the business climate index at 84.3 points, which corresponds to September 84.4 points and exceeds the preliminary scores 83.3 points. According to experts, this data indicates that after five months of pessimistic views, expectations in the country’s business circles have finally found a “bottom,” from which a turn in a positive direction can begin.

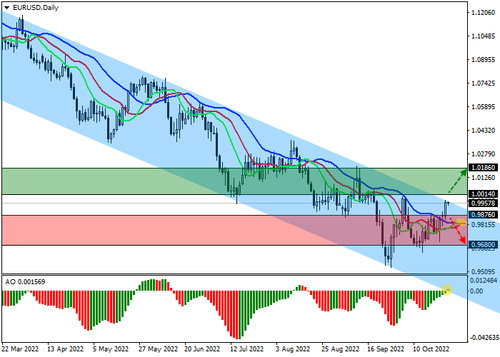

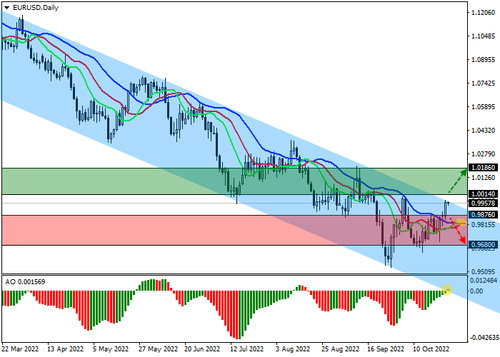

The trading instrument is moving within the global downwards channel, coming close to the resistance line and demonstrating its readiness to break it.

Resistance levels: 1.0014, 1.0186 | Support levels: 0.9876, 0.9680

AUDUSD Technical Analysis

The AUDUSD pair breached 0.6397 level strongly to rally upwards and confirms heading towards the next correctional level at 0.6540, to support the continuation of the expected bullish trend for today, noting that breaching the mentioned level will extend the bullish wave to reach 0.6650, while the expected rise will remain valid conditioned by the price stability above 0.6397.

The expected trading range for today is between 0.6430 support and 0.6540 resistance. The expected trend for today: Bullish.

Crude Oil - US inventory growth puts pressure on oil quotes

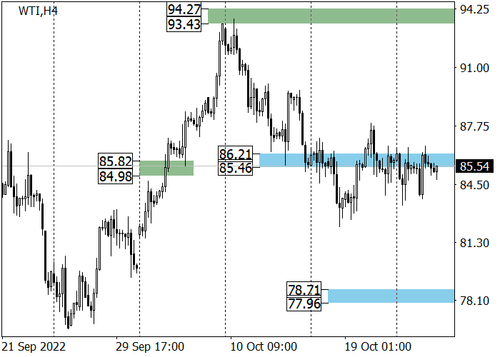

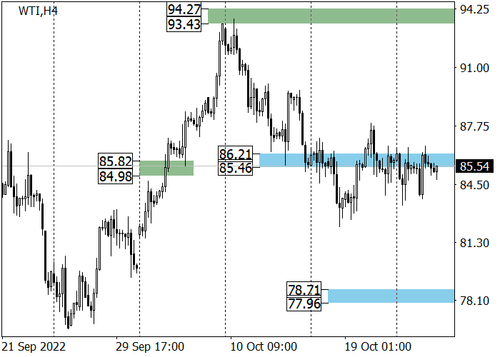

The long-term trend is downward. The key resistance level is located at 93.5, and the key support is around 76.50. Last week, buyers unsuccessfully tried to break out the 86.5 mark, therefore, we can assume a decline in prices to the nearest support level of 81.

The mid-term trend remains upward. Last week, market participants tried to break the key trend support in the area of 86.21–85.46. The trading week closed inside the range, which indicates the retention of support. The trend target is the October maximum in the area of target zone 2 (94.27–93.43). Consequently, it will be possible to consider oil purchases when the first signs of an upward movement appear from approximately the current levels.

Resistance levels: 86.5, 89.5, 93.5 | Support levels: 81, 76.5