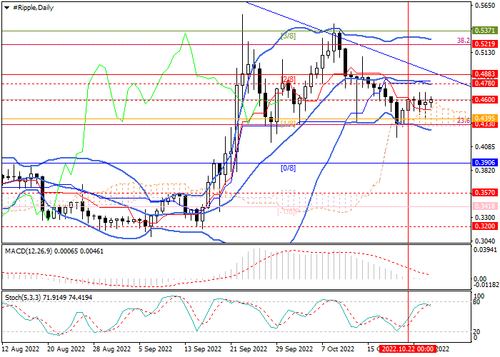

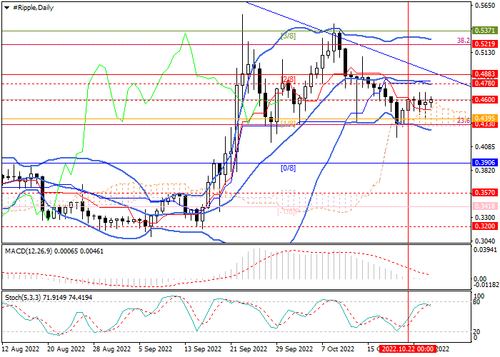

XRPUSD - Technical analysis

The uncertainty of the movement of quotations is associated with the approaching timing of the court decision on the suit of the Securities and Exchange Commission (SEC) against Ripple, as well as the departure of one of its leading specialists, Nik Bougalis, who was previously involved in the software of the XRP Ledger payment system. To continue the decline, the quotes will have to consolidate below 0.4330 (Fibonacci correction 23.6%). In this case, the decline will continue to 0.3906 (Murrey [0/8]) and 0.3570. The zone 0.4883–0.4780 (Murrey [2/8], the middle line of Bollinger Bands) seems to be the key “bullish” region, the breakdown of which will lead to the price exiting the long-term downward channel and give the prospect of further growth to 0.5219 (Fibonacci correction 38.2%) and 0.5371 (Murrey [3/8]).

Resistance levels: 0.4883, 0.5219, 0.5371 | Support levels: 0.4330, 0.3906, 0.357

GBPJPY Repeats the Bullish Attempts

The GBPJPY pair kept its stability near 170.10 recorded high, hinting surrendering to the domination of the bullish bias, also, the major indicators continue to provide the positive momentum allowing us to keep the bullish overview that might target 170.70 followed by attempting to achieve additional gains by moving towards 172.45 that forms the next main target.

We remind you that it is important to hold above the additional support 166.70 to confirm blocking trades within the bullish track until reaching the suggested targets. The expected trading range for today is between 168.8 and 170.7

The expected trend for today: Bullish

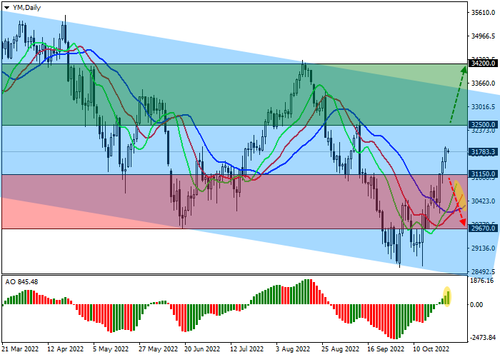

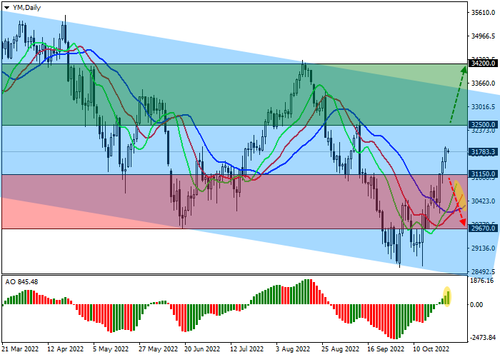

Dow Jones - Correction after the publication of corporate reports

US stock indicators took advantage of the slowdown in the bond market and continue to grow on the back of positive corporate reporting. Now the quotes of the Dow Jones index are being corrected in the area of 31783.

Index quotes continue corrective dynamics, rising in the direction of the global channel resistance line.

Technical indicators are holding a buy signal, which is gradually strengthening: the range of EMA fluctuations on the Alligator indicator expands in the direction of growth, and the histogram of the AO oscillator is forming new ascending bars in the purchase zone.

Support levels: 31150, 29670 | Resistance levels: 32500, 34200

USDCAD - Bank of Canada decides to keep the rate hike pace

Yesterday, the regulator decided to raise the interest rate by 50.0 basis points, not by 75 points, as most experts predicted, bringing it to 3.75% from 3.25% earlier. In an accompanying statement, officials noted that they expect the country’s gross domestic product (GDP) to seriously slowdown from 3.25% to less than 1.00% by early 2023 due to inflation, which, although it fell from 8.1% in the last quarter to 6.9% the basis of this weakening was fuel prices, which fell on the world market. Core inflation, a more accurate indicator of consumer prices, has not eased, and the Bank of Canada expects negative dynamics only in the second half of 2023.

On the daily chart of the asset, the price is trying to consolidate in a downward corrective trend.

Resistance levels: 1.3610, 1.387 | Support levels: 1.3500, 1.325

Crude Oil - US fears Russia’s complete refusal to import oil

Quotes are growing against the backdrop of new information from the United States about the possible introduction of a price limit for imported from the Russian Federation oil. After negotiations with the parties to the agreement, the American authorities decided to soften their position, and the value was changed from 50.0 dollars per barrel to 60.0 dollars per barrel, which was supported by the G7 countries, Australia and South Korea. US Treasury Secretary Janet Yellen explained the decision by saying that if the price is too low, Russia can completely abandon imports.

On the daily chart of the asset, the price is moving within the downwards corridor, coming close to the resistance line.

Resistance levels: 97.6, 103.5 | Support levels: 89.8, 82.5

Gold price builds support base

Gold price settles above 1660 level and attempts to gain the positive momentum on the intraday time frames, while the EMA50 continues to support the price from below.

Therefore, the bullish trend scenario will remain valid and active for the upcoming period, affected by the previously completed inverted head and shoulders’ pattern, waiting to visit 1686.40 level as a next main target, reminding you that the continuation of the bullish wave depends on the price stability above 1660.

The expected trading range for today is between 1650 support and 1686 resistance, and the expected trend for today: Bullish.

EURUSD Under the Negative Pressure

The EURUSD pair ended yesterday below 1.0000 level, to fall under potential negative pressure in the upcoming sessions, but we notice that stochastic shows clear positive signals that pushes the price to start positively today, to face contradiction between the technical factors that makes us prefer to stay aside until the price confirms its situation according to the mentioned level.

Note that consolidating below it will press on the price to achieve new declines and head towards 0.9890 followed by 0.9850 levels, while breaching it will lead the price to resume the correctional bullish wave that its next targets located at 1.0150 followed by 1.0285.

The expected trading range for today is between 0.9900 support and 1.0080 resistance. The expected trend for today: Neutral.

NZDUSD Breaches the Resistance

The NZDUSD pair rallies upwards now to breach 0.5835 level and attempts to hold above it, reinforcing the expectations of continuing the correctional bullish trend, opening the way to head towards 0.5910 as a next main target. The EMA50 continues to support the suggested bullish wave, noting that holding above 0.5835 represents initial condition to continue the expected rise.

The expected trading range for today is between 0.5810 support and 0.5930 resistance. The expected trend for today: Bullish.

USDCHF Gets New Negative Signals

The USDCHF pair provided clear positive trades yesterday to breach 0.9890 level, but it begins today with new decline to press on this support and attempts to hold below it, motivated by stochastic negativity that appears clearly on the four hours’ time frame, which supports the chances of continuing the correctional bearish trend, which its next target located at 0.9815.

Therefore, we will continue to suggest the bearish trend for the upcoming period conditioned by the price stability below 0.9890. The expected trading range for today is between 0.9800 support and 0.9950 resistance, and the expected trend for today: Bearish.

AUDUSD Technical Analysis

The AUDUSD pair trades with clear negativity now to test the key support 0.6397, which urges caution from the upcoming trading, as the price needs to hold above this level to keep the bullish trend active for the upcoming period, as breaking it will push the price to stop the correctional bullish scenario and return to the main bearish track again.

The expected trading range for today is between 0.6370 support and 0.6480 resistance. The expected trend for today: Bullish.

BTCUSD Technical Analysis

The BTCUSD continues forming the new uptrend as a standard zigzag A-B-C. The A impulse completed; the descending correction B formed as a double zigzag [W]-[X]-[Y]. The upward wave C is currently unfolding as an impulse [1]-[2]-[3]-[4]-[5]. Sub-wave [3], currently developing, should finish at a level of 21244.00, where it will be 200% of sub-wave.

Crude Oil Technical Analysis

The short-term oil uptrend continued yesterday. As a result, the Target Zone 89.51 - 88.76 was reached. After that, the price corrected and tested the Additional Zone 87.42 - 87.23. If the AZ is held, the rise will continue, and yesterday’s high will be updated.

If the Additional Zone is broken out downside and the price consolidates below, the correction will continue with the target in the Intermediary Zone 85.54 - 85.17. It is also profitable to consider new purchases in the IZ with a target at yesterday’s high.

US Crude trading ideas for today:

-

Buy according to the pattern in Additional Zone 87.42 - 87.23. Take Profit: 89.24. Stoploss: according to the pattern rules.

-

Buy according to the pattern in Intermediary Zone 85.54 - 85.17. Take Profit: 89.24. Stoploss: according to the pattern rules.

ASX 200 - The stock market is preparing for a downward correction

A significant part of the filling of the Australian budget is the sale of goods to other countries, and a serious disappointment for the market was that Export prices in the third quarter showed a decrease of 3.6% for the first time since autumn 2020 after rising by 10.1% in the previous quarter, while Import prices remained virtually unchanged, rising 3.0% after increasing 4.3% earlier. Against the backdrop of negative dynamics, investors ignored the rather strong data of today’s report on the Producer Price Index, which added 1.9% in the third quarter, and 6.4% in annual terms. The increase in producer prices now has little effect on market sentiment, as it is almost impossible to sell these products at a high price.

The price continues to trade in the global downward channel, having reached the resistance line.

Support levels: 6700, 6440 | Resistance levels: 6870, 7040

CHFJPY holds above the support

The CHFJPY pair formed mixed trades recently, affected by the strength of the additional barrier at 149.75, to decline towards 148.25 as appears on the chart, while the main stability within the bullish channel and the price consolidation above the major support line at 147.2 form the main factor to confirm the continuation of the positivity for the upcoming period.

Now, stochastic attempt to provide the positive momentum allows us to expect the beginning of forming bullish waves, to repeat the pressure on the mentioned barrier and assure the importance of achieving the beach to open the way to resume the rise and achieve new gains that start at 150.5.

The expected trading range for today is between 147.80 and 149.75, and the expected trend for today is Bullish.

EURUSD Awaits more Decline

The EURUSD pair confirmed breaking 0.9915 after ending yesterday below it, which supports the continuation of the expected bearish trend for the upcoming period, waiting for more decline to visit 0.9840 that represents our next target, noting that breaking it will push the price back to the main bearish channel and confirm the continuation of the bearish trend domination on the short term and medium-term basis.

Therefore, the bearish trend scenario will remain active conditioned by the price stability below 1. The expected trading range for today is between 0.9810 support and 0.9970 resistance.

The expected trend for today: Bearish.

GBPUSD Under the Negative Pressure

GBPUSD pair ended yesterday with clear negativity, as it broke 1.1520 level and settled below it, to move below the main resistance line that appears on the chart, noticing that the price completed double top pattern that might force the price to achieve more decline. On the other hand, we notice that the EMA50 attempts to protect the price from suffering more losses, while stochastic provides clear positive signals that might push the price to start positively today.

Therefore, the contradiction between the technical factors makes us stay aside until the price confirms its situation according to 1.1520 level, as consolidating below it will press on the price to decline towards 1.1315 areas mainly, while breaching it will reactivate the positive scenario that its next target located at 1.1700. The expected trading range for today is between 1.1420 support and 1.1610 resistance.

The expected trend for today: Neutral.

S&P 500 - US stock market continues to recover

The American market continues to correct against the backdrop of corporate reporting and positive expectations of investors regarding a possible reduction in inflation. The S&P 500 is currently trading at 3898.

Experts predict a slowdown in consumer price growth in the US, which will allow the stock market to continue its upward correction. Mike Wilson, a leading analyst at Morgan Stanley banking holding, believes that against this background, S&P 500 quotes may overcome 4100.0 in the near future, as the M2 money supply has fallen sharply over the past month. The analyst is confident that the results of tomorrow’s meeting of the US Federal Reserve will also be a catalyst for the upward dynamics in the asset, at which, most likely, a decision will be made on the next increase in interest rates by 75 basis points.

The index quotes continued the local corrective trend, taking a lead from a Head and Shoulders reversal pattern.

Technical indicators maintain the buy signal: the fast EMAs of the Alligator indicator are above the signal line, and the histogram of the AO oscillator is trading in the buy zone, forming ascending bars.

Support levels: 3830, 3630 | Resistance levels: 3950, 4120

ETHUSD - Murrey levels analysis

Last week, the ETHUSD pair attempted to grow within the general market trend, left the stable sideways range of 1375 – 1250 (Murrey [2/8]–[0/8]), and reached two-month highs around 1663.

Currently, quotes have rolled back to the area of 1562.5 (Murrey [5/8], Fibonacci retracement 38.2%), but the upward momentum may not be lost yet. In case of re-consolidation above 1625 (Murrey [6/8]), positive dynamics may continue to 1750 (Murrey [8/8], Fibonacci retracement 23.6%) and 1812.5 (Murrey [+1/8], the upper limit of the long-term downlink). The key “bearish” level is 1500 (Murrey [4/8]). Its breakdown will give the prospect of quotes returning to 1410 (the middle line of Bollinger bands), 1375 (Murrey [2/8]), 1312.5 (Murrey [1/ 8], Fibonacci retracement 61.8%).

Resistance levels: 1625, 1750, 1812.5 | Support levels: 1500, 1410, 1375, 1312.5

NZDUSD Technical Analysis

The NZDUSD pair shows more bullish bias to move away from 0.5835 level, reinforcing the expectations of continuing the bullish trend for the rest of the day, and the way is open to achieve our waited target at 0.5910, supported by the EMA50 that carries the price from below, reminding you that the continuation of the bullish wave requires holding above 0.5835.

The expected trading range for today is between 0.5790 support and 0.5900 resistance, and the expected trend for today is Bullish.

EURJPY Hovers Near the Initial Support

The EURJPY pair formed temporary negative waves, affected by stochastic crawl below 50 level, to notice reaching the initial support 145.65, while the upcoming scenario depends on the stability of this support line, to expect renewing the bullish attempts and target 147.2 followed by 148.4.

On the other hand, facing continuous negative pressures and crawling below the current support will confirm postponing the bullish attack, to suffer some losses by crawling towards 143.95 that forms additional support as appears on the chart.

The expected trading range for today is between 145.5 and 147, and the expected trend for today is Bullish.