Market outlook on June 10

10.06.2020

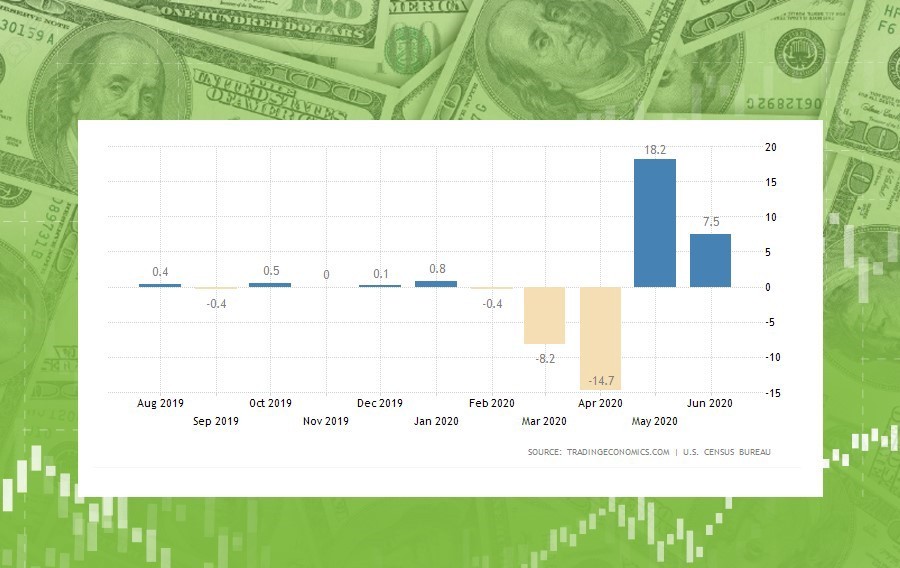

USD is still loosing positions against major currencies. There is a good chance to gain on it! Let’s have a closer look.

EUR is back on track

EUR had been climbing for over two weeks since May 26, but it dropped on Friday after the encouraging NFP data. Nevertheless, this week EUR started on a positive footing. It’s headed towards pre-crisis highs at 1.15. Support levels are at 78.6% and 61.8% Fibonacci levels, 1.131 and 1.117, respectively.

GBP keeps rallying

Now GBP/USD is approaching the 78.6% Fibonacci retracement level at 1.2825. The British pound is likely to gain this week as UK Business Secretary claimed further easing of lockdown restrictions. If it crosses it, it will clear the way up towards the three-month high at 1.31. In opposite, if the pair fails to grow, it will meet the support level at the 200-day moving average at 1.265. If it breaks it down, it may fall deeper to 1.25.

Gold is moving up

XAU/USD reversed after the pullback last week. It’s going towards the retracement level at the high of May 29 at $1730. If it breaks it out, it will open doors to the highest point for over 8 years at $1750. Otherwise, if it starts falling, it will meet support levels at $1700 and $1680.

USD/JPY is steeply falling down

USD/JPY has easily passed the support at 107.5. Now it’s getting closer to the next support at 107. If it crosses it, it may plummet even deeper to 106. However, if some factors push USD/JPY up, the pair will meet the resistance – the 200-day moving average at 108.5.