Care to share your success with all other newbies…just don’t try to sell anything…I aint buying. Just looking for tips.

I took a look at mirror trader and decided to stay away. I just had a sense that they didn’t care about your money and it was just another way for you to lose money. I can’t really pinpoint my reasoning, just their stats, the vibe of the platform, etc.

$1000 is also a good capital to trade with and if we gradually increase it we can earn good profit so we have to trade with proper trading plan and strategies to earn good and consistent profit.

I learned forex trading with a free online book that gave me a forex broker, you have advise me to start forex with $ 100. so I start a deposit of $ 100 and my deposit dexiemes I is $ 500.

The most important thing with your forex account is to risk the appropriate percentage of risk regardless of balance. Don’t think that you can make bigger risks just because your account is small. If you have $50 for example. then your risk should be 0.50- $1.00. no more. don’t go for $10 dollars because you won’t be worried if you lose it all.

I started my trade with a $100 bonus from my post on mt5 forum at that time. Although, I got nothing out of that money, it helped me to know what real trading is all about. I still got that money on that platform, but am trading on another platform with $1000 deposit.

Well that’s good trader should take risk which he/she can afford because trading requires proper trading knowledge and plan so that trading become easy for the trader and we can earn good profit.

i first started with $1250 with gft back then. But honestly, you need to trade with money that you can afford to lose.

Actually, I try to keep feelings out my decision making as much as possible. Emotions can cloud judgement. That’s why I prefer a more systematic approach. That said, I don’t think anyone should simply follow any automated strategy blindly. Most strategies are designed to work best only in specific market conditions. For example, range-based systems tend to work best when the market is moving sideways, while momentum-based systems tend to work best when the market is trending.

However, it’s not always that straightforward. As you mentioned, even the pros can run into difficulties in properly assessing the situation. Just this week, I read two articles about prominent trading firms that had enjoyed success in the past but struggled recently:

[ul]

[li]“FX Concepts grew to manage $14.2 billion in January 2008 by successfully using systematic investment strategies in currencies, fixed-income derivatives, and commodity and equity futures. Taylor was named one of the best-paid hedge fund managers of 2008 by Alpha magazine, pulling in an estimated $250 million. But like many trend-following hedge funds (often called managed futures shops or commodity trading advisors) FX Concepts has lost money in recent years. The flagship multistrategy fund is down 11.35 percent this year through August.”[/ul]

[/li][ul]

[li]“Profits across many of Europe’s largest high-frequency traders slumped by nearly a half last year as they struggled with an industry-wide fall in volumes and regulatory attempts to curb high-speed trading.”

[/li][/ul]

I think the lesson to take from these examples is not to become complacent. The market is always changing. There is hope in that fact. It means that whoever is willing to put in the work today will be the best prepared for tomorrow. People can’t hang their hat on past successes.

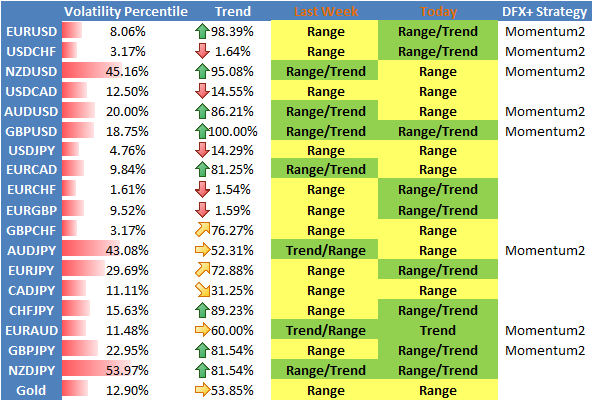

Something that has helped me in selecting systems is reading news about current market conditions. For example, quantitative strategist David Rodriguez updates the table below every Monday on DailyFX.com which is a free site. (I refer to this research in the DailyFX signals thread.) It shows his preferred strategies for the coming week.

It’s not that Rodriguez changes systems every week, but he does continually assess whether the conditions that initially made him choose a particular strategy are still present. The key is assessing current market conditions and being willing to adapt accordingly.

I am yet to see any affordable trade copying service that makes more pips than my manual systems.

Just get yourself to class and learn how to do this on your own.

1 year ago I started with 600 euros. Now I have 2400 euros. I studied 3 months everything about forex and stocks. Now I have my own strategy which I have developed and consistently making money.

The reason why I make money is because I’m disciplined and I trade like a sniper. I wait for a good opportunity and then I’ll take all the profit. I trade weekly charts and have huge winners but little losses.

My first real cash in a Forex account was 100 Euros I received as a bonus for attending a Forex seminar. I used this money to earn 100 Euros in one day only…but it was pure luck! I never invested my own money! I have a little jar where I put all the coins I have, and my plan is to save money this way and practice trading for at least one more year (or two). After that, if I realize I’m a profitable trader, I will invest those savings and start making money!

My first live account is a HotForex mini-account with $10 bucks, I have tried demo for 4 months and started trading with a small capital. I also made 20% profit before burning account with 0.1 trade volume without STOP LOSS.  That’s my great experience!

That’s my great experience!

My first account was an equity account at $6,500. I subscribed to an advisory service. Their recommended trade of the year was some slot machine manufacturer. I bought on Friday. Over the weekend a rival company sued for patent infringement. Monday morning my account opened at $2,500 (an almost -50% loss). I had only been in the stock market ONE DAY. :15:

The amount of money that I invested for Forex trading is 100 USD. It is actually the minimum deposit fund required by GDMFX to open a trading account with them. It is equivalent to the classic trading account of the said broker.

Hi nice to meet you here.I also started trading with the same amount and with same broker.I think it just the right amount to start as a newbie and I consider it as a learning fee:)

I started with about 2500 a couple of years ago. I lost about 1000 in 2012 followed by a break even year in 2013. I’m extremely pleased with my development and am hoping to make 2014 a profitable year!

I have been trading with a real acc. for more then 2 years, started with Eur 200 and increased it up to 2000, I was with MAYZUS broker, very good one, but they stopped the fixed spreads, so I have a new broker NSFX, VERY good one, with fixed spread, so far I am happy with them. I am an intraday trader, 5 min chart ( 15 min using to see the trend, short term trend)and I like to have my spread fixed, so I know where I am  My charts and indicators are very simple, some indicators I modified for my use, but nothing complicated…

My charts and indicators are very simple, some indicators I modified for my use, but nothing complicated…

Why don’t you try a true ECN with a cTrader platform? You won’t be sorry, and you won’t miss the fixed spread when the variable spread is usually very close to zero. Your style of trading is similar to mine (except I also play news). I use IC Markets and I love them.

After a few months demoing I just opened a live account with $1,000 at IC Markets using the cTrader platform (a billion times better than MT4). My plan is to grow that to $3,000 by June, using a maximum of 0.1lot per trade intraday (except news trading which I use a full lot).