COMMODITIES ANALYSIS WEEK COMMENCING MON 16TH AUG 2021

WHEAT SHORT TRADE…

As per my post above. In this video I do a quick analysis of a few commodities. We found “Wheat” as a Short opportunity for tomorrow. I only run a 15min free screen-o-matic video, Silver has a very good reason to start an Uptrend. Whilst Currencies such AUD/USD and EUR/USD are in a long term bear market.

We can see the pattern, safe heaven instruments like Gold, Silver, etc are in a Long Term (Week Chart) Bullish Trend same as the USD against other currencies, meaning a downhill scenario for AUD, EUR…

However, this view is in the Long Term, Weekly Chart, but I do not trade at this level, I trade at the Day or 4H Chart Level and seek to “fine tune” my entries using 30M, 2H charts.

It is a bit complex trying to explain the “top down” approach. On one hand, a Week Chart like AUD/USD is showing that we are in a Bear Market for that currency, however the immediate Day Trend is Up, this only means one thing “We will be trading the retracement leg of the down trend”…

So we just need to “keep the longer term in mind” and know that this “up trend” in this AUD example, is only “intermediate” and it will turn around and align with the current “Bear” market for that cross.

The same principle/thinking process applies to the commodities in this video…

I will be doing my best to post videos of Real Time trades for all of this 14 instruments as they appear…

MON 16TH AUG 2021: AUD & WHEAT TRADES UPDATE

FX TITAN TITO TRADING METHODOLOGY IS NOW IN YOUTUBE…

I have 8 lessons in summary form that I am uploading in Youtube. Each video is only 15min long, and it will cover the topics below.

But please be mindful, I am only pointing out the @tools@ I use, I am not @training traders on each of these tools@, I point out the tools I use and are required to be known so one can apply my Trading Method.

So these lessons are not for novice traders. You need to be familiar with all the topics listed already. Through my videos you will learn how I think about and use each of these tools.

I hope that by the end of the series I am better are creating these videos and that I can @clearly and simply@ explain my method.

The final outcome will be:

You will be familiar with the 3-types of trades I enter and how to manage each trade using sound Money Management principles.

My method can be applied to any Multi-Timeframe eg:

Weekly Chart > Daily Chart > 4H Chart

Daily Chart > 4H Chart > 60M Chart

4H Chart > 60M Chart > 15M Chart

etc

Happy trading

WED AUG 18TH 2021: TRADES

AU: LONG

COFFEE: SHORT (SL @B/E with nice book profits so far)

OIL: LONG

GJ: LONG

WHEAT: SHORT (SL@B/E with nice book profits so far)

THU 19TH AUG 2021 TRADES:

COFFEE: CLOSED @PROFITS

OIL: CLOSED @SMALL LOSS

AUD: S/L HIT

WHEAT: Exit The Short on profits

WHEAT: LONG

SUGAR: SHORT

GOLD: REMAIN SHORT

EUR: LONG

AU200CASH INDEX

DAY TRADE & 1H CHART TRADE, LONG

this is a clearer picture of the Buy entry…

TRADES AT MON 30TH AUG 2021

COFFEE: WILL BE CLOSED TODAY SINCE IT HIT THE 127 FIB EXTENSION

TRADES AT TUE 31AUG21

COFFEE: CLOSED AT PROFITS

AUD/CAD: CLOSED AT SMALL PROFITS, AND REVERSED (NOW LONG)

EUR/USD: CLOSED AT B/E. This trade didn’t have any other signals a part from shown in picture, so I cleaned it up.

GBP/JPY: CLOSED AT MINOR LOSS. This was another trade that I had to clean up. The GJ had formed what appear to be a 2H-BEAR GARTLEY but only after moving into a buy zone in the smaller timeframes (30M/1H). I felt this could have invalidated the 2H BEAR GARTLEY. Secondly, the DIV between points marked as 1&3 was pretty “close to each other” in the 2H chart, and there was NO such divergence in the 4H Chart

IF IN DOUBT…STAY OUT…

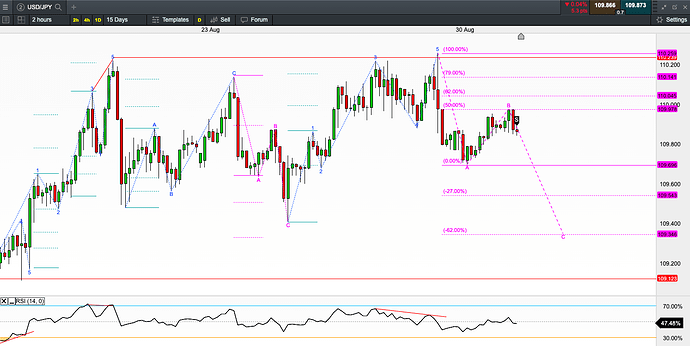

USD/JPY: SHORT

1 Like

Mon 7 Mar 2022: Jap 225 Long: a quick loss and a quick lesson

POST TRADE: THE INDICES ARE BEARISH, YET I WENT LONG…DUMB TRADE

JPY, USD, METALS, GRAINS: BULLISH!

This is a 0.5% investment trade only. I have to leave soon and I couldn’t wait for the 30m candle to form.

This is a LONG only IF: The current 30m candle completes a “Harami” ie if this current candle finishes as a Bull Doji or Hammer. Like I said I had to live so I invested 1/2 my usual 1% unit

My main 1%-5% investments have been focused on trading my “Gartleys” as I have defined them before.

I havent been posting because of personal constraints, but I hope to resume my posts here on

Happy trading

usdjpy short (1%)

pls remember for privacy reasons i post the “demo” version of my trades

happy trading

corn short: gartley 79 (1%): CLOSED -0.25%

After closing my first entry I managed to re-enter upon further 30’ candle confirmation

This Gartley worked once more

SILVER SHORT: 0.5% ONLY @B/E

This is a “Divergence” trade which is one of my “C” trades, so only investing 0.5% instead of the usual 1%-5% for A & B type of trades

eur/gbp: 0.5% long Harami: CLOSED

platinum: short @ 0.5% risk

USD/JPY: LONG (REVERSED ABOVE POSITION): 1% RISK

Tue 8/310AM OZ Open positions:

New Gartley Trades 8/3:

Some are Gartley 62% others like Aus200 G79%

POSITIONS @2:30PM 8MAR22:

CLOSED A FEW OF THE TRADES AT PROFITS AND SOME A SMALL LOSSES…

HERE ARE THE UPDATED POSITIONS

after reviewing the above trades, i didn’t want to make the same mistake of trading the 30m-1h charts “against the main trends” we all know that the indices are still down trending and the usd and jpy are getting stronger. so I readjusted my trades to ensure I am going with the main trends

the exception is Gold and Silver, the latter has broken a recent up trend line and the latter has formed divergence plus what I call a “flat top” in the 4h charts

the charts:

Note: I reduced Gold, unlike Silver which is now at locked in profits, and it has broken a TL, Gold hasn’t so I didnt want to risk too much too early

TUE 8 MAR 2022 18:30 : UK OPEN UPDATE CLOSING SOY AND CORN

Attached the current positions, we got stopped out of a few some at a profit some at a loss. My equity is around the same but from here I am hoping for a move above the 5% mark…wait and see…

AUD/CAD & AUD/JPY: My “A” trades! Where a “Textbook Gartley” both at the Fib 50%. I added extra investment in both in my real account. This I consider a 2%-5% risk.

Gold& Metals, are turning around. Although I made profits on Silver going against the trend, this caused me to “miss the bigger picture and turn around” earlier. So I missed the bull move.

I am still working on dropping the “Against the trend trades” and rather, wait for my Gartley (as my only Reversal which a lot of times can also be a Continuation when found in a smaller time frame), this will yield me a lot more profits I am certain!

Corn, Crude and Oil: All are Fib Swing trades which I consider at 0.5% risk (“B” trades)

1 Like