Hey Meza.

Sorry for this delay. But I did want to respond to your question.

I’m gonna divulge as much knowledge as I can for ya. Hopefully it’ll help in your understanding of it all.

Risk-on

— The most notable currencies are the AUD, NZD, CAD (a.k.a. Comms).

Risk-off

— The most notable currencies are the USD, CHF, JPY.

Risk-on & risk-off should be thought of as a seesaw. With one on one side with the other on the other side. It’s a dynamic. A perspective that the broad market tends to side with. One or the other.

Cause we all know that the reason why the participants are in it is to be making a profit. Making some money. Right? But in our market, with the currency’s, each of them have behind them a reason for why they are traded. It’s the fundamentals that drive them. Now I’m not talking about the technical side of things. Just the fundamental side. Cause that’s another topic of discussion.

But, you can get a sense of risk-on when you see the Comm currencies being bought up. Along with the safe haven currencies getting sold off. That means the money is more daring. It will take a chance with those horses. And there’s reasons for that, like the fact that they are the economies that have more growth to be had in comparison to where they’ve been. Basically, their up and coming nations. Cause where can you go when you’re already at the top?

And well, that’s the whole reason for the safe haven currencies. They’re at the top for a reason. It’s safer. Which is where the money will want to go when the fundamentals of the world turn ugly. It’s just playing it safe.

You can think of the stock markets in the same way. Think of it. In the equity markets, what are they doing, anyway? All their doing is putting their money there for growth only. It’s one way. Up. Not down. The stock markets want up only. That’s it. And that’s why when you have a risk-on sentiment the stock markets are moving higher. It’s common knowledge over there in that market. It’s the investors actually saying that I’ll invest in your company. And you better be getting more valued as time goes by. They want a return on their money. So therefore, the price of that company better move higher so they can get that higher return.

But when that market moves lower, who wants that? No one. Not the investors. Not the company’s. Not even the governments. No one. It’s a bad thing.

But…what’s most important to an investor?

Their capital.

Do you think they care more about what their invested in or what their account balance states?

They care more about where their money goes to.

So when they want more security they’ll move their money into the safer markets. Like the treasury markets.

But getting back to our market. It’s different. We’re not in a one way direction type dynamic, like the stock markets are. It’s much more complicated. The reasons why the investors (now we’re talking fundamentally here, only) buy a currency and sell a currency can take many different reasons. And one of those reasons can be divided into the risk-on, risk-off dynamic. That’s why you’ll hear many analysts frame it that way. Cause it is a truism.

But that doesn’t necessarily mean those are the only reasons why money goes there. You got to think about these other reasons why money moves in the way it does.

-

Technical analysis. All of the things pertaining to what the charts are saying. S/R levels. Overbought indicators. Volume. Any lines on the charts. Etc…

-

Interest rate differentials between 2 countries. How a broker needs to pay the difference at every EOD.

-

Political economic reasons. Think of Brexit. The USA and whoever is elected (think of the battle between Trump and Hillary back when he got elected Nov. '15.). Talk about the market flying.

Look. I can go on and on. In fact, some time ago I did some thorough research on all of the reasons why currency’s move. I should dig it out, from one of my notebooks that I done very much journaling on. I remember it very well. It is very informative, no doubt. But guess what? You want to know what I concluded?

It doesn’t matter what the reasons are, were, will be.

It doesn’t.

What matters more, is what’s trending. And even then, that’s a difficult thing to get a handle on. As what we find on this thread.

We simply want to go with the flow.

But I see you’re wanting to define some natural rhythms of the market.

You are definitely thinking Meza. Good job. You are on the hunt, and are thinking like a trader. Awesome.

But, you got to be a little more specific on what riding the wave means, to you. You got a beginning, the middle, and the end of a trend. You know how hard it is to know when a trend starts. Very. They say it’s practically impossible to pick tops and bottoms. That’s simply saying it’s hard to know when it begins and when it ends.

So they say it’s best to jump in on when it’s in the middle of trending. Right? That’s your best chance to be right on something.

So riding a trend needs to be explained pretty specifically. From my own experience, I’ll tell ya, that it doesn’t pay to try to be in it from the beginning to the end. The whipsaws are so detrimental, that in the long run the best you can do is only break even. It’s best to get real good at a specific part of the trend. Let’s see…you can break it down into the beginning, the middle, or the end. The beginning would be the bottom. Impossible to see until afterwards. The end would be the tops. Same thing. Impossible until it’s over. So all you got is the middle part, which is where you’ll have those boosts. Then retracements. Then boosts higher. It has to be that. Higher highs (for uptrends) and lower lows (for downtrends). The ranging criteria is hard to get right, I think. Therefore I don’t count that variable. It only makes things so much complicated.

Plus I’m not wrong in making everything either in an uptrend or downtrend. If something actually ranges, then I call that a retracement from the direction it’s going in, that’s all. Cause it’ll eventually either go back to the established trend direction (higher swing highs) or it’ll change that trend and go the other way (lower swing lows).

So, all I’m saying is that it’s better to get good, and practice, one specific dynamic of a trend. The problem is that there’s so much we don’t know until after the fact (hindsight). Always remember that, Meza. Don’t be deceived by where you think the market should be going. Know what the market is doing, first. Know for sure. Then act accordingly.

What do we know for sure?

Every trend has a beginning, a middle, and an end. We just don’t know for how long, on each of those aspects. Think of it. For a beginning, we don’t know until afterwards. Cause we can have a very long down trend. It can then range for a long time. Then we can think it’ll change into an uptrend. But it could very well be a fake out and just continue on it’s down trend. That’s why I say you don’t know until afterwards. Much afterwards. Like after it starts making higher highs. That takes time.

And the same things goes for the end of the trend. Think of a long uptrend. It doesn’t make higher highs anymore. It retraces. Or ranges for a time. Will look like a flag. But we are not going to know whether it will continue on that uptrend or not unless it starts making lower swing lows. That takes some time. So therefore, I’m saying, that we don’t know until after the fact on the starts and ends of a trend.

It’s almost impossible.

That’s why they say when it has started, technically speaking, your direction should be established. It’s all in the middle part of the trend. And even then, you got to be specific on how to trade that. Just after the retracements only? Or when it makes higher highs? Or only on the break and retests. Know what I mean?

Basically, you want to get good, very good, at one particular part of a trend. What else is there? Well, I told you, I tried the whole entire trend. Look. You can try it. Try surfing that surfboard higher and lower and hopefully in the end come out in profit. I found wayyyyy to much slippage. To much lost profits. It doesn’t pay. Trust me.

Sorry. Maybe I got off subject. But those are some things to think about when it comes to the specifics of trading something. Like a pair. On a chart.

But, you want help on exactly what to trade. Cause if you can determine correctly how the market is moving then your chances of picking a good pair helps matters, right?

Well, if you don’t mind, I’ll tell you how I go about this.

Talking about which pair to trade.

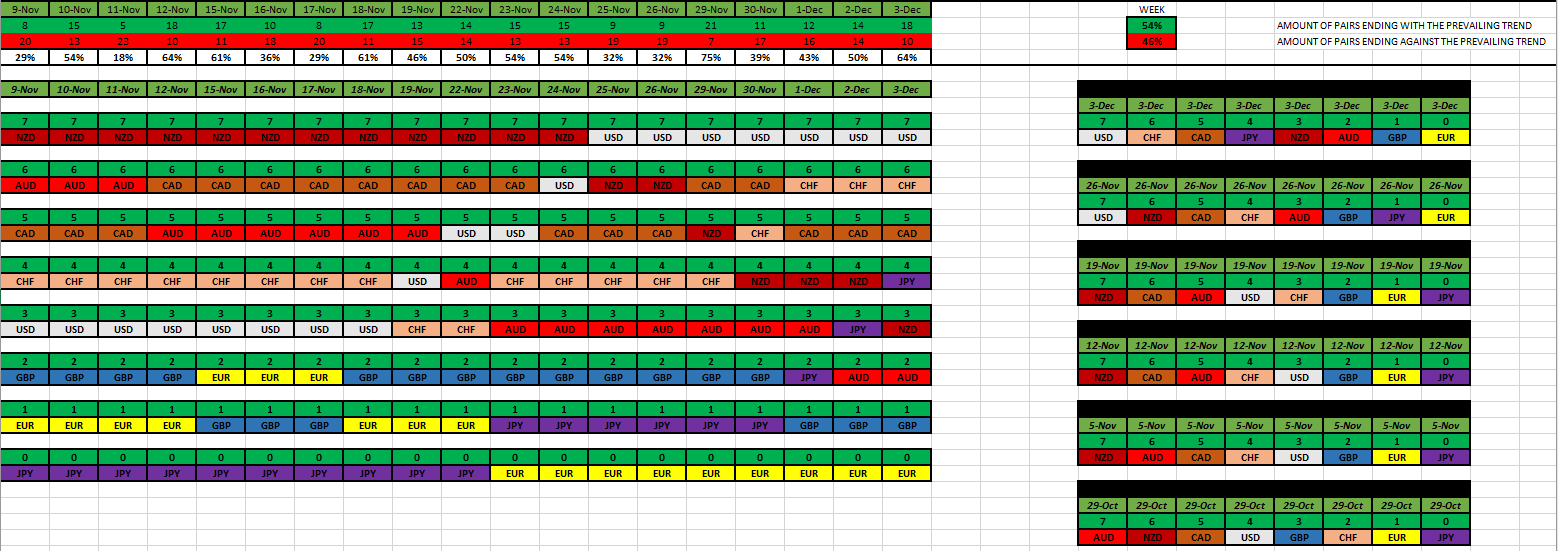

- I look at the currency aggregate.

- I determine their aggregate trend (will either be long or short).

- Pick a long trending currency.

- Pick a short trending currency.

- Then it’s just a matter of time about WHEN to get into this trade, and WHEN to get out of this trade.

Or.

You can just use the cheat sheet from Dennis’ thread —

But as I keep looking at what you’re asking, your wanting to know about other identifiable distinct phases.

Well, as mentioned. And which I think is the best, most consensus driven one is the risk-on vs. risk-off sentiment. In fact, you previously said that the AUD/USD pair was the bell weather pair for that. That’s very correct. But the AUD/JPY is that also.

Others?

– Strongest against the weakest.

– The USD against anyone else. Cause that’s the most traded currency in the world today, volume wise. It is the worlds reserve currency.

– Correlations. That is how two particular currencies are related to one another. Examples are : EUR & CHF. USD & JPY. AUD & NZD. CAD & Oil. They are all known for riding similarly. This is not so easy. Correlations can be broken for such a long time. Be well prepared if you want to go this route.

– Majors against the Comms. Back in '16 I developed this system. I grouped the entire 8 currencies into those 2 groups. 5 against 3. 15 pairs. But it worked much better then because the CAD just does not always act as a commodity currency these days. It used to though.

– Interest rate differentials. Or whoever is poised to raise interest rates next. Cause that’ll affect what goes on in the bond markets. Remember, money wants to grow.

– Individual currency trends. That’s what I do. Look at the aggregate and boil it down to a pair. In fact, that’s exactly what the strongest to weakest is all about also.

I don’t know any other broad market tendencies. Money just wants to be accumulated, that’s all. And it’ll be done by moving in some kind of trend.

You got to look at the individual characteristics of a currency, and market sentiment. Most of the time that sentiment will fall under risk-off (safe) or risk-on (daring).

And even Bitcoin has proven to be a risk-on asset. All the money there is nothing but investors extra, play around type money. That should tell you something about how the world is today. There’s so much money around it’s not even funny.

Well, I’m sorry about all this. I know it’s a lot of nonsense.

Take what you can from any of this.

Throw the rest out.

Mike