Hello @Pattop I will post finer details here before the end of the week.

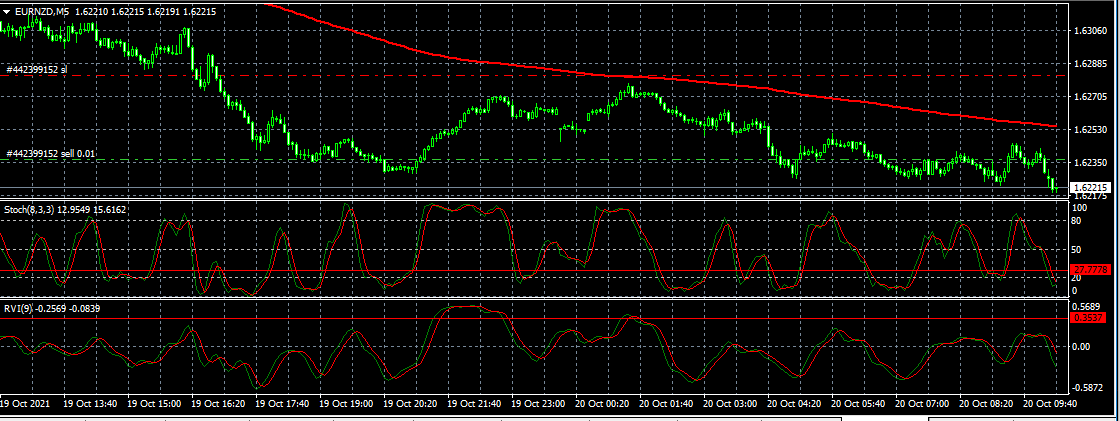

Right now I am looking at EURNZD, it looks like it has a nice sell opportunity at around1.6236 and sl at 1.6282. Those are just my views

@[quote=“Pattop, post:412, topic:324853, full:true”]

Hello! I just found your thread and i was very VERY skeptical because it said guarantee haha. I really only got through a couple trades from Jun of 2020 before realizing i was a whole year behind, So i dont have to go through a years worth of information. How successful was your strategy over the last year? Thanks for the read

[/quote]

hello @Pattop I have about 10 interday (long-term) trading strategies that have helped make more over the years. However, my key focus has been to offer intraday signals with minimal drawdown (not exceeding 3%) and at least 3% ROI per month.

Initially, all my trades were long but after successfully developing another code for short trades, I have been able to sell some pairs and make some profits.

I will be sharing two accounts by the end of the week dedicated to intra-day trading.

If you have come across chunyffs333, see this link (ZuluTrade), you will realize that traders are not always in control of interday trading or long-term trades.

I like the intraday trading because it gives me more control and maybe it can have many returns. However, I no longer scalp because scalping proved too challenging for me.

But we have usd news at 15.30 (GMT+ 3)

I will try to describe one of the trading strategies that I have found to be useful. It is called trend following.

Basically, it is buying an asset when its price trend goes up, and selling when its trend goes down.

For me, however, it is more than that, not just following a trend, I do detailed analysis using my EA.

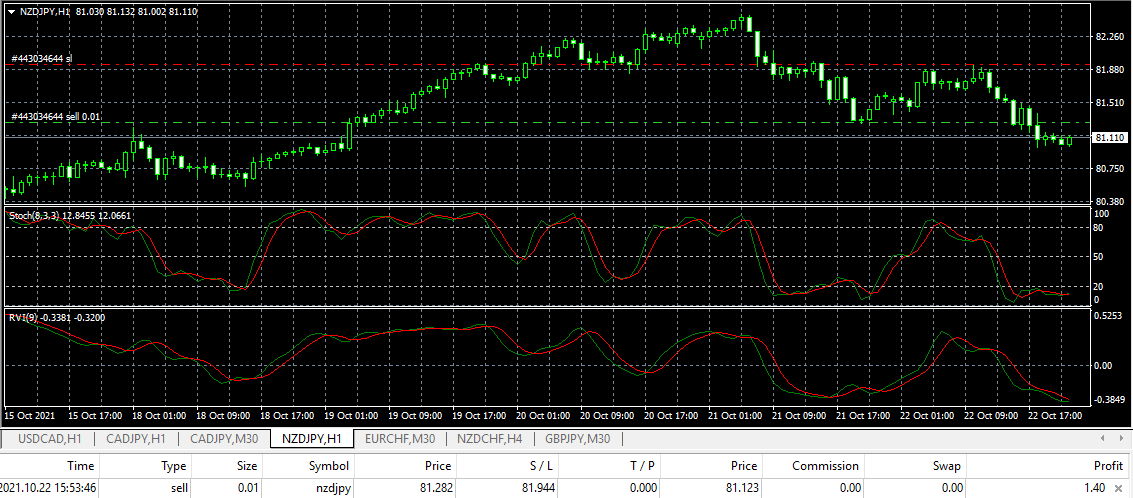

Right now, NZDJPY and EURCHF show a downward trend continuation. My EA, however, indicates that these are not the best selling opportunities. You can have a look at it and sell if you are convinced there is an opportunity to do so.

I would recommend a risk taker to trade NZDJPY

With stop loss at 81.944

I have a telegram channel, for those who joined recently, I have not been posting any signals there for two months now because I was working on my code. I will start sharing many signals through the channel from next week. I work from Saturday to Monday but I am free from Tuesday to Friday. So I hope to be able to share many signals there on those four days. All of then will be trend following signals. I will also be able to offer some explanations based on the knowledge I have so far. anyone can also ask me a question. Thanks for taking time to read all my posts.

I believe my EA will work well in the weeks ahead. One way it helps me is that it measures momentum and identifies support and resistance. for instance, it pointed out this resistance here and I expected some retracement for NZDJPY even though it had a strong bearish momentum. That is why I didn’t trade NZDJPY

So trend following works this way, you can see what happened to NZDJPY (but I would like to point out that I usually close my trades within 2 hours) Lets meet next week on Tuesday.

Hi,

I note this thread consists of over 400 posts. I am sure readers will be fascinated to know whether you have managed to demonstrate a positive edge from your trading. As has been asked by others before, do you have a summary of your trading account results to date? It would be fascinating to read and analyze your trades, but without an indication of results, it is pretty pointless.

Hi @Mondeoman. Thanks for the feedback. As I said, I have been working to create several trading strategies. I attempted scalping but it wasn’t successful. Trend reversal and trend following have proved profitable.

I see you are interested to read and analyze my trades. For that matter, I think I should have one or two accounts dedicated to trend following and share the links to those accounts. I will do that from next week. I will share myfxbook account and mql5 link.

I will also have another thread specifically for trend following.

Again thanks for the feedback.

A pleasure. I look forward to seeing your results. Thanks for quick reply.