Good morning Journal.

Let’s see.

What am I going to talk about today.

Whatever you want.

I’m here to listen to all the nonsense you can get out.

Just type away and you’ll feel better.

Alright Journal. Thanks. Here goes.

I got this idea. But it’s unfinished. Quite.

I really don’t know if I’m on to something or not.

This could be such nonsense. But I have to follow this and see if it’ll lead to something.

At first, when it hit me, I thought I uncovered some kind of secret weapon. Something maybe that no one has every thought to try. It’s something under everyone’s noses.

It’s a tactic. A methodology. A way of caring out a trading strategy.

Remember, this is incomplete.

I’m just gonna get it onto print and see how it looks. Well, honestly, I did break out my journal (binder full of paper that I write in) and drew up some things about it. I’ve been sitting on the idea for a few days now.

I’ll tell ya where it all comes from.

Someone (a reader of my stuff) recently mentioned how much I demo.

Ok. Let’s go there.

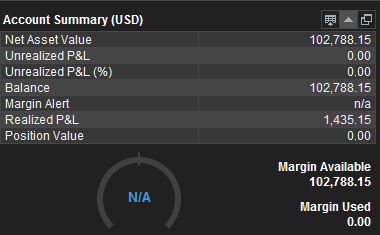

Yeah I demo. That’s all I’ve been doing is demoing. In fact, I’m not so sure that I could be more fulfilled otherwise. It’s the journey. I’ve been on it, for some time now. It’s been years. At the end of this year, I will have completed 9 years on my journey. Most of it has been demoing, as opposed to a live account. Actually, this journal started when I first went live (Jan '16). And so, the first 6 months of my live trading journey has been documented. It’s not pretty. But, the whole point of it is, that I’ve felt, experienced, and operated in that setting long enough to learn the emotional control needed for that environment. Honestly, for me, there was not much difference between the two methods. It’s all serious business for me.

It just doesn’t make sense to me, when you don’t have enough capital, to be trading in a live account. Especially when everything you need to see, experience, and prove to yourself, with all the documentation of course, is enabled in the demo arena. Honestly, if you can’t prove it to yourself in demo, you’re not going to live. I don’t care who you are, pretend all you want, it’s not gonna happen.

With me, I’m not successful in demo yet. This reminds me of a very thoughtful conversation I had with my (very intelligent) brother one time, not too long ago. On the subject of my journey and goals. Coming from someone who is learned on a number of diversified subjects, like monastery monks’ visions and whatever they seek to attain, he asked whether I would be completely satisfied and fulfilled if I proved, with all the documentation, of a perpetually increasing account balance operated as a virtual business, rather than having a real life business entity that operates off of a live account and generates enough income to self sustain the business and also continually grows from there.

What is most important to me? The actual self sustaining trading business I desire? Or the self fulfillment attained from successful trading operations that is continually being proved over and over again, in the market? Virtually.

I don’t know, that’s a tough one. Cause I think I can die very peacefully knowing that I can do it, over the long term, proven over and over again. Able to build and grow a generator of funds from the market.

But then again, I do think that the absolute top in life, for me, would be a simple self sustaining trading business that ensures I don’t have to depend on anything else for my finances.

Well, when I get deep into this discussion, I always have to remind myself …"unless the Lord builds the house, they build it in vain who build it."

Now that’s what’s most important to me.

But, I guess it’s a two fold thing for me. Finances, sure. Self accomplishment, definitely. I can’t separate those. So. The answer is, “I just don’t know, Bob.” (bro)

So.

I will continue indefinitely with my demoing. Until I attain.

Bottom line.

Now. To continue on with my train of thought.

What if someone gave me a lot of money, enough capital for the business venture. How would I really use it?

I’ve always, always said. I would trade the way I trade in demo. Cause that’s the entire reason, premise of why I trade demo in the first place.

Seriously. If I ran into $300,000. I would have to determine how much % a month I should expect to generate. Look at my trading plan and strategy and just do what I’ve been doing but with the adjusted position sizes. I would expect to withdraw on that every end of month.

That’s just common sense stuff. But I took it a bit further. I asked myself whether I would still trade in demo. See. My first thought would be a no. I go ahead and just do what I do being live, that’s all.

But.

Why stop the demo?

(Now we’re getting somewhere)

Why would I want to discontinue doing what I’ve been doing for such a long period of time? No one’s making me stop demo. There’s no rule saying that it’s either / or.

Then this thinking leads me to my whole entire point.

Is there a way in which I can utilize my demo trading at the same time I trade live?

Can this assist my live trading?

An aid. A tool. A methodology. A developed system for minimizing trading risk.

Look. I’m not in the habit of reading how other traders are doing it. In fact, I’m such adversed as to how others are trading. Even if they are successful. I’ll just summarize my thought here. One of my favorite words is proprietary. It comes from within. And so, what I’m saying here is that I think this is original thinking.

And if by some chance this has been discovered, or experimented with by others, then so be it. But in my mind, this comes my own originality of thought. I mean, think about it. No one on the planet has demoed more than I have (surely I could be wrong, but somehow I don’t think so).

And now all I want to do is further this methodology. I’m not too sure that’s correct English. Or proper grammar. But the point here is that I would like to develop this into a tactic.

Again, this is by far anywhere near complete.

I’m just gonna start throwing out there a lot of thoughts on this. Maybe something will start to make sense.

What’s the difference between demo and live? Nothing but the pure and unadulterated topic of destructive emotional trading. Ok. Is that it?

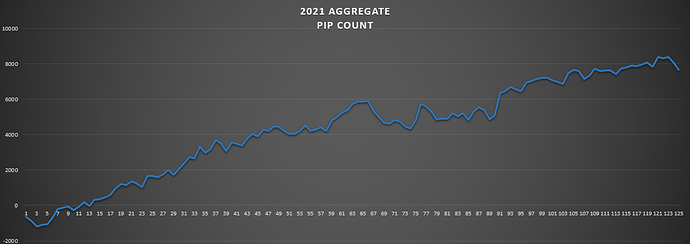

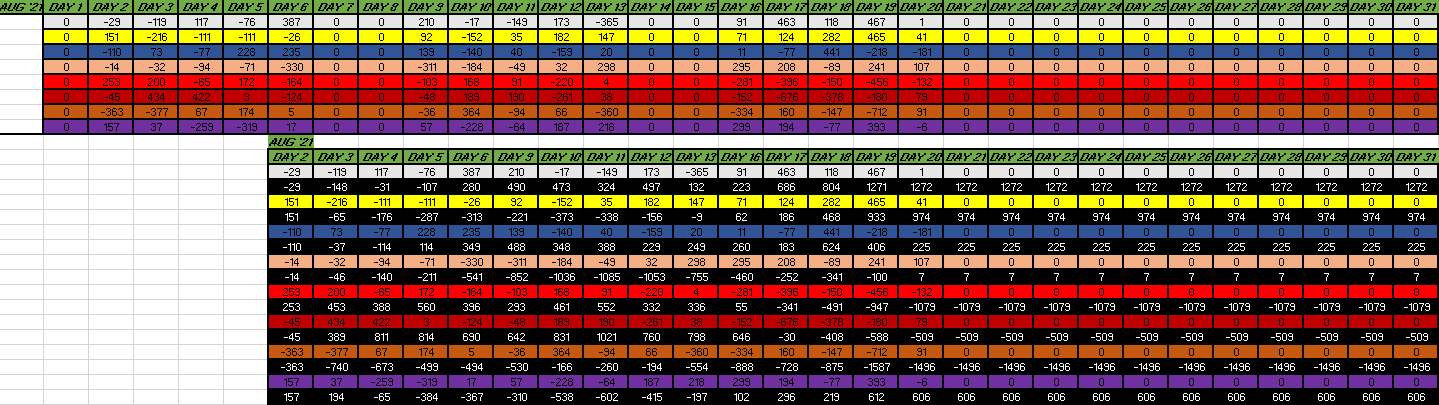

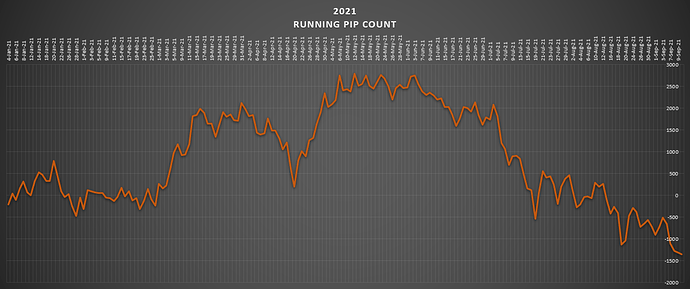

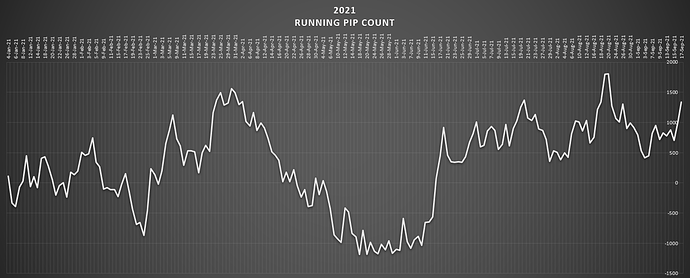

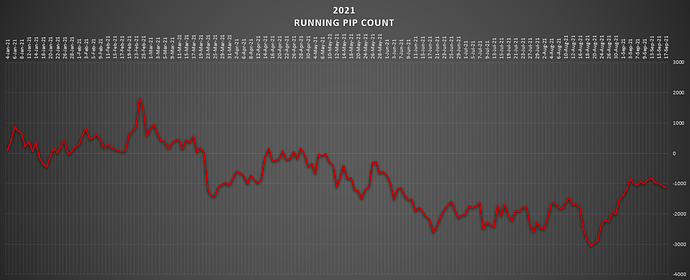

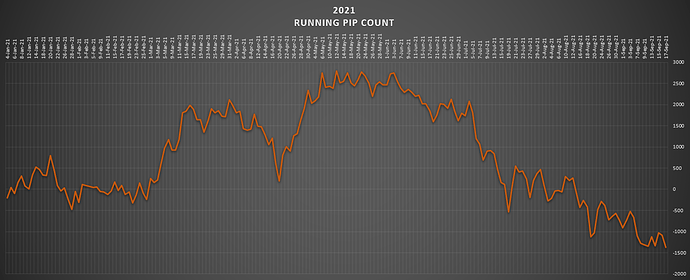

I surely would love to know the answer to this. Is it true we trade way much more successfully the demo way than the live way. Well, experience tells me that’s not true at all. If it were, I should be way much more advanced than where I’m at right now. I mean, I can’t even go a complete year without stumbling in a major way. Even ending a complete year in the positive!! I can’t even do that yet. Demo wise.

There has to be other benefits to demo trading. Not just the emotional subject.

How about something like this. A way to have something run in the market and to be able to follow it. A precursor. A tell. An indication.

Look. I’m all about following the market. In my mind, a few years ago, I boiled it all down and to this day I believe in this mantra.

It is best to follow than speculate.

What if I followed a demo strategy instead of the live market?

Somehow.

The difference is in the time factor.

If I have a demo trading strategy running in the market. Trying everything to follow the market. Which is always the case for me. But then riding alongside I could have the live account determined in a way dependent on that, and not specifically the market. Like for instance, answering the question of whether I should be in the market to begin with would be determined by the results of what the demo strategy is doing.

I guess a lot has to do with what specific strategy we are talking about.

I have 3 strategies.

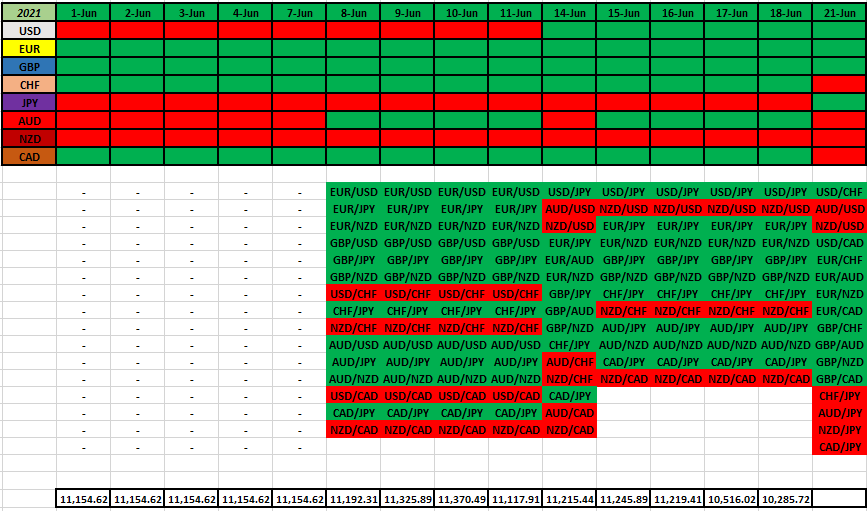

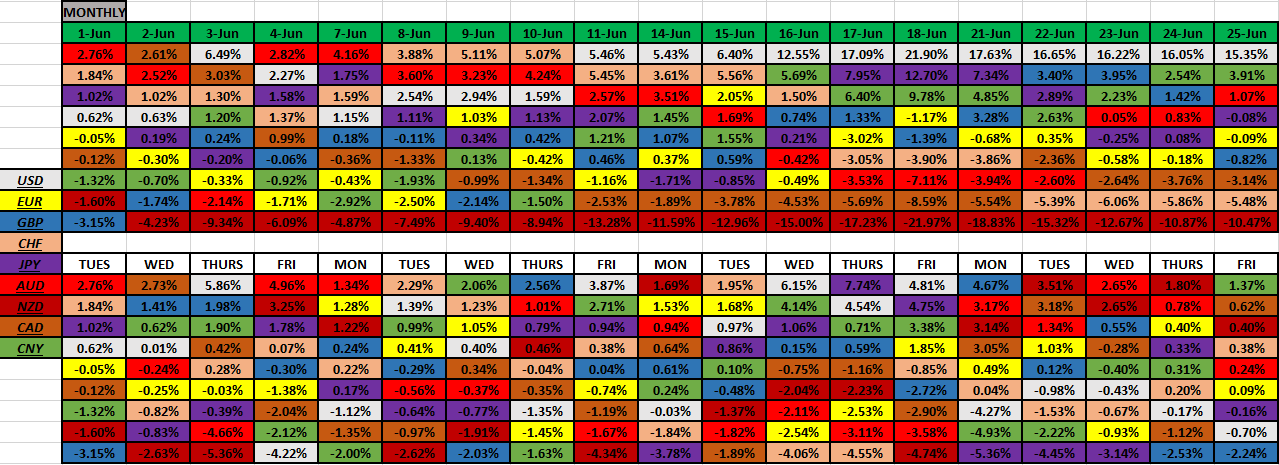

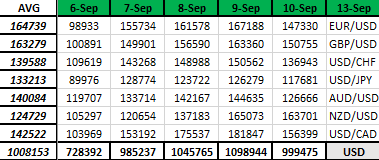

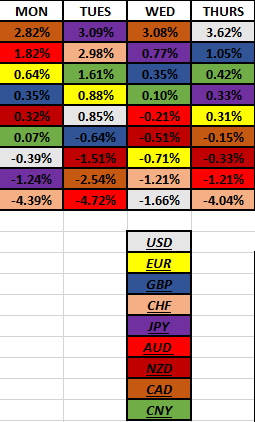

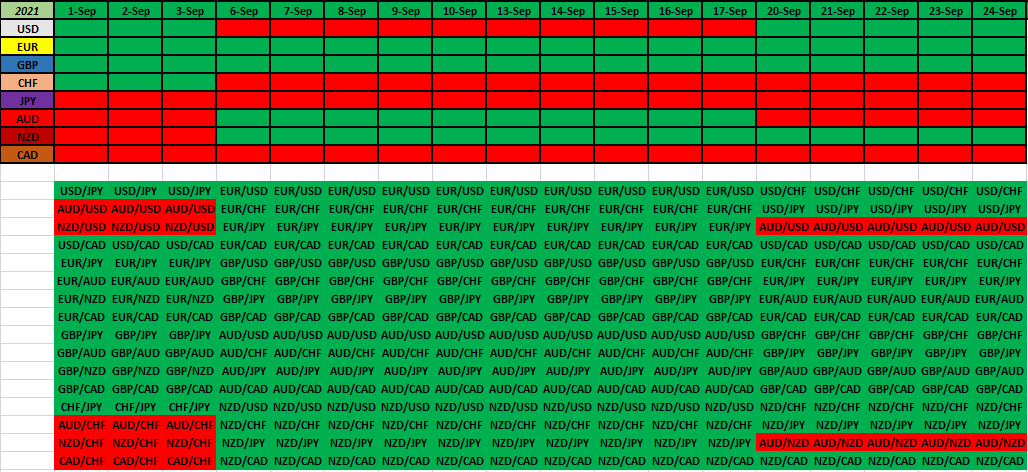

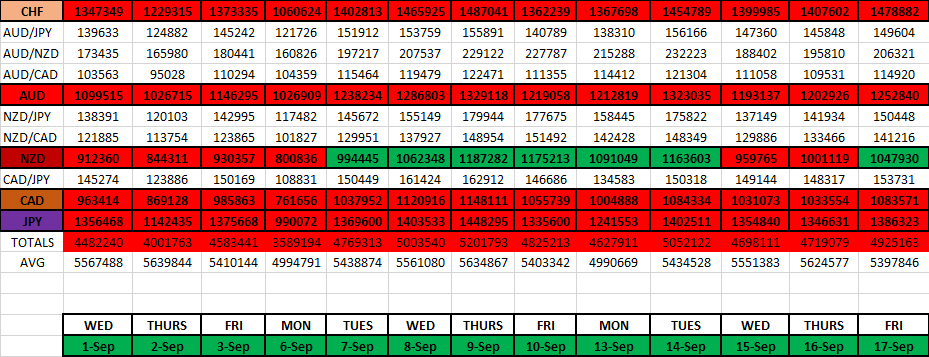

— #1 Anchor Trade = “Complete Currency Trade”. That’s a basket of 7 pairs running (all with a common denominator currency). High volatility type trading environment.

— # 2 Anchor Trade = “MWPortfolio”. It’s my basket of trades in which 15 or 16 pairs are running perpetually. Trending high against trending low pairs. Preferred method.

— # 3 Anchor Trade = “One shot.” I don’t really have a name. But it’s the trade that I use for unique opportunities only. I’ll pick one pair only. I should be sitting on the sidelines more than it being active.

I guess I should be looking at the most important questions regarding a trade, to begin with.

- When should I get in?

- When should I be in?

- When should I be out?

- When should I get out?

And in some fashion, instead of the market normally being the case, have my demo running trades answer those questions for me. For my live account trades.

I’m just wondering if I can somehow see whether the demo running trades are successful and mimic that with the live account trades. And when the demo is not going according to plan then I should be out. Or maybe just to do the opposite.

Can I avoid some pitfalls by following the demo?

Can I learn when to leverage up?

Can I learn when to leverage down?

— Both accounts would have to be the exact same strategies.

— Both accounts would have to be on different time frames.

Seems most logical.

Man, I don’t know.

Maybe the only way I will find out these answers is if I practiced it (like I do with everything else).

I guess you can’t go wrong with trial and error.

I need rules. A structure in place.

That’s my first thoughts.

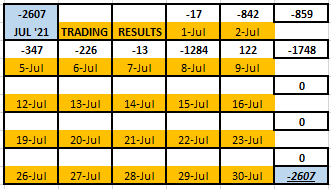

But then again, why don’t I just develop a “live account”. Set it all up in my excel sheets (like I do with the demo tracking account).

Trade that somehow alongside the demo account and see the results at every end-of-month.

Will it be too much and ineffective. Detrimental?

Or can I really mitigate a lot of risk because of it?

Journal, I think I went off the deep end.

But I have to say, it feels good to get this off my chest.

I did a lot of talking, huh.

Maybe I am a talker.

Well, if I kept this to myself, then maybe I’m not.

Let’s see if I can summarize, compartmentalize these things and maybe come up with some correct names.

What am I doing?

------ I want to know if I can utilize a demo account to enhance a live account.

------ Is trading both accounts alongside one another more profitable?

------ Is it beneficial or detrimental to follow a demo account?

------ What specific strategies would work and which wouldn’t? Why?

As I am thinking about this, it really seems like I’m wondering if there’s a way to follow a demo account. Like, that’s the bottom line.

Normally, I follow the market. How? Well, every EOD I note the prices. Track the trend. And position my trades according to the corresponding currency trends. That’s following the market. My trades are following the the trends of the market.

Is that an easy thing? No.

Am I successful in that? Not as much as I would like to be.

If the market does not follow the trend (or I should say what’s normal…Tommor’s territory) then my trades do not fair good. Negative resulting pips. And that’s not my fault. But over time I am counting on the market to end more positively than negatively. It’s banking on the principle that the end result will always turn out more trending than counter trending. Ok. That’s all about following the market.

What about following demo?

Let’s see.

My trading results in both positive and negative days. Positive days correlate with the trending days. Same goes for the opposite. But is there a way in which I can be in just the positive, trending days? Only? And not in the negative?

See. That’s what I’m talking about in following demo. Doing the positive and staying away from the negative. Mitigating the risk. Well, somehow, anyway.

Seems like I would need some kind of rules to follow. And those would be indicators of when to be in, and when to not be in. Or…when to leverage up and when to leverage down, all by the position sizing. Hmmm. Which one would be easier? Be in or out? Or go heavy or light?

Yeah man, it seems like I always come back to needing to try it out. Experience it first hand. Trial and error. Well, demo it! That’s what I do best anyway.

I’m also thinking that the principle of discretional trading has it’s place. As opposed to strictly mechanical. In this way, I’d definitely be using discretion when following what’s been happening in the demo results.

Alright Journal. I think I’ve talked enough.

I’m gonna explore this demo/live side by side trading methodology.

Looks like all I have to do is open up a “live account” tab in my excel. I simply trade the way I trade on demo. But somehow follow that when I place my “live” trades. And of course keep track of the account balance.

Hopefully at the end of each month I can make a determination of whether this is pure nonsense or something effective.

Thanks for listening Journal.

Let you know how this plays out.

Mike