Good morning Journal.

Let’s see…what’s going on.

Well, this should be fun. A little continuation from all that nonsense I wrote up last weekend. Here’s what I was thinking, and here’s what I’ve done so far.

So.

No joke.

(In my mind)

I got $300,000 handed to me.

I’m all set. The biggest hurdle in the way of my goals and dreams is taken care of. Now it’s time to set on the journey that I’ve been waiting for. It is time. This is the business that I’ve been waiting for. Waiting on. Practicing. Struggling with. Writing about. But mostly, praying for.

The time has come. And now I have the means to get this started. Surely, that should be enough to begin with. It’s the capital they talk about. Seed money. Start up capital, to be more precise. I remember that from the course I took a couple years ago. Boots to Business program. It was a veterans course for learning how to start your own business. I learned a lot of things going through all that. It’s one thing to have dreams and visions of what you want to do. But you get a little closer to it when you are actually talking to other business owners about the venture. It seems to get more real when you are in a class learning the material.

Maybe this can come true.

It all starts out with an idea.

Draw up a good business plan on it.

Get the funding approved from somewhere.

Carry out the plan. Or in another words, start the business.

Like I said, I did learn a lot. In fact, I still have my business plan on a word document somewhere. I spent so much time on that, I remember. But going through the whole process was not all that pretty. Kind of bothersome. Cause all I was doing was trying to convince someone else that I could do this. I did get a chance to talk to many different business people about it. That was sort of fun. But, in the end, it was like I was a salesman. And I had something to sell you. Yeah, me. However I could prove it to you, on a piece of paper, that I could do this and that it will work was the goal. But of course, they would have to believe you and then give you that large sum of money. With strings attached, no doubt.

Yeah, going through that whole process bothered me. It was like begging. Pleading my case. You’re at the mercy of someone (or some entity) who just has a lot of money. Deep down inside, that just doesn’t feel right. But whatever I learned, I’m sure it helped for something. It was an experience. Pathetic might be a good word for that time. You know how hard it is to get funding approved for a trading business? Very. It’s not like trying to establish a coffee shop or something. Some dreams are just impossible to make come true. But I tried.

Anyway. Sorry about that.

I just got stuck in time there for a moment.

Where was I?

Ok. Well, what am I going to do with 300k?

Trust me, my mind has gone down this particular thought process many times before. But this time I’m not playing.

I know one thing. I’m not going to put all that in one trading account. Something just don’t feel right about having that much money at risk. I just don’t like the idea of all of it exposed in the market. Man…you never know what can happen. I just have to be a little smarter than that. So this is how I’m doing it.

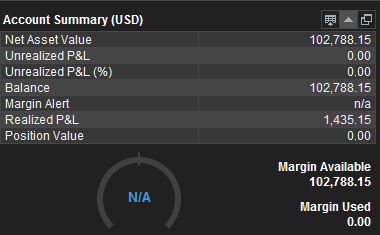

That’s the total amount of equity I have. Ok. Great. It’s down. On paper (and on an excel sheet). But I will open up one trading account with 100k. Even though it all won’t be exposed in the market at one time, I tend to think that it will, just by the fact that a broker has it all. Know what I mean?

The next most important thing I noted was that I plan on withdrawing from my total line of equity at the end of every month. How much? Well, all I need is 3k. That’s like for real, also. That’s more than plenty for me to pay all my bills. Anything more would just go into savings.

So therefore, that’s my goal. Well, I should say, that is what’s gonna happen at the end of every month. And I think that’s important because it gives me some kind of reference point regarding how much I need to generate out of the market.

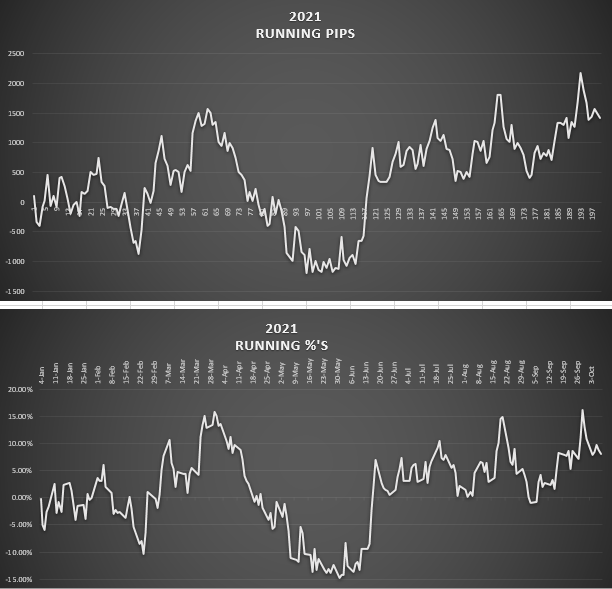

Well, 3k out of 100k is 3%. That’s all I’m shooting for. Regarding my trades. That’s it. I’ve done that before. Many, many times. Even though we’re not at the beginning of the month I think I have plenty of time to get the job done.

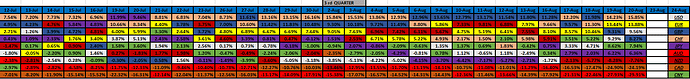

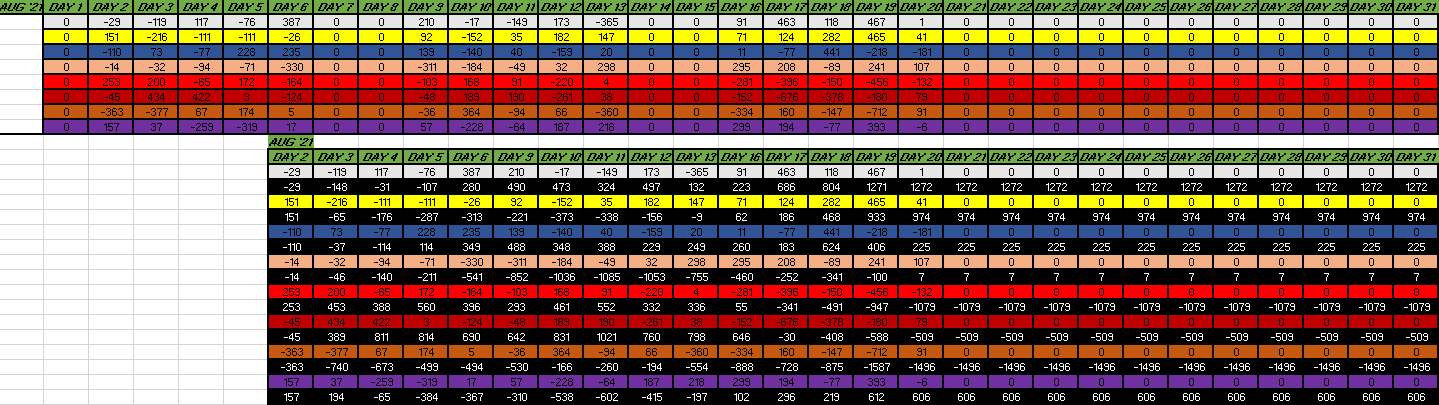

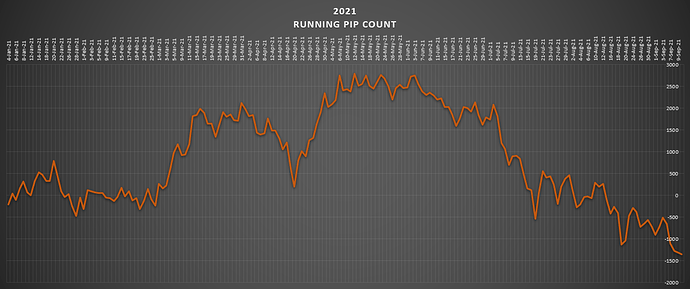

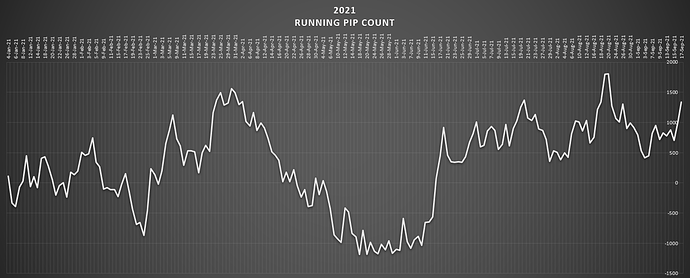

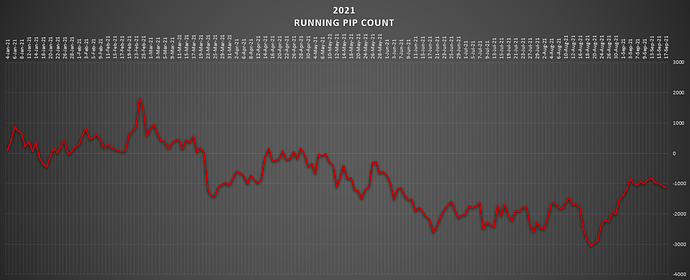

I have 3 trading strategies. Surely I’m not going to use the basket of trades that I like running in the market. But it does help me understand what’s happening when it is running. That will run, and continue to run, on my demo account.

I’m gonna have to revert back to some primitive style trading. Actually, that falls under what my trading strategy # 3 is (A.T. III). One shot. It’s where I’m like a lion. Waiting in the wings for the opportunity to present itself. Then I just pull the trigger on that one pair to trade. Quite boring. But I got to pay the bills.

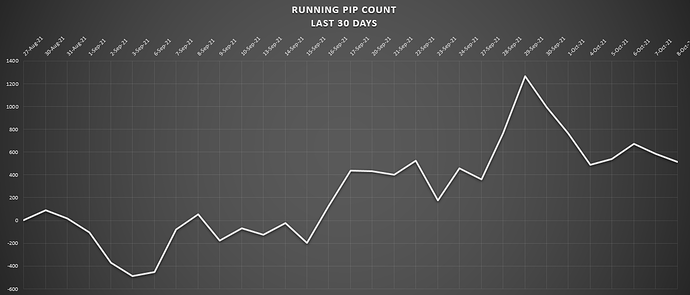

I want to show my thought process on this. Cause it went down this past week. My very first live trade. It happened. And I have results.

I break out the pencil and paper and write down what I would want to see happen in the market. It’s the scenario that I’m looking for. It would be like the lion wanting to see a gazelle walk right on by in front of you, grazing on some grass like there’s no problems in the world. To be close enough to strike, with minimal risk and a most probable chance.

These are some of my notes.

I’m waiting for some risk-off scenario. I have cause to believe that it’s around. It’s in the air. I just don’t know when it’ll strike. But when it does come around, then what?

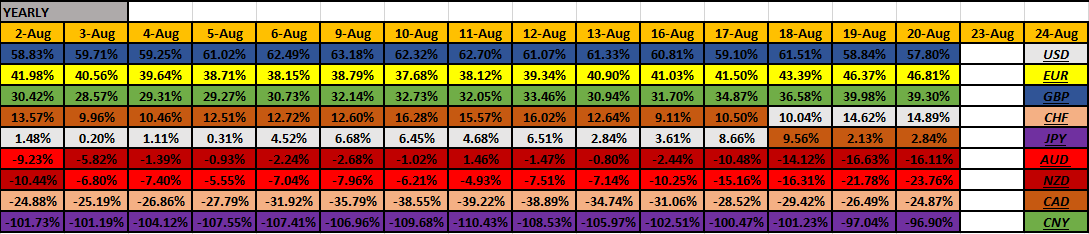

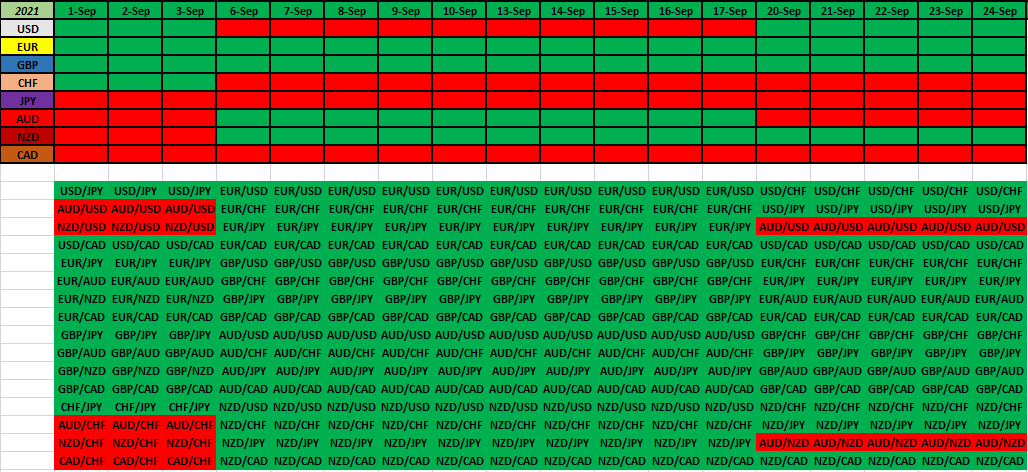

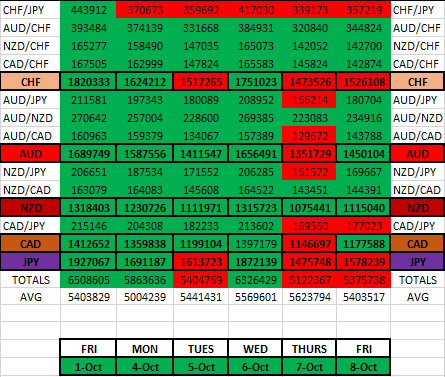

That leads me to be looking at either the JPY, CHF, USD. For strong.

But then for the weak currency I will be looking at those who are trending low. Which are: JPY, AUD, NZD, CAD.

Of course I can’t pick the JPY cause that’s one of the safe haven currencies above, regardless if they are trending low (which they are). Therefore, my field narrows down to one of the Comm currencies.

So, there are a few currency pairs to look at given all that criteria. But this is the one that jumps out to me.

CAD/JPY

For low.

On the weekly time frame, the price action looks promising. The trend is down. But the most recent price action retracement is moving higher. You know what they say…Sell the Rallies.

So. I got to wait for the opportunity to present itself on this pair.

The week unravels.

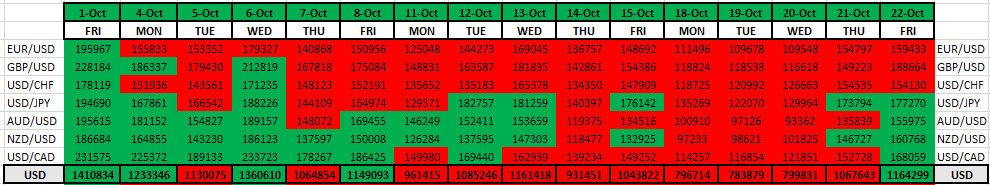

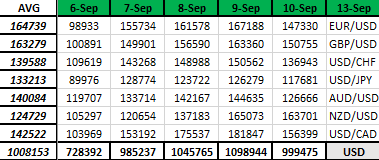

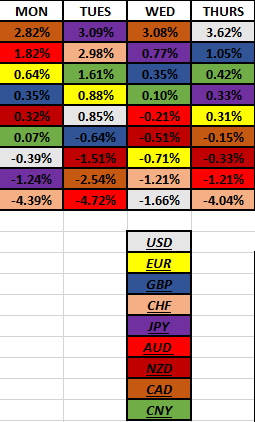

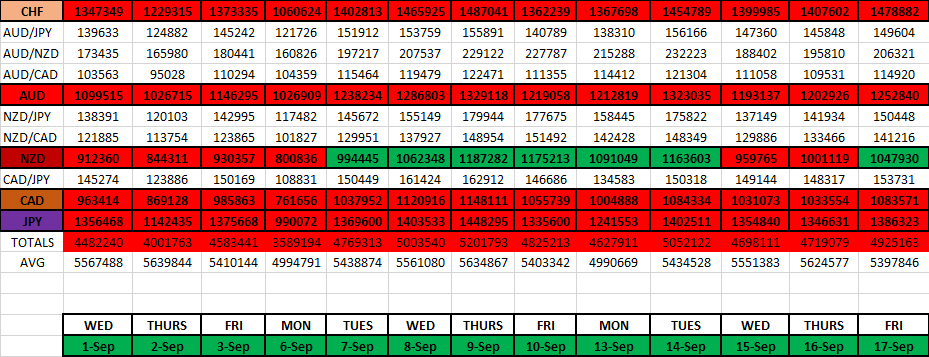

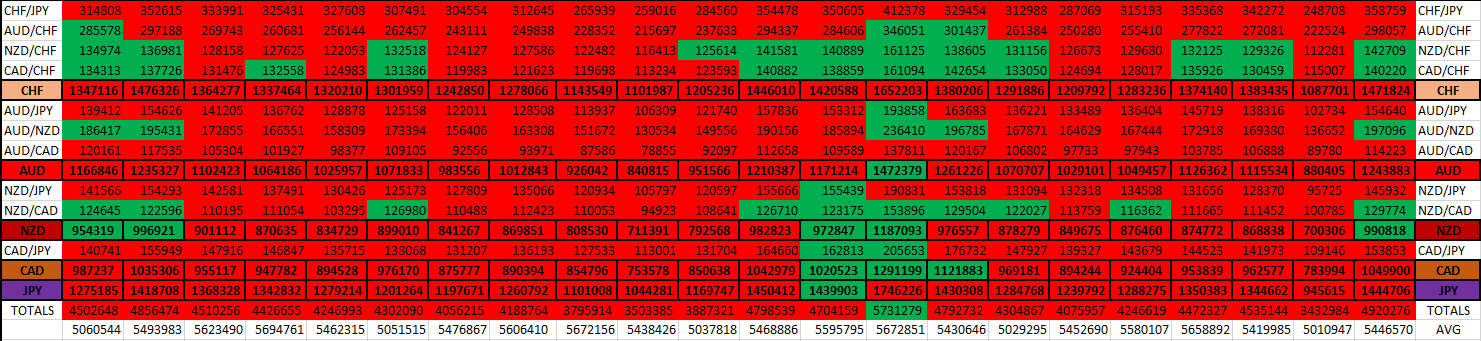

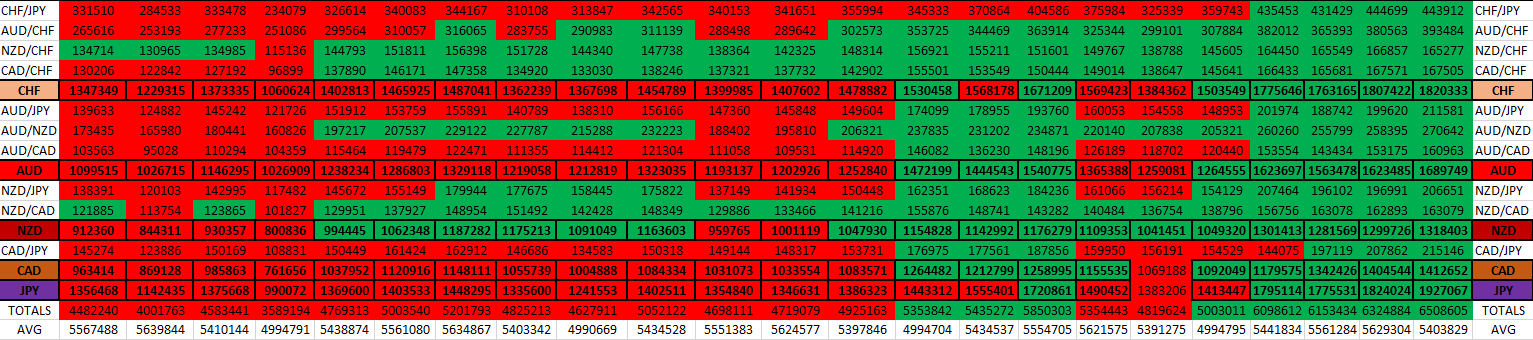

Monday comes and goes. EOD data shows nothing but the USD the strongest currency.

Can’t really tell about risk on or risk off that day. Was mixed. The day comes and goes and nothing tells me that I should do anything regarding trading. Even the EOD results.

Tuesday.

You don’t need to be a genius to see that it was a risk-on type day. Also, what do you think that CAD/JPY pair was doing that day? When you got the CAD moving the strongest and the JPY just about moving the weakest. This is a no brainer. I’m sitting out and still waiting.

Wednesday.

These are EOD results, but the point is, that during the day it was risk-on still happening. That was being carried over from the previous day.

Still. I’m not even thinking of a possible trade. To risky of an environment for me.

Thursday.

Now it’s getting interesting.

Let’s look at what the pair is up to. From the start of the week up through Thurs.

I’m not glued to the market during my days. Even though I’m on vacation still (as the kids are still off from school). I’ll check in with the broad market and currency’s from time to time. But this Thursday I started to notice a change in the air. Risk-off is coming.

Then I look at this chart, honestly for the first time this week. When I seen that very large hourly candle, I’m like, that’s a tell. Yeah, I might have been a couple hours late, but we’re not too far off away from that though. That one candle pretty much told me that I need to get into this trade. This is the opportunity I’ve been waiting for.

That triangle tell you exactly when and where I got in at. South of course.

This was 2:40 pm ET.

Ok. That’s nice. What’s the plan now?

Well, I wrote that stuff down. This is exactly what I wrote.

- Only settle for a profit

- Leave open to end of week (1 more day)

- Desire risk off to come back before the week closes

— If it does —

- Take some profit

- Ride it through till next week — If I’m in much profit

— If it doesn’t —

- Jump — Take the loss

Well, the EOD data for Thursday comes in (only like 2 hours later).

Well, to my surprise these results did show me that we had some risk-off this day. These numbers are quite low for how much a currency will travel in a day. Very low. Like 4% is normal for the strongest and for the weakest.

Ok. So. Some details of my trade.

Of course I broke out the Babypips

Position Size Calculator - BabyPips.com

Pip Value Calculator - BabyPips.com

Since I don’t play with stop losses, I guess I have to put something in. So I put in a 100 pip stop loss. Cause I wouldn’t want a trade to go much further than that much. And I use the figure 5% of how much I want to risk.

So, between those input numbers, I end up with 552,050 units of a position size.

That’ll be a $50 amount for every 1 pip movement of travel.

So that means if it moves 60 pips then that’ll equal $3,000. That’s what I’ll be looking for at the end of the month. That amount would be great to make as profit.

This just gives me some kind of idea of what to expect if I went with this unit size amount, that’s all. Surely I’m not gonna put on a stop loss. Or even a take profit. No way. I’m not going to box any trade in. Are you kidding me? I’ve learned some things over the years. That’s nonsense. That’s when you get trouble coming.

Cause the trade just won’t go the way you want it to.

All I know is that I’m going in with that amount of position size, and that’s it!

That’s all I need to know.

So. It’s placed. And let’s see what happens.

I have all month if I get into trouble.

But, as my plan is stated, I’m hoping for some profit before the week ends. Which will be very soon mind you.

This is what lunch time Friday looks like.

You better believe I’m happy. No worries here. So, I’m noticing that every hourly candle here in red is not retracing up much at all. That is telling me that there is some serious selling going on. And it doesn’t make sense for me to jump any time real soon. But surely before the day ends, oh, I’m out alright. Should be enough dough.

Then I jump a couple hours later.

See the triangle? I’m out at that point. And that is where the week ended at also. Guess what? Looks like I hit the bottom of that one. Now that’s lucky.

I probably need to remember about this, cause the way this was moving, there just might be much more to come next week. I got to remember to keep my eye on this pair. Though, I do not like watching individual pairs. nod,nod,nod

Well, how much did this produce?

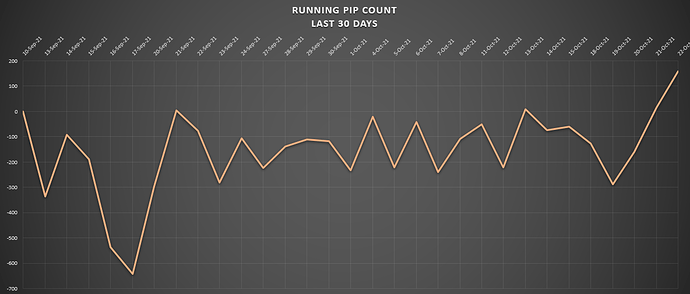

Oh yeah. That’s close enough for me. You know how much I will be deducting from my account at the end of the month. But all I know is, that I am about there already!

No pressure.

I’m gonna take a nap.

Hopefully some gazelles will come on by before the month ends. But if they don’t want to, I’m not gonna sweat it. A couple dollars out of my 300k is not gonna hurt me.

But I got to tell ya.

I feel that I get great opportunities when I wait patiently as the week rolls out. I’m seeing what’s going on. And when things want to turn a certain way, well, it does seem to end up going that way. This is deja vue. I know I posted a very similar set up and situation some time ago. Like a couple months ago or something like that.

Man…I should probably make a complete strategy out of this.

Honestly.

In fact, I don’t think I ever had a losing scenario this way yet.

I just works.

Anyway. I wanted to tell the story.

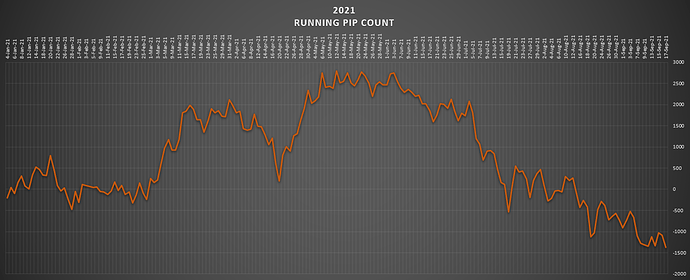

And my live account trading is off to a wonderful start!

I guess this is the way I have to play this primitive trading style.

It’s not me. But, if I have to make the profits, well then, so be it. I’ll bite.

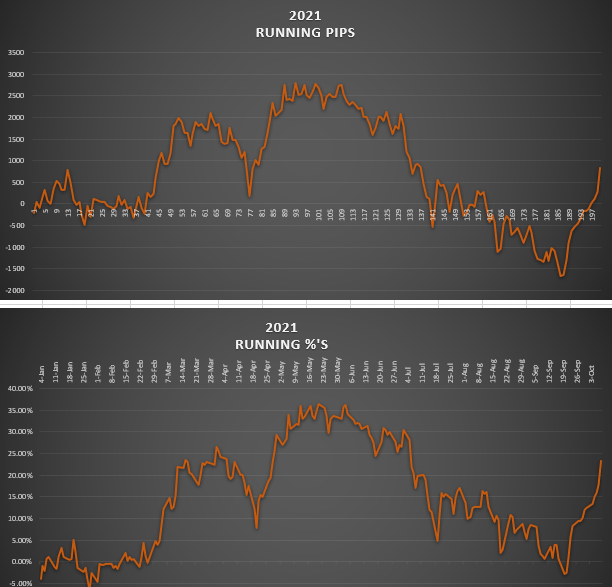

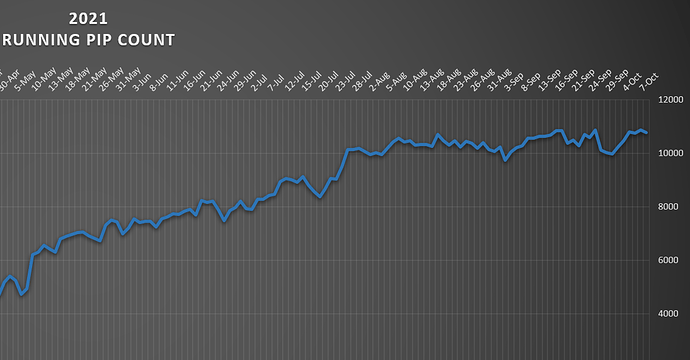

I’ll just keep my other demo accounts running and monitoring.

Alright Journal, thanks for listening.

Mike

]

]