Good Morning Journal!

ssssippppp…ahhhhhh

Nice to see you again, Journal! Ok. So. What’s on the docket for today?

Well, we have to check on my trades, like what happened this past week. Find out what the market sentiment is. And uh…I don’t know. How about…Well…looks like we’re just gonna have to find out.

So, let’s talk some market.

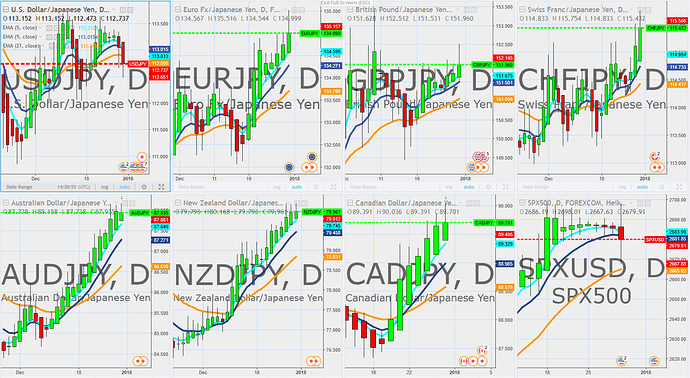

Ok Mike. Yeah, you have to explain what happened to the JPY this week. I heard that it wasn’t good.

You go that right Journal. Hey…I don’t know. But, I did my adjustments like I should. So, that’s all I can do. Let’s take a look.

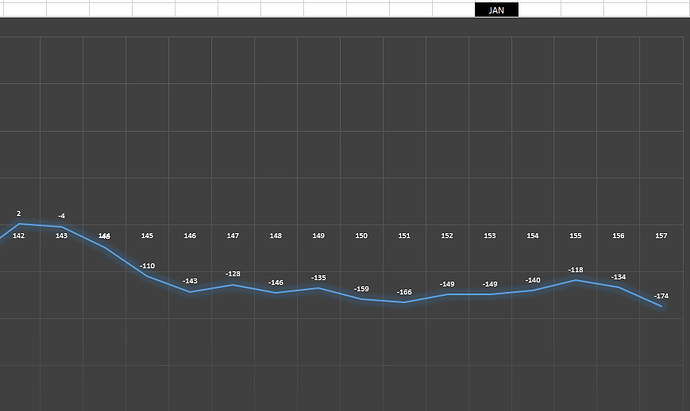

Sorry, can’t really see the last couple numbers, so I threw in the totals bar at the top. And yep, don’t need to be a genius to see those last 5 days. All down days. And let’s not forget, this is the aggregate number. 5/9 total pip spread. Man…what a difference than last week. I know I was telling you that I thought this was gonna be the start of something pretty big. Well, if it is, not yet anyway. Maybe it’s just getting geared up. We’ll see. I actually doesn’t matter, because all I’m doing here is following the market. That is, follow the plan, which essentially is set up to follow the market.

Good job Mike.

Thanks man.

Welp…this is what I had to do this week. I cut them loose. Yeah, at the start of last week, I was in with everyone, except the NZD. And by the end of the week, I’m only in with the USD, and the CAD. So, in regards to following the plan, I think I did good. Let’s roll the tape and find out.

The EUR/JPY trade.

Well, everything’s there for ya. I lost 141 pips. But my system shows an 18 pip gain.

shrug What can I do? That’s the closest I can get. I got in 59 pips too late. I got out exactly 100 pips too late. But…at the end of the day, I was spot on. You can see up there that my trades were placed within the same days as when the crossovers took place. And that’s all I can do. And in hindsight, good thing! Yeah, this is exactly what they always say, ‘cutting your losers short’. Cause look, price just kept taking off. I jumped out at end of day Monday. No more hoping going on here, anymore. So…in hindsight, so far…look. Up there. All we had is a pretty good dip occur. It happened to go into the trending arena for the Yen. It (my system) went down to grab some pips, let’s see…it started 2 Mondays ago (look at the 5/9 counter on top). And it went pretty deep for only 4 days, then did a U turn. Never looked back. It’s evident by looking at the (red) price on the bottom row. Price (let me remind you, again, that this is all average pricing) shot down below all the ema lines. Even the 21, technically trending, line. So…what can I do…But, I have a feeling that this might be a precursor to some more trending. But, it doesn’t matter. All I’m doing is following the plan. Whenever it turns out to be a formidable, longer lasting Yen trend, look out. I’ll be in it.

Anyway, this was a carbon copy of the other pairs. I’m not ashamed. Let’s look.

GBP/JPY trade. Bottom line, I lost 73 pips. The system made 20. shrug Better…but sucks.

CHF/JPY trade.

Same old story.

AUD/JPY trade.

Well, how about that entry, huh? I happened to get in

exactly at the same price the crossover took place. And that was 2 days earlier! …Yeah, that’s nice. What a short trend though.

Now. these next 2 are different. First, the USD.

So, on 1/10, I got in the first time. That happens to be at the same day that the crossover took place. Nice. Then last Friday I took another position. And then, this past Friday, it was towards the close that I wanted to get in with another position, and did. I will chalk that up as beginning on Monday. But anyway, this trend has some legs to it. So let’s see. Let’s compare the pip count, mine to the systems’. Well, since I keep the running total of the system there already, that number is 186. (Don’t forget, that the system counts from the crossover to the latest 5ema line) So the ending figure is 110.984. My first trade has how many pips? 112.748 minus 110.984 equals 176 pips. My second trade is 111.025 minus 110.984 equals 4 pips. So, that would be 180 total pips. (I’m not going to count the 3rd position yet, cause that just started) Ok, so. I’m close. 180 pips compared to 186 pips. I’m happy with that. Pretty dog-gone close. So, I guess I’m going to have to learn how to juggle these open positions. And to be honest with you, this will be a first. I better be on my toes about it. As I think about this now, looks like I’m going to have to watch what the system is producing, cause that’s what my whole entire goal is about. Matching that number. So, if I see that number start to decline, then I got to do some cutting.

So, we’ll see what happens. That’s just what I need to remember, moving forward.

And lastly, the CAD trade.

I don’t know why I kept this for last. But, let’s see what’s happening. Well, my entry, pretty awesome. Within 2 pips. Then last Friday, like with the USD, I took another position. Ok, so, no harm. But, you have to admit, that something is interesting going on here. I think it was like Wednesday, or Thursday, that the CAD central bank raised interest rates. Normally, that spells trouble. Price shoots way high. And we did see that, on Thursday end of day. I was a little nervous about it. But couldn’t help notice that the trend leading up to it just didn’t change much at all. So, that’s what kept me in the game. I follow the trend, nothing else. So, ok. Well, how many pips do I have running now? Let’s see. 59 pips for me. The system has 76 pips. I don’t know, not all that bad. Kind of close. But, I remember being in my car, as soon as I got done with work, on Friday end of day, before I drove off to home. It was close to 5pm. The market will close up very soon. So, at that time, I chose to go in with another USD, but not with the CAD. And I can’t fully remember why, but, it just didn’t look right. (of course this was before I ran these end of day numbers) I don’t know, maybe if I would have seen these, I might of went in again. It’s not all that big of a deal anyway. I do remember seeing that with the USD, I think price broke down below a support level, there at the end. Ok, so, let’s see what the charts look like on these 2.

Ok. So. We have the USD/JPY. The left chart is the Heikin Ashi chart. The right on is the normal one. Well, I don’t know exactly what support level I was looking at. Maybe the one back at the end of Nov. I don’t know, we’ll see. But, in any case, the trend is on. This is going good so far.

The CAD/JPY.

Uh oh. Now this is interesting. Look at the difference in the ending prices. The one on the right is the normal candlesticks. The left is my average prices. Well…I don’t know. Sometimes I think it is better to watch the average price. The left one is sitting right on the support level. For the most part. The right one…I don’t know…seems like thats kind of fooling to me, when I think about it. Yeah…you know…the more and more I ponder these 2 differences in charts, the more I come to conclude that I prefer average prices better. You just caught me with my first initial reaction to what the actual price showed. It is kind of concerning, seeing that large down candle. But, again, price is everywhere. No one knows where it’s going to go. And with that, I’ll just leave it with that.

Mike…go grab some more. I’m here with ya.

Good. We got some more time yet.

Ok. So. I’m done talking market. What happens, happens. I follow my plan, and that’s all I’m concerned about. So, I guess I should pick up where I left off. Yesterday, I did do a lot of searching on the ‘carry trade’. Well, I guess I should show you the mind map of it. I’m not all that impressed with it. Not a whole lot on it.

Well, let’s see. To be honest about it, I’m starting to lose interest (ha! that’s funny!) on the subject.

This is what I know, Journal. Every day at 5pm EST, if your in a trade, someone’s going to be paying interest. And that’s because of the overnight interest rates that the banks always has to deal with. Someone’s going to buck up. It’s kind of like that’s just how it is, when you own a security. Given that fact, regarding the pairs we hold over a day, one of them is going to be higher than the other. Meaning, the difference has got to be paid. So, if I am long the one that has the higher amount of interest that needs to be paid, then I will get that difference of interest. If I am short the one currency that has the higher amount of interest, then I will have to pay the difference, of that amount of interest. And, I’m not sure if it’s compounded at a daily rate, or what. Maybe each broker plays it differently. I guess it could be either not compounded, that would be just the yearly rate. Or compounded at a monthly rate, or daily. I kind of think it’s a daily thing. Anyway, compounding at a daily rate is better than anything higher. So anyway, I’ll make the fine points that I’ve come up with on the subject.

— Long term trading benefits this method more. That only makes sense. The longer, more money accrued.

— The movement of price between the 2 currencies, is the biggest factor. The interest is just the little bit of gravy that’s left over and the end, whether is helps matters or not.

— The carry trade usually signifies a Comm against the Yen. Comm long.

— I think it’s enlightening to know that this could be a very good reason why big money would want to trend high against the JPY. For the trend to go that way for a much longer time period. When your dealing with millions of dollars.

— I didn’t realize that the CHF was that low. In fact, lower than the JPY. Interesting relationship between those 2.

Ok, so that’s all nice and good. But, how does that affect the way I trade? I guess I realize more about the horse I am riding. There’s a good reason to go long against it, that’s for sure.

Well Journal, I guess this is a good segway into what I’ve been wanting to talk about.

When I step back and look what I’m doing. How I’m trading. We are talking about baby steps. See, I get into the market one, and only one, way. It’s only with the Yen. Not only that, it’s long the Yen, only. Yes, it is simple. (Just like me). And not only that, it’s also simple that what gets me in is the crossover, and then the opposite crossover. It’s all a no-brainer. And I know that what I’m supposed to be doing here is practicing that technique. This year is the year for it. And I am doing just that. Have been, for some time now.

But.

I can’t help think, that this pace, might be a little bit on the slow side of things. I mean, look, I have solidified some real foundational principles, techniques to follow. I’ve been wondering about the need to branch out. Expand a little. You know, broaden my horizons. Look Journal…honestly…this has been on my mind for quite some time now. How many times have I mentioned to you that there is much on my mind. And I never get around to talking about it. And then I go ahead a read a good book that ends up making me want to go further and further. I don’t want to sit here, day after day, waiting to see whether I this system is going to work well enough, or not. I’m wanting to take some bigger steps now. The only thing that checks me is, the 'ol, “don’t go to fast, mentality” or “you’re getting to impatient, young man.” You know what I’m talking about Journal? There has to be a balance. Where does the balance lie, where I can give it my all, with all the fervency I can give, at the same time that I’m not moving too fast?

I know, it’s a rhetorical question.

Let me show you what I worked on this past week.

I know, kind of stupid right? But, let me explain.

My purpose was to boil down, in the most simplest of terms, my strategy. The top row is every currency. And I pick the JPY. It’s green. That means any combination that I pick will be one of these, JPY strong, & every other one short (red). Then under that, is what makes me get in a trade. (That’s not correlated to the GBP,CHF,CAD. Supposed to be a separate entity) Now, where was I supposed to go from here? Well, it should be able to give me the next most logical steps in order to branch out. Like any other possibilities. The question should be…what would be the next biggest step that I can take? I had some ideas. Like, how about this. Maybe it would be, to stick with the JPY. And if they are not trending high, then take them trending low. Let me change this view, now.

Ok. How about this.

Would this be the next baby step? Staying with the JPY. If they trend the other way, then I would be taking advantage of that trend, which would be Yen weak. This could work if the Yen stays one way or the other most of the time. It wouldn’t work well if it’s a constant changing of the trends. Cause I would lose with the natural slippage that comes with the territory. So…that was the first thing that came to mind.

Another possibility would be to pick another horse to ride. Well, it can’t be any other way, cause there isn’t anything more than either up or down with them. Well…yes there is. How about this. Since I keep track of every one of them, whoever ends up trending high, that could be the one I go in with. But…as I see on my tables, that changes way too much. On the daily time frame anyway, believe it or not. That would be too much slippage, again. So, back to the possible changing of the currency. See, I’ve always known that the JPY was an outlier. They do make the most sense. Now, because of that interest rate table shown above, the CHF looks to be the only other probable possibility. We all know that these 2 are the safe haven currencies. Isn’t it funny that both of them have such small rollover interest rates? So, it’s like, their both attractive, yet, not attractive. Go figure.

Well, as I think about it now, the only other major thing that I can think of is the old Major vs. Comm dilemma. It’s the risk-off vs. risk-on scenario. I’ve been down that road before. And it can get a little bit tangled. So, I’m not going to consider that now.

So, as I’ve written up there. Seems to me like it would be between sticking with the JPY, completely. Or switching over to the CHF. Ok, maybe just adding them, long only. Along with the JPY long. I don’t know yet.

If I go with the JPY, in total, then that means I would be in the market at all times. That kind of scares me. Maybe too risky. If I only just add the CHF long, then I’m only adding one more component. Let me view it like this. Give me a second.

Ok.

Hmm. That don’t look too bad.

You know, I did think about this. If I were to go in with the Yen, full time, I could demo it only. In fact, you might remember, Journal, that I did mention this a while back. I was supposed to do that very thing. But, I found that it was quite difficult to do, for some reason. Therefore, I stopped doing it. It was like I forgot about the demo thing, and just paid more attention to the live market action trades. It is tough to demo it, when you really believe in the system. You just want the live action.

Ok Journal. Looks like I got to run.

I don’t know what I’m going to do yet. For sure, today, I will contemplate this. But what seems like the answer is, back testing. I should want to know what history has shown. Does the JPY trend more than it ranges? Does the CHF trend more than it ranges? Somehow I think I need to find these answers.

But, whatever I come up with, you will surely know. Cause, I need accountability. It all happens right in here, Journal.

Mike out.