Hi tokyotrader. I have not heard of this CBL count back line method, but I’m trying to find out more about it. I see there is a thread here on BP from tymen where it is referenced so I will dig around and see if I can figure out what that means.

Personally, I don’t think ENTRIES are the issue, it’s more the exits… more specifically, when to take a loss. I have real problems abandoning a trading idea and calling it a loss. My mind would rather support the original conviction and keep scaling, it does that naturally I think.

Meanwhile, I’m still here. I traded only a half-session on Monday and it was really bumming me out. On Tuesday for the first time I didn’t even feel like waking up to trade. That’s not good, it means I’m losing momentum. I don’t want that…

I start getting depressed if I am not continually fueling a “light at the end of the tunnel” proposition. In other words, if I can’t see that I’m going anywhere, then I will lose interest.

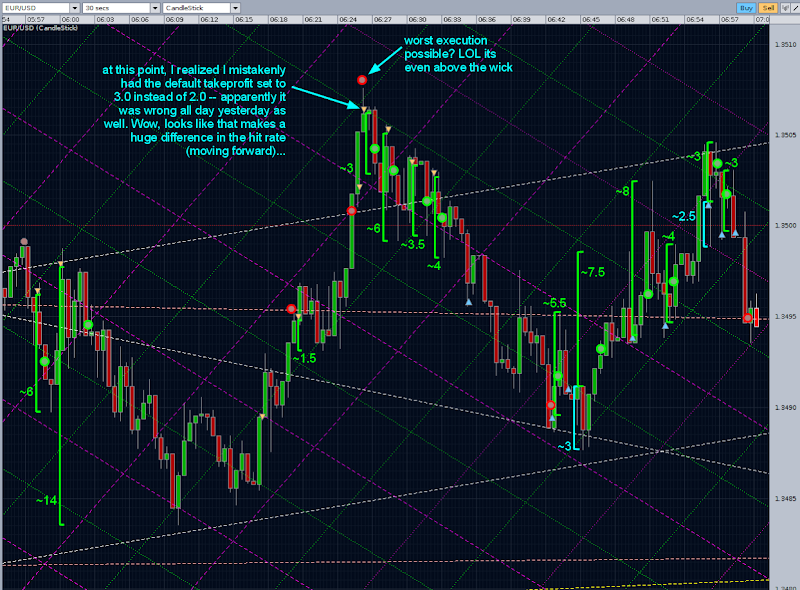

I crunched and crunched numbers all day Friday, trying to make heads or tails of the trade stat info gathered from last week. At best, it seems that trading without scaling can be about 50/50. After all those trades, the best I could hope to do is breakeven. So that doesn’t really help me at all I think.

One thing that WOULD help is if I could find a way to detect when scaling is not appropriate, having a non-arbitrary way to take a loss. This is a big problem for me, I must find a way to determine this. There must be some characteristic of a trade gone awry that shows up in the price action pattern. If I could spot this, I could train myself to take action and cut the loss. One problem I see is that the likelihood of this behavior is very infrequent, meaning I don’t have very many opportunities to play with it. It’s less like playing with fire and more like playing with dynamite.

So taking a step back is helpful to me in times like this. I do have other projects to work on, and perhaps during this time my mind will percolate a little richer on this thorny issue. One other project is my mind movie, which I’m excited to get completed. Another is continued reading – I have a growing reading list but very limited time to devote.

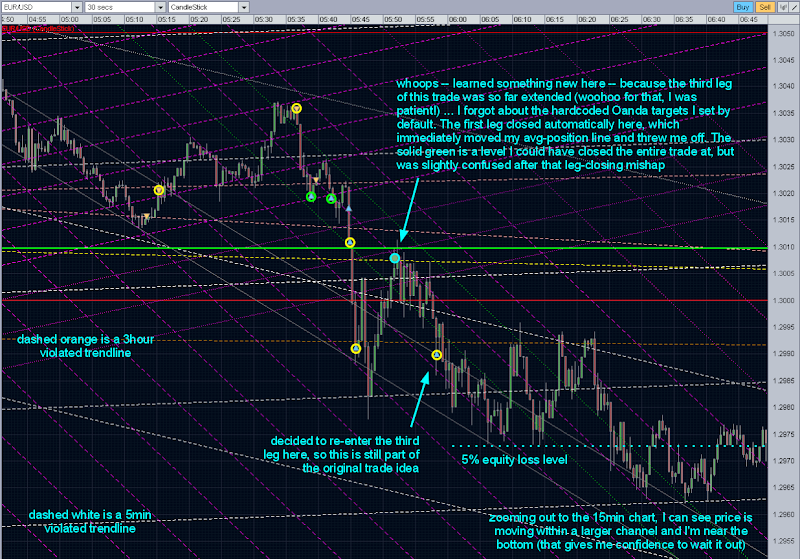

One brainstorm I had, not really developed yet, is this: what if I were to more clearly define levels for scaling. These could be defined not in hard pips per se, but based on the discretionary trendlines I draw each day. This means they could change with each unfolding market. If I set a trading rule that says (for example)… only scale at the predefined levels, and only scale max 2 times… then on the 3rd level I must cut the trade as a loss. Doing it like this creates a definite loss point which makes it easier for me to then work backwards and calculate a risk leverage. I would like if the stop level were moderately tight, because this would enable me to take a higher units on the trades themselves.

One thing that might be helpful to know is how frequently price would move strongly, and how many levels it would cover. I could probably gather some of this from the history chartshots. For example, if it’s very unlikely that price moves 3 or more levels in a single thrust, then that supports the idea that I could scale up to this level (and that beyond that level might be a lost cause).