Why is FX trading so hard?? The freaking Price only goes up or down… plus we have all these fancy technical tools… thousands of oscillators, MA, Fibos, Bollinger Bands, waves, S/R, japanese candlesticks, etc.

Then you look back in the chart and start to see that price respected those tools when you did NOT enter the trade or that price couldn’t care less about the same tools when you took the trade.

So we know those tools work perfect!! But only when you are NOT in the market!!!

Then… by elimination the only culprit of your failure is YOU… but you fail NOT because you are lazy, stupid, uneducated or because you do not study those hundreds of books about trading…

I tell you why you fail…

because you are [B]HUMAN[/B]

Yes… I just show you the holy grail

If you are a Human then the odds are that you think like the majority of Humans (let’s say like the 95% that losses in FX  )

)

Believe it or not… Human behavior is VERY predictible… and if you are a FX trader, being predictable is VERY bad, cause Banks are the masters at mind reading!!

But banks do not target just you… (although some times looks like that) … Banks target the liquidity of those 95% of the herd…

Remember that the theory says Markets DISCOUNT everything… and in FX being the most frontrun market in the world this can’t be more true…

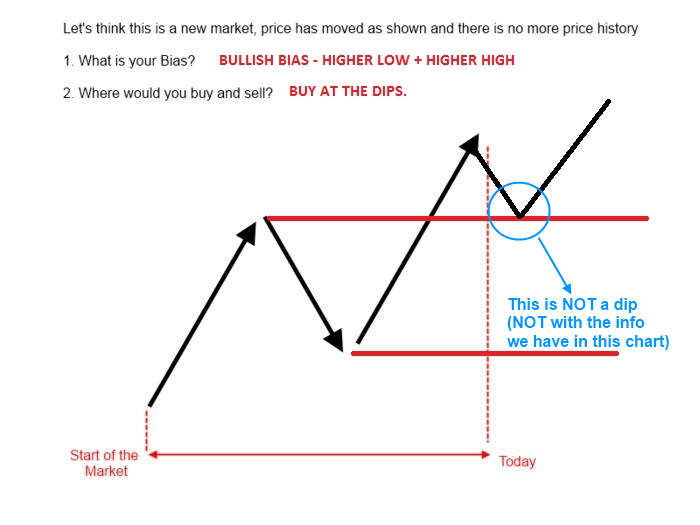

So before you place a trade you have to get rid of that human behavior thing (even if you are a discretional trader) and SYNC your bias with the [B]bias of the market[/B] (real meaning: the bias of the Banks)

After all this philosophical BS I just wrote  I have a test to see if you are part of that [B]herd[/B]…

I have a test to see if you are part of that [B]herd[/B]…

This test actually I found it reading a post in a forum (do not remember if was here or at FF)… the poster said he had a mentor that asked him to play hundreds/thousands of times the game “Rock-paper-scissors” online…

In that game there are not any possible edge to be a consistant winner… just than you understand your “HUMAN” opponent

That is right… the edge is to exploit the human nature of your opponent… then you can be a step ahead…

But before show you the game I want you to see this video ([B]please do not skip it[/B]):

OK, Here is the game: Rock-Paper-Scissors: You vs. the Computer - NYTimes.com

Choose to play against [B]Veteran[/B]… Play at least 30 rounds… I bet it will remind you your last trades

thanks for posting the game too, a little satisfaction that I can overplay a machine, haha. gave back a part from my self-confidence

thanks for posting the game too, a little satisfaction that I can overplay a machine, haha. gave back a part from my self-confidence