If you ask me it just emphasizes the importance of using a stop loss in your trading. Devine intervention does NOT come along that often to save us !!

And just for the record to all newbies on this forum. None of us on here including nut not limited to HOG, ST, RC, or myself claim or have ever claimed to be god. Nether did (to my understanding) we tell him to leave the forum.

Oh I dunno bob, Mrs HoG has said I’m capable of odd miracle now and again.

A story for another time perhaps !!

Bob - you’ve just bust a bubble - there was me thinking that you had something special in mind for the aussie, and me going long term short, and now you go and tell us you are not who we thought you were - have to cover quick …

Well you know if I am trying to drag the Aussie straight to hell that would not make me god :16:

And hog that would be a story for another day.

Hi HoG,

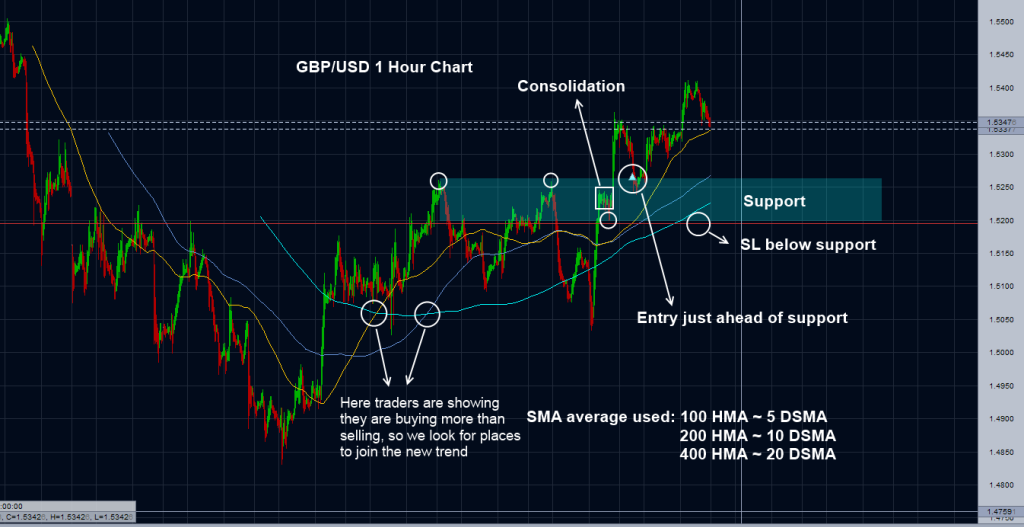

I have always liked MA as an aid to make some trading decisions. As you said some types of MA have some advantages and disadvantages… that being said, my favorites MA are SMA. They show the true average of the period.

Usually I use SMA to help set my bias, remember trading is at the end of the day played by humans and we humans like to count time in days, weeks, months, years. That is why the most use SMA are:

5 DSMA = 1 trading week

10 DSMA = 2 trading weeks

20/21 DSMA = 1 trading month

50 DSMA ~ 3 trading months

100 DSMA ~ 6 trading months

200 DSMA ~ 1 trading year

Here is an example in how I use SMA…

The idea is to trade only with the direction of the true average of the selling/buying done by traders in the last 5, 10, 20 previous trading days… this way I can stack the odds in my favor

PS hope the image is not too confusing

Hi guys… firstly I’d just like to go over the various candles I briefly talked about one at a time. I’m very aware that simply throwing up a bunch of charts with whats obvious to me will likely cause confusion. The only difference between a newbie and an experienced trader is screentime. Also these are the candles, indi’s and time frames I use nothing more nothing less. Its not the ‘Holy Grail’ nor am I a ‘Guru’. So please guys… if you feel like giving my system a spin around the block, do so in demo only. Having spent many tens of thousands hours experimenting… this is what I use, if it helps or you can take something away from it and make it your own great.

I’m a technical trader. I don’t pay attention to analysis prefering instead to look to the charts. Price action will tell me what the market [B]is[/B] doing. Getting that part right is hard enough without trying to second guess ‘sentiment’. From experience, I will not look to charts below the two hour chart. I only use 2h, 4h, daily and weekly. I do not trade any particular session, prefering instead to take the market as a whole.

I will assume that all are up to speed on support and resistance points/ areas as I do put these onto my charts, particularly the higher TF’s.

Ok… Heikin-Ashi (HA) candles. Those who do not know what they are should do some background reading… a good place to start would be Investopedia. I have the luxury of monitor space, so will always have up a HA chart alongside a ‘normal’ candle chart for each TF chart for comparison. In the four posted charts… you can see GU h2, h4, daily and weekly to date. It should be fairly obvious looking at these charts what price action is doing. On the 2h and 4h, price is falling. On the daily and weekly, price is rising. I have added a white 2 Regression line on the HA open to help clarify the picture.

Often newbies get confused and ask why when looking to various TF charts do they see PA say falling on one time frame and rising on another? Hopefully these charts explain that. Price will ‘trend’ if thats the right word on varying TF’s. If I have decided to take a longer weekly trade for instance based on HA, then I can actively manage that trade on shorter retraces of price by looking to what HA price is doing on the shorter term TF’s. If I get this part right, I can add 50% more pips to the weekly trade bias rather than simply absorb the natural retraces as part of one single unmanaged weekly trade. Being out of the weekly trade when price is in a retrace is every bit as effective as being in a trade… if you see what I mean.

In this post I’ve shown HA as the basis and bias when selecting a direction to take a trade. Next I’ll look at the few other 'indi’s I use.

Apologies for not giving much input considering the stack of info which has just been added by Nikita, Yunny and RC, but the is the last night of the Masters guys.

I have a pile of questions and comments for all 3 of you, but tonight comes second only to the Ryder Cup in the HoG calendar of sporting events, so I hope you will all understand if I reserve them all for tomorrow night, when I’ll be back focused on trading rather than Tigers (or Cheetah as he should be known after the ballsed up drop situation !!)

As we can see on the GU 2h & 4h… price is currently testing an area of possible support. Having formally been an area of resistance. I will be looking to the 2h & 4h HA candles to battle it out before deciding whether I’m going to go back in long. My bias is still long on the Daily and weekly. The Daily has retraced to the 2 Regression HA open line. If the trend is still intact price should not drop significantly below. But more on interpreting HA later.

What if the only lie you were wise enough to catch, was in fact the only truth that was told? Ha ha ha

I know this may seem petty in amongst all the information you’ve given RC, but what exactly is a Regression line?

The Happy Happy Village may well suggest that hou either ARE the CarPainter, or you’re both on the same ward, but I’ll play along for now.

The lie wasn’t that the trade didn’t happen, the lie was that he said he took it when he didn’t.

A Regression line is the fastest line I can draw on a chart to link up the ‘open’ in this case, of the HA candles. The fastest ‘moving average’ on most platforms. On my platform the 2 Regression defaults to the actual open. The classical definition is… a line that best fits the prices between a starting price point and an ending point.

Here’s a pic with an HA open and close regression line.

I’ll make a start at replying to the previous posts now.

Nikita Point 1

When I first started looking at trading, I used to read a lot of things advising on the importance of Trading psychology, and to be honest, it was a subject that I dismissed almost at once. “What nonsense.” I thought. I’d read these things about the importance of deciding what kind of trader you’ll be, long or short term etc. Funnily enough, I still think that’s not very important.

For me, you don’t need to make a conscious decision about that because it’s almost the same as why you never need to tell yourself that you love your kids, because you don’t need to, it’s pretty much instinctive, you just know it deep inside.

But the trading psychology, as you have correctly pointed out Nikita, is vitally important. However, I have a slightly different view of it than yours.

Sure we’re all here for the money, that’s undeniable, but what we want the money for can have a variety of effects on our trading decisions also. Our level of NEED, in many circumstances dictates the level of risk we take.

Some people may be in the situation were they simply would LIKE more money, more money to enjoy the better things in life. Maybe that’s a flash car, a big house, the holidays, 19 year old Hungarian model with size 38D…sorry, lost on a tangent there, but you get the overall picture anyway. And because this is no more than a “wish”, people may be happy enough just to plod along in no great rush with their trading.

Some people however, may NEED the money, and that’s a different animal all together. Even within it, there are different levels of NEED, and this is where I think the whole subject of Trading Psychology really kicks in.

Traders, IMHO, don’t need to decide what kind of traders they will be, but why they want to be traders and what it is that REALLY affects their trading decisions in the first place.

Take me for instance, I hate my job. Nothing new in that I hear you say, most people hate their job, most people hate working for “the man”. But in my case, I AM the man, I’m already self employed, so it’s not that I hate. I hate my job because of what it takes from me.

I have 2 daughters and I became a taxi driver when the oldest girl was just 6 years old. When I was working at my previous job, we earned less money but my weekends were mine, so as a family we were able to do lots of things together AS a family. Then I became a self employed cabbie, had to start working the weekends, (cos that’s were the money is in this job) earned more money, but lost the “family” time.

When my youngest came along and started doing her different hobbies, I couldn’t get involved because I had to, and still do, have to work the weekends. So I “discovered” currency trading as hopefully a way to get my family life back. There’s a need, a burning desire to make trading work so I can get out of this job and get that family time back. But as I’ve mentioned a couple of times recently, that very haste to get there, may well be the very thing that is STOPPING me from getting there.

Losing trades don’t hurt me emotionally from a “Oh Sh*t, I’ve lost some money.” point of view. They hurt me because every losing trade puts the “final destination” that little bit further from reach. But it’s the haste, the desire, the need to get that new life, that more than likely is the ROOT CAUSE of why I take trades that I really shouldn’t.

Trading, to me, really IS, or at least should be, a lot more like a golf tournament than people think. You don’t win a 72 hole golf tournament when your standing on the tee of hole 1. Focussing on the “Big Picture”, again IMHO, in golf or in trading, can actually do you more harm than good.

Winning a golf tournament is merely a by-product of playing 72 consecutive good holes. Winning in trading is merely a by-product of making a succession of good decisions. Make those good decisions, and more often than not success will come along anyway.

It’s like crossing a river:

If your focus is PURELY on the destination, on that new life in the green pastures across the river, you may well be blinded to the fact that some of the stepping stones to get there, well…aren’t there, and you may just end up going for a swim.

Understanding what drives you in the first place, recognizing when that driving force may well be pushing you into taking trades you really shouldn’t be taking and then having the discipline and patience to take each step, one at a time, is how you get to the other side.

Dreams are not always good things, for as much as they may seem to be desirable, they may well be what is holding you back.

All of which, I suppose Nikita, is just a long winded way of saying what you said LOL! Chasing money alone may leave you without any at all.

EDIT: Apologies for the less than professional picture editing. There’s another career gone LOL !!

[B][U]Nikita Point 2[/U][/B] (but not directed at Nikita)

I think a lot of people just have a problem with admitting they are wrong. At the end of the day, you are the only person who has access to your trading account, you are the only person who can hit the “buy” or “sell” buttons, so why is it so difficult for people to admit they got it wrong?

I think the answer to that lies somewhere amongst a subject peterma and I touched on very briefly in the “crackpots speaking to God anonymously” thread. Unfortunately forum web sites can be an unhealthy influence, if you’re not disciplined enough to prevent it.

If I come on here later tonight and say, “take it from me people, Cable is gonna go through the roof tomorrow, hit the buy button NOW to get the best price.” somebody, somewhere WILL be crazy enough to do it. Because they’ll think that I know something they don’t. Lots of people, including myself, have taken trades purely based on something they read on a forum, rather than their own analysis.

They may have read a more “experienced” trader make a comment, and instantly made a trade based purely on that comment, it may work, it may not. That’s probably one of the reasons some of the more experienced people actually are quite careful in what they say on these pages.

It’s hard though, for new traders, to differentiate between a scam and genuine help. I suppose that’s that’s were the old saying, “If it sounds too good to be true, it usually is.” comes in.

It’s also hard, to advise people to leave places like this, because where do you go to learn if not the very place people are coming to discuss the very thing you’re trying to learn?? It would appear, that ANY person who has tried to help, has been flamed by somebody at some point, helping, or at least trying to, may well be a thankless task.

Adaptability I think is key in trading. Giving something, a system or a method time to work, then changing or dropping it if it ISN’T working, is important. When we first went to see the consultant when my youngest daughter was diagnosed with epilepsy, we asked what the treatment was.

The consultant then produced an A4 sheet of paper with over 100 different epilepsy treatment medications listed on it. She told us that something on that list, would work for our daughter. Something may work, but because of the side-effects, it may not be right for her. But something will work, it’s just a matter of going through the list and finding it.

Luckily for us, treatment 3 worked !!

But that’s the point here, everyone has to find their own “treatment”, their own “system” that works for them. It’s just a matter of going through the list. Just because PA works for one, it may not work for another. Just because one person uses MA’s, bollinger bands, MACD, tea leaves, astrology or ashes in a fire, it doesn’t mean you should use them and it doesn’t mean they work any better.

There is no “cooler” way to make money. If I make a million using PA and you make a million using MA’s and MACD, we both still have a million, my million ain’t cooler than your million. But sure, the desperation to reach that million may affect what system we try and how long we give it to prove it’s worth.

I’ve no doubt that simpler is better, I’ve no doubt that trading can be relatively straight forward, I’ve no doubt that it is us ourselves that complicates the matter. But whatever decisions a person makes, be man enough, (or woman enough) to admit we made those decisions and accept the consequences of them.

You WILL get back no more than you are prepared to put in. Won’t be quick, won’t be easy I guess, but tell me what is?

Hi Yunny

Sorry it’s taken me so long to reply to this, work over the weekend and then The Masters sort of took over.

On my charts now I have a 10, 20, 50, 125 and 200 EMA These I use, just as pointed out in the book I’m reading, on the higher timeframes to give me a visual indication of the underlying move.

The “proper order” of the EMA’s helps me to focus on trading only in the direction of the bigger move. I realise these MA’s can be slow to react and therefore I may miss out on some entries, but for now it’s keeping me a wee bit safer.

Also I have the daily pivot points. I’ve always had these, I just like them. I’m cautious around the levels the show and I’ve used them to make reversal trades previously if price is reaching a bit too high or low.

I also now have RSI, mainly though because this again was mentioned in the book. As I’m not familiar with RSI I don’t use it as part of my decision making for now, just make a sort of mental note where RSI is when I do enter a trade.

I also look at the daily, 4 hour and 1 hour charts, never lower. Getting into the habit of looking at the weekly now for overall direction.

I’ve tracked EU daily range for quite a while now, has stopped me from entering a trade before. Due to work though, it’s a lot to keep track of daily range for all pairs.

Obviously actions of the candles are the first consideration, but I use the things listed above now also. Sometimes I tend to throw the Ichimoku on to a chart that I’m considering making a trade on. I have only a very basic understanding of this though and use it mainly to see if we are above or below the cloud and whether there has been a cross of the lines.

I very rarely use Fibs, not sure if this worries me or not. I’ve stuck them on a chart before, but never used them as part of making any decision.

Mr Carter

You’ll have to excuse me RC if I don’t make much of a comment about this subject. I’m not familiar with HA candles mate so I wouldn’t know what to ask or add, but I am reading avidly, be assured of that !!

Right then, now I’ll get cracked on with the “plan”.

Time and time again I’ve mentioned that the real reason I came here initially, like a lot of people I guess, was to learn. Sometimes though, I can be my own worse enemy and wander off on a tangent or get involved, too involved, in things elsewhere that I shouldn’t really be bothering my arse with. Learning therefore, has always been the victim.

At the start of this year Mr Templar made a suggestion that trades to be discussed, would only be of any value if they were in fact subject to full disclosure, ie…entry levels, target levels, stop levels, why you entered in the first place, if and why you bailed early etc. That was actually a good suggestion.

It’s the route in fact, that I now intend to try and take this thread down. I’m not doing a MyFXBook thing, F**k that nonsense. This is what I’ll do my best to do.

Just around the end of February, sart of March, my LIVE account sat at almost exactly $100. Not what you’d call a fantastic achievement for someone who has been here a year and a half already, but then that is precisely the point now. Too much time has been spent mucking around.

First week of March I made up this table of targets:

The way to read it, as I’m sure you’ve already twigged, is as follows.

1st line, week 11th march to 15th March, starting balance was $100. My intended % target each week is 3% (second column) This means for week 1, my Target would be 3% of my balance, which in this case was $3, (third column) That would then leave my balance at the end of that week at $103 (4th Column). And so on and so on down the page.

However, this is the actual madness that followed:

As you can see, start of week 6 (this week) my balance was $143.55, target for the end of this week being $147.85, which is actually where, according to the “plan” I should be around week 16. Sounds pretty impressive until you actually have a close look at the roller-coaster madness of the second image. It’s been a wild one, and it can’t continue.

Here is my account balance from my actual account as I write this very moment:

Next few posts I’ll outline what’s going on.

Every Sunday night, from now on, I’ll post a snapshot, like the one above, of my actual account. I’ll either post charts, or a video, of what I’m looking at for the week ahead. Obviously during the course of the week things may change.

All trades taken from home, will be captured by picture or video and posted with the reasons I took the trade, my thinking on it, my levels, (entry, target, stop) and the reasons for those levels. If I do bail out early I’ll explain my thinking as to why. I shall do my utmost to post this information BEFORE the trade has ended.

It may prove more difficult to capture, especially by video, trades taken from the mobile office, since the wee laptop is pretty basic, but I’ll check it out and if it’s possible I’ll do it.

Here’s the thing with all of this. I openly admit I’m doing this for very selfish reasons. This is a way of keeping myself in check, the majority of people on this forum are very friendly, but they’re also good at giving a friendly kick up the arse as and when it is required, and that’s exactly what I’m depending on.

A couple of things I would ask though. I’m not asking anyone else to do this. If anyone feels they’d like to do the same then fine, but I’m not asking anyone to do it.

The guys who trade for a living, I really don’t want you to do it, not that I think you would, that would involve giving away more than you ever should and your business is your business, but I will ask one thing of you.

If I post details of a trade, please no-one make comment on it until AFTER the trade has closed. Then it will be pretty much open house for anyone to critique what they believe the good the bad and the ugly were. Not looking for lessons here, if anyone wants to add “I don’t think that was a good support level.” or “I think your reasons for getting in weren’t that great.” then that’ll be fine, whatever you feel like sharing.

Nothing will happen tomorrow, unless it happens early around LO as I’m at the hospital most of the day tomorrow.

I’ll try my hardest to do a video, or at the very least some charts tomorrow though to show how I’ve set my charts up, what I’m using to make my decisions and then I think it’s pretty much good to go.

I fully understand your hatred of Myfxbook, but it sounds like exactly what you need to accomplish your goals, and would save you so much time.