Thoughts: Trading is similar to open a business

When you open a burger stand, you have to know how to make burger. You need to prepare equipment and things related to having a burger stand. Let say, for each burger you sell, you make profit $1. Then you can sell 100 burger for 1 day, your profit will be $100.

If you sell your burger $7 each, that means the cost of a burger will be $6, you need $600 as the capital. Your profit will be 100/600 x 100 % = 16%.

That looks big, isn’t it?

Before make any conclusion, we need to calculate the capital and cost. For example you need to by kitchen equipment, promotional stuffs, cooking material and etc. There are also cost to handle garbage, rental and permit to open the stand. So in total let say we need 5000 capital to run the business. There is also expenses need to deduct every month for example 1000. You also need to calculate the cost of employee and yourselves to run the business. After all, you probably will have 5-8% profit each month.

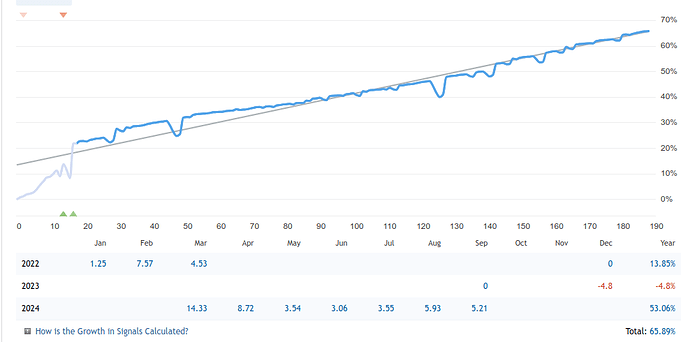

The same thing happened in trading. You need to think capital, profit you have on every position and the cost of trading. When you can reach consistent profit about 5% / month, it’s similar to run a business in real.

The similarities are:

- You need have a long vision to run a business. The longer you can commit, the higher the opportunity to get rewarded.

- You need enough capital to run a business. You have to breakdown the requirement to have accurate amount of capital to run the business.

- You need to know the cost of running the business. In trading that will be the risk.

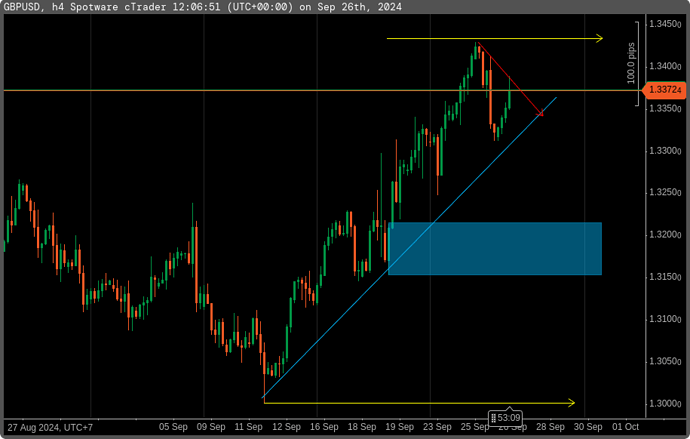

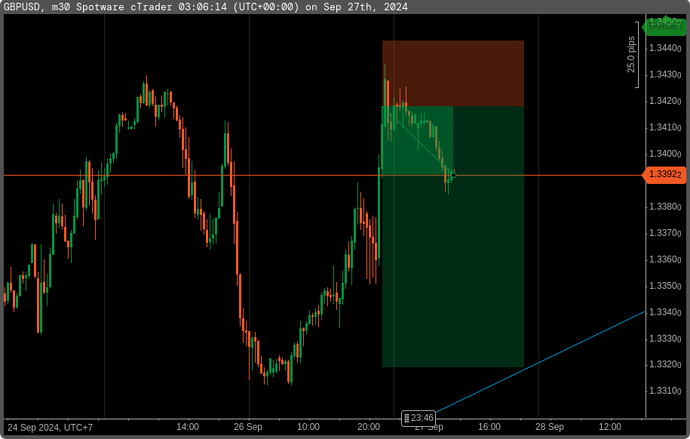

- You need to find a good spot to generate profit. It must be a joke to sell burger in cemetery. In trading, where to open a position.

In short, to start business you need to understand these points.

I often got asked, can I have a good income from trading?

I was asking the definition of good income. It was 500 USD.

I asked again, how much capital the person had. It was 500 USD.

Immediately, I got my mouth shut. ![]() …

…