Thoughts: Trading Changes Path of Life

A lot of unexpected thing in our life. We just need to give ourselves a chance to explore them.

It was back to end of 2006. Once I left my mentor, I pursued trading by my own way. I bought many books, went to many courses and joined many trading communities. Once was Baby Pips  . My intention was only one, to learn more.

. My intention was only one, to learn more.

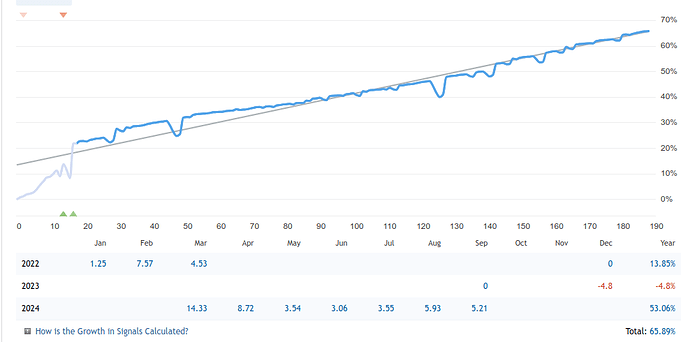

After a long time, I finally could construct a strategy from every information I got. I traded for 3 months and I successfully increased my balance up to 60%, more and less. Boldly, I shared my result to my mentor, I was in his mailing list. Nothing happened in the beginning, after more then a month, he contacted me.

He asked my trading method, I didn’t tell much. In short, he explained he was managing fund from few companies. He asked if I had interest to help him. After a long talked, I agreed. I wanted experience, the benefit was also interesting.

Since then, I was his helper to manage fund from several company. A long the time I developed an EA. The EA could mimic my performance for around 60%. The EA then used to manage some corporate’s fund.

Since I was graduated from Computer science, I was then asked to help him to establish a broker. I handled all issues related to computer, such as installing server, trading infrastructure, Managing MT4 trading server, I finally knew how to setup a broker from zero. I also learned how to operate a broker. In the beginning, we were white label broker, after less then 3 months, we were converted to a full white label broker and got self-owned server to manage.

It was amazing to look at how our clients made orders. We earned only from commission or spread. Profit was huge, same thing with to operational cost. Later I knew, many international companies were using CFD as hedging tools for their business. Even there were only few of them, the portion of their funds were extremely huge. I then realized the truth of Pareto Principle: on many outcomes, 20% are the cause of 80%. 20% of our clients were the owner of 80% of our trading volume.

This was the key that allowed me to have deeper experience with the world of broker. I learned how important regulation and license for broker, how dangerous is an unregulated broker. These knowledge enriched my trading’s method. It changed every single thing on how I saw market.

![]()

![]()