Technicality: (2) EURUSD - Design Trading Scenario

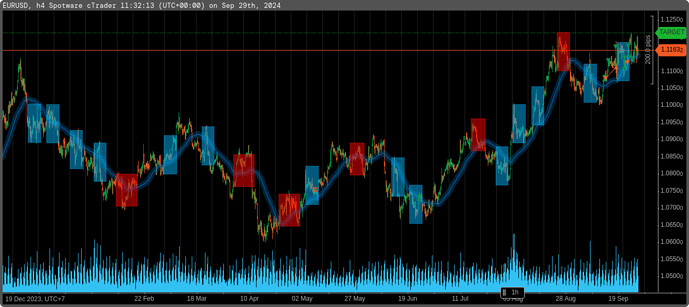

The performance of MA50 in last 16 months:

Base on pattern, the statistic show, 24 wins vs 12 loses. It’s a 60%++ win rates system. We don’t just open a position blindly by knowing this pattern. The next important thing is how to define an entry and exit points. We need to get into the detail on how the pattern works, all in numbers and precision. We don’t just look into it and hoping get intuitions from no where.

Here is one of setup possible for the pattern.

It’s a very simple setup on H4 chart, target for 1RR. On example above, we have RR 70 pips vs 80 pips. We need to be flexible to plot our RR, market is dynamic so our trading style have to be adaptive. Don’t be stubborn, put fix TP and SL without considering current price level in the market. Always respect SnR.

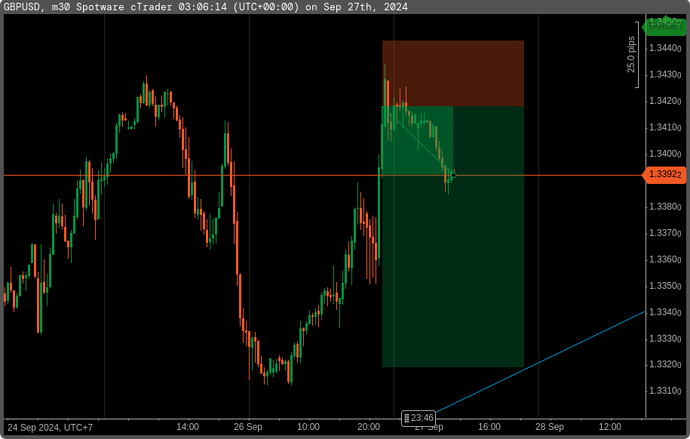

The next example:

The same thing, after broken previous resistance and have correction around MA50, the price went back to retest the new resistance. The key is,

when it tries to retest the resistance, it usually passes by our target.

As now we can see latest price formation. We need to practice to look at Signal #1 and Signal #2 before action.

So now we already have a quantitative trading system. We no longer trading qualitatively. From here we can do many things to optimize this method, such as increasing RR, Win Rate, finding other patterns to trade.

We no longer say, my ear is tingling, a signal to long EURUSD. Or I have gut feeling for shorting EURUSD. I even met mentors who trading base on moon’s phase or planet formation. Why don’t I just rely on my cat? If the white cat comes, that means long. When black cat comes, that means short?

Btw, I didn’t disrespect any of them. I’m fully understand the concept of seasonality. But seasonality doesn’t work in this way. it’s very quantitative and predictable method.

Once, second phase is done, we need to establish our money management. This is the core to support our trading system. It’s like you are black belt in martial arts. You are good in training, but it doesn’t mean you are good at street fighting with thugs.

Note: this will apply only to EURUSD exclusively.

As a sales, I will announce, the strategy can be applied to all instruments, holy grail to rich fast

( crossing my finger and whispering: I don’t guarantee you can make money of it  )

)